Top 12 Perpetua Competitors for Amazon Sellers

Author:

Neha Bhuchar

Last Updated:

Dec 22, 2025

Published on:

Table of Contents

If you run Amazon ads, you have probably heard of Perpetua. It is a popular eCommerce advertising software that helps brands manage and grow their PPC campaigns. However, for many Amazon sellers and agencies, Perpetua’s high price, closed decision-making, and limited control push them to explore top Perpetua competitors that offer more flexibility and better value.

That is where this guide comes in. We will start with a quick snapshot comparing 12 top Perpetua competitors and alternatives for 2026. You will see what each tool does, who it suits best, key features, pricing, and ratings. At the end, we cover some quick FAQs to help you pick the right fit.

Snapshot: Perpetua competitors comparison

Brand | Best For | Key Features | Starting Price | G2 Rating |

atom11 | Sellers and agencies needing retail-aware automation. | AMC software, dayparting, retail-aware automations, sales analytics, free advertising tools, AI copilot | From $199/month | |

Pacvue | Large brands and agencies managing multiple marketplaces | Rule-based automation, dayparting, cross marketplace reporting | Custom pricing | |

Teikametrics | Multi-channel brands wanting AI marketplace optimization | Predictive bid automation, keyword suggestions, budget pacing | From $149/month | |

M19 | Small to mid-sized sellers booking for under $5K in ad spend per month | AI-based bidding, campaign structuring, profit-based targeting | From $59/month | |

Quartile | High-growth brands looking for full-funnel AI automation | Smart bid optimization, cross-channel management, campaign structuring | Custom pricing | |

Skai (Kenshoo) | Enterprise brands with multi-platform media strategy | Omnichannel campaign control, advanced audience targeting, forecasting tools | From $95K/year | |

BidX | Sellers managing Amazon and Walmart campaigns | Automated campaign creation, keyword harvesting, AMC integration | From $295/month | |

AdBadger | Small to mid-size Amazon sellers seeking PPC automation | Dayparting, negative keyword automation, bid rules | Custom pricing | |

Jungle Scout | Brands scaling Amazon with analytics and automation | Retail and ad insights, campaign automation, market share tracking | $29/mo | |

AiHello | Sellers looking for AI-led bid automation | Automated campaigns, profit-based bidding, dayparting | From $100/month | |

Sellerapp | Sellers seeking keyword and listing optimization tools | Product intelligence, keyword research, listing optimization | Free | |

Intentwise | Data-driven sellers and agencies managing Amazon and Walmart | Rule-based bid automation, AMC integration, custom reporting, AI copilot | Custom pricing |

atom11

Description

atom11 is a retail-aware Amazon PPC software that helps sellers and agencies get more out of every ad dollar. It ties ad performance with real retail signals like inventory levels, buy box wins, and competition data, so you stay ahead without wasting ad spend.

Features

Amazon Marketing Cloud Suite

Build different AMC audience segments, analyze shopper behavior using AMC reports, and connect ads with customer journeys using AMC data.

Dayparting Automation with Custom Rules

Schedule bids and budgets for your best-converting hours to control spend more precisely. In atom11, you can layer custom rules on top of dayparting to automatically adjust bids and budgets based on time, inventory, or performance triggers.

Performance-based Automation

Fine-tune bids, budgets, keyword harvesting, negators, placements, search rank, and inventory. You can set conditions to set up your custom rules, save those filters, and monitor to track performance on how your rules impact spend and results.

Retail Analytics Dashboard

Track sales trends on an ASIN level and compare retail, inventory, and ad performance in one place. Includes pivots on labels, sub-categories, and parent ASINs for flexible reporting.

Recommendations Engine

The recommendation engine provides you with actionable suggestions on bids per your target ACoS. It helps reduce ACoS and boost ROI without heavy manual work.

Free Tools Library

Use free Amazon PPC tools like PPC audit checkers, real bid calculators to plan and fine-tune your ads faster.

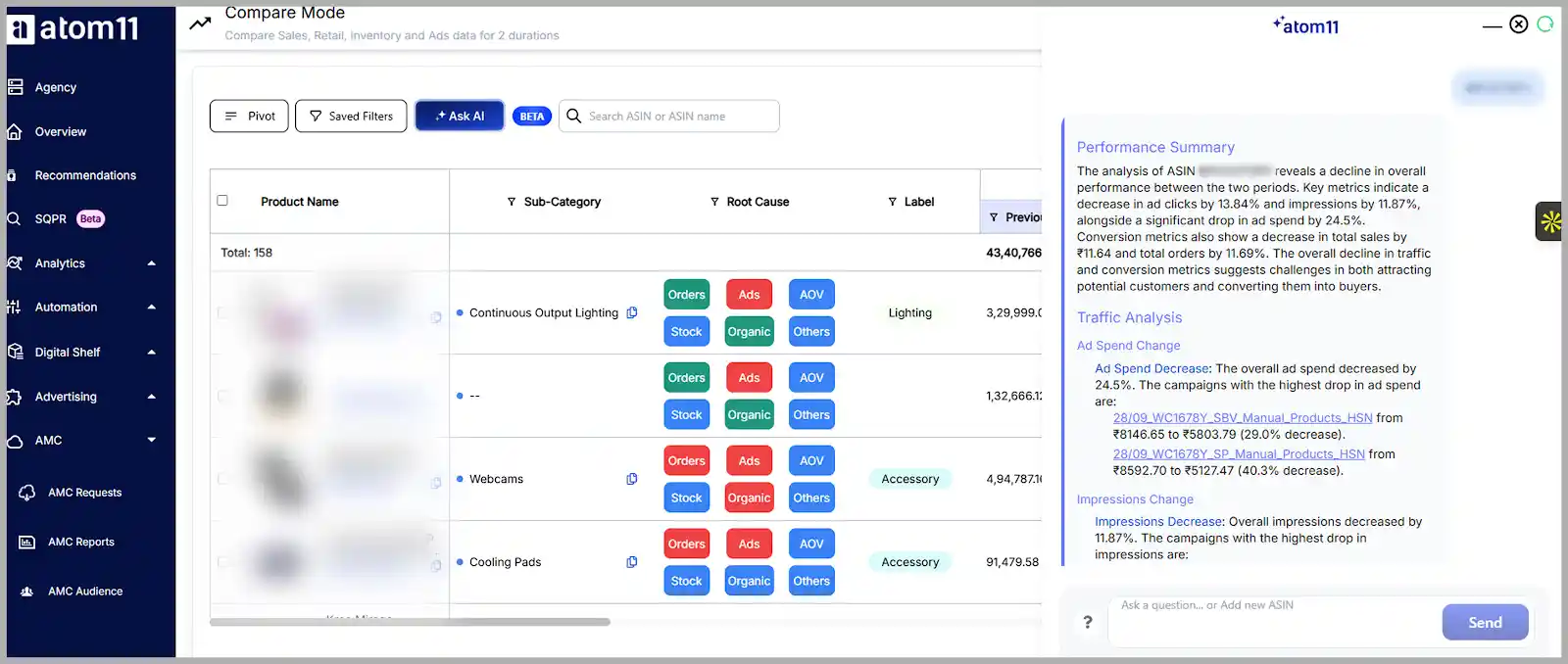

Amazon Copilot Neo:

Neo helps sellers compare two different periods for analytics and conduct root cause analyses for sales fluctuations between the two periods. It also gives you personalized advice on optimizing your ad strategy.

Version control:

Save bids, budgets, and placement modifiers at a certain point in time; e.g., Bids for Pre-Prime Day or Pre-BFCM period. Once BFCM is over, you can simply revert bids in a single click of a button.

Pacvue

Description

Pacvue is an ad and commerce platform built for brands and agencies that want to run advertising across Amazon, Walmart, and other major retail platforms using one interface. It provides visibility across campaigns, automations, and retail insights to help teams scale efficiently. Check out this in-depth guide on Pacvue competitors and alternatives, which compares similar Amazon PPC platforms in 2026.

Features

Rule-based Automation

You can set custom rules to automate bids and budgets across campaigns, letting advertisers stay in control without manual updates. This is a core approach shared by atom11, which also uses customizable rules to adjust bids and budgets based on performance signals like ACoS, inventory, and buy box status.Dayparting and Budget Pacing

Schedule when ads run and how budgets are spent across different times of day. Like Pacvue, atom11 offers dayparting, with added flexibility to automate both bids and budgets at a granular level using a math-driven framework.Cross-Marketplace Reporting Dashboards

Build dashboards combining ad, sales, and inventory performance across Amazon, Walmart, and more. While atom11 is Amazon-first, it offers pivot-ready dashboards that link ad performance with retail metrics like pricing and inventory in one view.

Pricing

Pricing is tailored based on spend and is available on request.

Pacvue is ideal for advertisers managing multiple marketplaces and teams. atom11, while focused solely on Amazon, brings a stronger emphasis on retail signal integration. With bid and budget rules tied directly to inventory, pricing, and buy box status, atom11 offers precision suited for sellers who want control over their Amazon ad spend without losing time.

Teikametrics

Description

Teikametrics is a campaign management platform that helps Amazon and Walmart sellers run ads efficiently. The platform offers automation features to manage bids, budgets, and keywords. If you’re looking at other tools in this space, check out this comparison of leading Teikametrics competitors and alternatives.

Features

Automated Bid Adjustments

Teikametrics adjusts bids based on traffic trends, seasonality, and product availability. A similar feature is available in atom11, where bid automation uses both performance and retail signals.

Keyword and Targeting Suggestions

The platform recommends keywords to add or remove from campaigns based on past performance. This is also offered in atom11 through its Search Term Harvester and Negator tools that automatically optimize keyword targeting.

Budget Controls

Teikametrics includes pacing features to help stay within daily and campaign-level budgets. atom11 provides a comparable Budget Optimizer, which adjusts spend dynamically based on conversion data and ACoS targets.

Multi‑Channel Campaign Management

You can manage ads across Amazon, Walmart, and other marketplaces through one interface.

Pricing

Plans start from $99 per month for up to $5,000 in monthly ad spend.

Teikametrics leans heavily on AI for automation and insights across marketplaces. atom11, in contrast, puts Amazon sellers in control by combining timely automation with insights from live retail signals like inventory and buy box status, giving users more clarity and influence over how and when ads run.

| Related read: 10 Best Teikametrics Competitors in 2026

M19

Description

M19 is an Amazon ad automation platform that uses machine learning to manage campaigns and adjust bids in real time. It is built for hands-off advertising with a focus on efficiency and sales performance.

Features

AI-Powered Bid Adjustments

M19 adjusts bids dynamically based on conversion data and sales trends. atom11 takes a different approach with customizable rules that let sellers automate bids using retail data such as inventory levels and Buy Box status.

Campaign Auto-Structure

Automatically builds campaigns, ad groups, and keywords using your catalog and sales goals.

Budget Forecasting and Automation

Budgets are managed and redistributed automatically to hit defined ACoS or ROI targets across campaigns.

Search Term Management

Search terms are added or negated automatically based on performance. atom11 includes dedicated tools for this as well, offering keyword harvesting and keyword negation based on real-time campaign data.

Performance Dashboard

Campaign data is visualized at the keyword, product, and campaign level, with filters and views tailored to ad metrics.

Pricing

M19 charges a fixed fee of $49 per month for sellers spending up to $5,000 on ads.

Unlike M19, which centers its approach on automated AI decisions, many Perpetua competitors like atom11 give sellers the flexibility to apply their own logic. From setting guardrails on bids to adapting strategies based on sales cycles or inventory levels, atom11 helps brands balance automation with control.

Quartile

Description

Quartile is an AI-powered ad optimization platform designed for Amazon and other marketplaces. It uses machine learning to manage bids, keywords, and campaigns at scale.

Features

AI‑Driven Bid Management

Quartile continuously adjusts bids based on performance data and user goals. In contrast, atom11 offers rule-based bid automation that gives advertisers more control, letting them set exact conditions based on metrics like ACoS, inventory, and organic rank.

Keyword Harvesting and Negative Targeting

Quartile automatically adds converting search terms and blocks underperformers.

Smart Campaign Structuring

The platform restructures campaigns using its AI to improve performance across ASINs. atom11 supports this through customizable campaign mapping and exact-match harvesting for manual control.

Multi‑Marketplace Support

Quartile runs ads across Amazon, Walmart, and Instacart. atom11 is currently Amazon-first but offers granular performance dashboards linking ads, sales, inventory, and spend data.

Pricing

Quartile does not publish its pricing online. Brands need to contact the team for a customized quote based on their ad spend and goals.

Quartile takes a data science-first approach, using AI to make optimization decisions across large catalogs. For brands that prefer visibility into how campaigns are being adjusted—and want the ability to steer those changes—atom11 offers customizable rules that respond in real time to signals like stockouts, pricing changes, or ACoS shifts.

Skai (Kenshoo)

Description

Skai is an enterprise-grade advertising platform built for brands and agencies running campaigns across Amazon, Walmart, Instacart, and more. It focuses on unifying omnichannel data, advanced targeting, and measurement to support large-scale media strategies.

Features

Omnichannel Ad Management

Skai allows advertisers to manage campaigns across multiple retail media and search platforms through a single dashboard.

Advanced Audience Targeting

Users can tap into first-party, third-party, and CRM data to build highly segmented and personalized campaigns.Budget Forecasting and Pacing

The platform predicts spend outcomes and distributes budgets based on goals and channel performance.Retail Media Intelligence

Skai integrates sales, inventory, and pricing data to inform campaign decisions and uncover missed opportunities.Enterprise-Level Reporting Tools

Users get access to customizable dashboards that align ad metrics with business KPIs across marketplaces.

Skai is built for enterprise brands running complex cross-channel campaigns and comes with a premium price tag. Unlike Skai, atom11 focuses exclusively on Amazon PPC and offers high-impact retail aware automations without the steep learning curve or six-figure commitment.

Pricing

Skai’s standard plan is priced at $95,000 annually for advertisers spending up to $4 million per year.

BidX

Description

Bidx is an ad automation platform for Amazon and Walmart that helps sellers manage keywords, bids, and reporting from one interface.

Features

Campaign Creator

It allows you to set up and launch campaigns using automation to save time on setup and structuring. Their Campaign Creator allows you to create campaigns as per ad type.

AI Keyword Research

They offer a ChatGPT integration that helps in researching keywords .

Customizable Dashboards & Reports

Create tailor-made dashboards using diverse visualization options and export reports for review.

Multi‑Platform Support (Amazon & Walmart)

Manage Sponsored Products, Brands, Display, and DSP campaigns on both marketplaces from one interface.

Amazon Marketing Cloud Integration

Their dashboard automates customer data extraction and analysis. You can use Amazon Marketing Cloud to understand customer journeys and improve decision-making.

Pricing

Plans start at $495 + percentage of ad spend per month for the Self‑Service tier.

BidX automates campaign setup and bidding using AI, offering fast execution for Amazon and Walmart sellers. atom11, on the other hand, gives sellers more control — layering automation with live retail signals like inventory, pricing, and competition. For teams that want to blend speed with strategic oversight, atom11 can offer more visibility and precision than BidX’s fully AI-led approach.

AdBadger

Description

AdBadger is a PPC optimization platform for Amazon sellers that helps reduce wasted ad spend and improve ACoS through automation. It’s built to simplify campaign management for growing brands.

Features

Negative Keyword Automation

Just like atom11, AdBadger automatically identifies underperforming search terms and adds them as negative keywords to prevent wasted ad spend.

Rule-Based Bidding Adjustments

You can create rules to adjust bids based on performance metrics like ACoS and CTR. Like AdBadger, atom11 also supports rule-based automations that let sellers fine-tune bids based on retail and ad signals.

Budget and Dayparting Controls

Set daily budget caps and schedule when ads are shown to optimize spend. atom11 provides similar dayparting, with added flexibility to control both bids and budgets using performance thresholds.

Campaign Launch & Audit Tools

Offers tools to help sellers create new campaigns and audit existing ones for issues like wasted spend or missed keywords.

Pricing

Pricing is available upon request. AdBadger does not display public plans and requires sellers to contact them directly.

Downstream

Description

Downstream has joined forces with Jungle Scout to power the Cobalt platform, offering enterprise-level Amazon advertising and retail analytics in one place. Cobalt combines Downstream’s ad automation capabilities with Jungle Scout’s strengths in market intelligence, making it a complete suite for brands and agencies scaling on Amazon.

Features

Market Intelligence

You can track competitors, market share, and consumer trends using Amazon sales data in context and analyze real-time behavior to refine strategy and stay ahead of category shifts.Retail Insight

They offer dashboards that combine sales, pricing, inventory and performance data to give you insights into how a product is performing across your catalog.Ad Accelerator

With this, you can automate campaign creation, keyword management, and bid adjustments. A similar feature exists in atom11, which also uses retail signals like inventory levels, rank, and buy box status to guide real-time bid and budget changes.Digital Shelf Analytics

Measure your share of voice, monitor search rankings, and find keyword gaps. You can optimize visibility by improving your performance on the digital shelf.Custom Reporting & Dashboards (implied from broader Jungle Scout suite)

You can generate tailored reports with brand, product, or campaign-level filters. Options to export, share, and visualize performance metrics to support decision-making across teams.

Pricing

Cobalt is part of Jungle Scout’s Enterprise Solutions and does not display public pricing. All plans are customized based on your brand’s scale and requirements. Sellers need to contact the sales team for a quote.

While Cobalt focuses on analytics and reporting at a brand level, atom11 enables more dynamic, rule-based control at the campaign level.

AiHello

Description

AiHello is an Amazon PPC automation platform focused on helping sellers grow revenue and reduce manual ad work. It offers AI-driven bidding, keyword management, campaign creation, and dayparting to streamline campaign optimization—all handled via a autopilot system.

Features

Campaign Creator

You can work with their AI-powered experts to launch new campaigns by selecting your ASINs and setting basic parameters.Automated Bid Adjustments

AiHello uses its “Autopilot” engine to automatically increase or decrease bids based on conversion rates, ACoS, and sales velocity. atom11 offers a similar feature, with added customization based on retail signals such as inventory levels, organic rank, and buy box ownership.Keyword Automation

The system automatically harvests high-performing search terms and promotes them to keywords while pruning underperformers. This mirrors atom11’s Search Term Harvester mentioned earlier.Automated Dayparting

AiHello adjusts campaign bids during high-conversion hours to improve visibility and reduce wasted spend. atom11 supports similar bid scheduling, with the added ability to factor in real-time retail triggers like stockouts or buy box loss.Account Manager Support

Premium plans come with human-led setup, audits, and optimization recommendations.

Pricing

Pricing starts at $175/month for ad spend under $1,000 for small businesses, with higher-tier plans available for larger budgets and agencies.

AiHello emphasizes set-it-and-forget-it automation, handling most campaign tasks without much user input. This can lead to loss of guardrails, not suitable for businesses who want control. atom11 takes a different route by offering strategic automation that responds to retail data.

Sellerapp

Description

SellerApp offers a full-suite Amazon PPC management solution It offers a variety of features that help sellers with product research, keyword tracking, PPC optimization, and more, built to support brands at scale across 18 marketplaces.

Features

Product Research

This feature helps you find products that have a high profit potential. It helps you find its listing strengths and weaknesses.Keyword and Search Term Optimization

This allows you to harvest top-performing search terms. This is also available in atom11 through its Search Term Harvester and Negator tools, which optimize targeting using live campaign and retail data.Profit Dashboard

This dashboard gives you an overview of the products that are performing well and evaluate your business plans for better investments. In a similar fashion, atom11 shows you your spend portfolio by ASIN type, allowing you to double down your investments on top selling ASIN bands.

Pricing

Their starter plan comes at USD 99/month. It offers basic functionalities like keyword tracking but lacks ad automation.

Intentwise

Description

Intentwise is a data-driven advertising and retail analytics platform built for Amazon and Walmart. It offers tools for bid automation, reporting, and audience insights powered by AMC and first-party data.

Features

AI and Rules-Based Bid Optimization

A system similar to atom11, here you can choose from over 20 automation models or set your own rules to control bids and budgets.Amazon Marketing Cloud Integration

Analyze shopper journeys and campaign attribution with AMC-powered insights. atom11 also offers Amazon marketing cloud software to gain a competitive view of your customer journeys, create high-intent audiences and get advanced analytics.Customizable Dashboards

You can build reports that display essential metrics such as stock levels and profitability. atom11 offers similar pivot-ready dashboards with filtering and deep retail metric pairing.Automated Recommendations and Alerts

You get suggestions highlighting optimization areas across keyword targeting and bid optimization. atom11 provides its own set of recommendations and alerts on inventory, advertising, and recommended bids.AI-powered Copilot, Wizi

Manage campaigns more efficiently. It acts as a smart assistant by continuously analyzing your advertising data and spotting any unusual changes.

Pricing

Not publicly listed. Sellers must contact Intentwise for a custom quote based on their ad spend and needs.

Intentwise emphasizes cross-platform reach and analytics, while atom11 offers a focused Amazon experience with more granular retail signal integration. Sellers who prioritize automation that adapts to inventory and pricing changes may prefer atom11’s control and visibility.

How do you choose an Amazon PPC automation tool?

Sellers comparing Perpetua competitors are often trying to balance automation, control, and retail data to match their unique goals. And the truth is, no single tool fits everyone. Many of the top Perpetua competitors offer a range of automation features, retail data integrations, and price points, giving sellers more control over how their ad strategies perform.

atom11, an Amazon PPC software, is built for sellers who want more control — not just over bids and budgets, but over how their ad strategies respond to real retail conditions like inventory, margins, and sales cycles.

If you’re looking for a focused, retail-aware Perpetua alternative that puts you in the driver’s seat, book a demo with atom11 and see how it compares.

FAQs

What does Perpetua do for Amazon sellers?

Perpetua is an ad automation platform that helps Amazon sellers manage campaigns, adjust bids, and track performance. It offers AI-driven tools for keyword targeting, budget pacing, and reporting across Amazon and other marketplaces.

Who are Perpetua's competitors?

Perpetua competitors include other Amazon-focused ad tools like atom11, Pacvue, Teikametrics, and Quartile, each offering its own take on campaign automation, analytics, and retail signal integration.

Is Perpetua better than Pacvue?

Whether Perpetua is better than Pacvue depends on your goals. Pacvue is a popular Perpetua alternative that offers broader marketplace support and deeper enterprise features, while Perpetua focuses on streamlined automation and usability. Some sellers prefer a Perpetua alternative like atom11 for its added control and custom rules functionality.

How do you choose an Amazon PPC automation tool?

To choose the right Amazon PPC automation tool, start by identifying your business needs. Whether it’s full automation, deeper control, or better retail data integration, tools like atom11 work well for sellers who want visibility and flexibility while ensuring guardrails on automation and staying tightly aligned with Amazon’s ecosystem.

How much does Perpetua cost?

Perpetua’s pricing starts at $695/month for advertisers spending up to $10K monthly. For ad spend above $10K, it’s $695/month plus a percentage of spend. For $500K+ monthly spend, pricing is fully customized.

What is Perpetua and how does it work for Amazon advertising? / How does Perpetua help optimize Amazon PPC campaigns?

Perpetua is an eCommerce advertising platform that automates Amazon Ads by letting you set goals (like target ACoS and daily budget) while its ad engine handles bids, keywords, and campaign structures in the background. It continuously optimizes Sponsored Ads performance so you can focus more on strategy than manual campaign tweaks.

How does Perpetua optimize ad bids using AI?

Perpetua’s AI bid optimization engine continuously evaluates keyword performance against your target ACoS and automatically raises, lowers, or pauses bids to hit those goals. It combines historical performance with current data (and, on higher tiers, Amazon Marketing Stream hourly signals) to keep bids closer to the “most efficient” level without constant manual intervention.

What pricing plans does Perpetua offer for Amazon sellers and brands?

Perpetua’s pricing is structured in tiers: an Essentials plan starting around $695/month for up to $10k in monthly ad spend, a Growth plan at $695/month plus a percentage of ad spend beyond that, and a Premium plan with custom pricing for very high spend levels (often $500k+/month). Public directories confirm a “starts at $695/month” price point, but you should always treat the website pricing page as the source of truth because fees and thresholds can change.

Is Perpetua worth it for small and medium-sized Amazon sellers?

Perpetua can be worth it for medium-sized Amazon sellers with meaningful monthly ad spend, but its ~$695+ entry point is usually heavy for very small accounts or experimental budgets. Many smaller and mid-market brands instead prefer a more Amazon-specialized, lower-waste setup, often pairing or replacing enterprise-style tools with rule-based platforms like atom11 when they want deep control without committing to a large fixed software fee.

What are the limitations of Perpetua that lead users to look for alternatives?

Commonly cited Perpetua limitations include relatively high minimum pricing, a “black box” feel to the bidding logic, occasional data delays, and mixed reviews around billing and support responsiveness. These pain points push some advertisers toward alternatives that emphasize more transparent, rule-based automations and retail-aware analytics, such as atom11, which surfaces explicit rules and diagnostics instead of hiding everything inside an opaque algorithm.

How does Perpetua compare to other Amazon PPC tools like Pacvue, Skai, or Quartile?

Compared to Pacvue or Skai, Perpetua is generally positioned as a slightly more focused retail-media execution layer with strong Amazon roots and a heavy emphasis on goal-based automation rather than broad marketing orchestration. Versus Quartile, which leans into ultra-granular, single-keyword campaign structures and very aggressive automation, Perpetua sits more in the middle—still automated, but with more “goal” abstraction and AMC-driven insights, while Amazon-first tools like atom11 prioritize transparency and retail signals over pure algorithmic control.

Which types of businesses benefit most from Perpetua’s automation features?

Perpetua’s automation features tend to benefit multi-marketplace brands, established Amazon vendors/sellers, and agencies managing sizable budgets across many SKUs, where “set objectives and let the engine run” saves significant time. It’s particularly attractive to teams that value omnichannel retail-media coverage and are comfortable trusting a centralized algorithm over highly manual, rule-by-rule management.

What languages and marketplace regions does Perpetua support?

Perpetua supports multiple interface languages—public listings mention English, French, Japanese plus other major languages such as German, Chinese, or Spanish—so it can be used by teams in several key regions. It’s built to run across many Amazon marketplaces and also supports channels like Walmart, Instacart, Target and others, making it suitable for North American and European retail-media coverage in particular (exact language/region coverage should be confirmed with their sales team, as directories don’t fully agree).

Does Perpetua integrate with Amazon Marketing Cloud (AMC)?

Yes, Perpetua offers a dedicated Amazon Marketing Cloud solution and even pipes AMC audiences directly into its DSP product. That means you can use AMC data to build custom or pre-built audiences, analyze full-funnel performance, and access CLTV and incremental-lift dashboards within the same ecosystem.

Is Perpetua suitable for multi-channel advertising management?

Perpetua is designed as a multi-channel retail media platform, with support for Amazon plus marketplaces like Walmart, Target, Instacart and some additional media via partners like Criteo and TikTok. It’s well-suited if you want one place to manage and optimize several retail channels, while more Amazon-only platforms such as atom11 may be a better fit if you only care about going very deep on Amazon rather than spanning many marketplaces.

How accurate is Perpetua’s bid optimization algorithm?

Perpetua’s bid optimization algorithm is built to keep bids “always on” and aligned to your target ACoS, and many reviews report strong improvements in sales velocity and ACoS after implementation. At the same time, other users report inconsistent results and stress that performance can vary widely by account, so its accuracy is best viewed as powerful but not magical, in that you still need to monitor outcomes, adjust goals, and occasionally override the machine when needed.

What customer support options does Perpetua provide?

Perpetua’s own and third-party listings describe support through onboarding webinars, chat, a Slack community, video tutorials, and access to a client success team on higher tiers; some directories also note email/help desk, phone, 24/7 live rep, and chat options. In practice, user reviews show a mix of very positive “hands-on support” experiences and complaints about slow responses or billing disputes, so support quality can depend on your tier and team.

Does Perpetua offer real-time reporting and analytics?

Perpetua offers daily reporting on lower tiers and hourly reporting plus intraday optimization via Amazon Marketing Stream on Growth and Premium tiers, which is “near real-time” for most retail-media use cases. Some reviewers, however, note that certain aggregate dashboards and historical analytics can lag by a day or two, so it’s not truly second-by-second live data everywhere in the app.

Can Perpetua manage campaigns across multiple ASINs and portfolios?

Perpetua is built specifically to handle campaigns across many ASINs, portfolios, and goals, letting you group products by strategy and manage Sponsored Ads performance at both granular and rolled-up levels. Its interface and analytics are designed so brands, agencies, and multi-SKU sellers can see performance across all Sponsored Ads or drill down into a single product or goal.

Is Perpetua a good fit for brands with large catalogs?

Perpetua is generally a good fit for brands with large catalogs because its goal-based structures, automated keyword harvesting, and multi-campaign management help keep complex accounts manageable. If your large catalog is primarily or only on Amazon, though, it can also be worth comparing it with Amazon-only tools like atom11, which emphasize catalog-level analytics and retail-aware rules specifically tuned for big ASIN portfolios.

What should advertisers look for in Perpetua alternatives?

When evaluating Perpetua alternatives, advertisers should look for the same core strengths—solid bid automation, strong analytics, and support for the ad types they use, plus any gaps they’ve felt around pricing, transparency, data freshness, or support. Many teams now seek tools that combine AMC-powered insights with more transparent, rule-based controls and retail-aware signals; atom11, for example, leans into exactly that mix for Amazon-only programs, making it a frequent consideration when brands want less black box and more explainable automations.