Top 12 SellerApp Competitors for Amazon Sellers in 2026

Author:

Neha Bhuchar

Last Updated:

Jan 3, 2026

Published on:

Table of Contents

SellerApp is an all-in-one Amazon seller platform that combines product research, keyword analysis, listing optimization, and PPC automation.

For many Amazon sellers, SellerApp acts as a suite of features that supports day-to-day selling workflows and helps organize operations across your Amazon business, including listings, research, and advertising. The platform allows sellers to analyze product performance using sales data, track profit margins, monitor market trends, and identify profitable products across major Amazon marketplaces. As an analytics platform, SellerApp aims to deliver valuable insights that improve overall business performance and long-term business growth.

While it offers a broad feature set, many sellers eventually begin evaluating SellerApp alternatives and competitors to find tools with deeper advertising intelligence, more accurate data, or better scalability for growing brands. These advantages can become a real competitive edge for growing brands.

SellerApp's strengths include:

Product Intelligence: Robust product research database with profitability calculators and trend analysis

Keyword Research: Reverse ASIN lookup plus a keyword tracker for monitoring ranking movement and targeting coverage over time

Listing Optimization: AI-powered listing quality scores and improvement suggestions

PPC Automation: Automated bid management with rule-based optimization

Profit Analytics: Comprehensive profit tracking accounting for Amazon fees

Chrome Extension: Quick access to metrics while browsing Amazon

For growing Amazon sellers who want research and advertising tools in one platform, SellerApp provides a comprehensive foundation for decision-making. Below, we break down the top SellerApp alternatives and competitors for Amazon sellers in 2026, comparing strengths, limitations, and ideal use cases.

Why Amazon Sellers Look for SellerApp Alternatives

Despite its comprehensive approach, many Amazon sellers actively search for SellerApp competitors and alternatives as their businesses grow and advertising needs become more complex. Here are the most common reasons based on verified user reviews:

Limited Advanced Features: Users report that while SellerApp covers many areas, the depth of functionality in each area is relatively basic compared to specialized tools. Advanced sellers often find they need additional platforms to execute sophisticated strategies. Many note that SellerApp’s basic features work well early on, but scaling often requires a more comprehensive suite of tools, deeper automation, and better visibility into what’s driving results across products and campaigns.

Interface Complexity: The platform tries to do everything, resulting in a cluttered interface where finding specific features requires navigating through multiple menus. Users report frustration with the steeper learning curve and time spent searching for tools.

Accuracy Concerns: Several sellers note discrepancies between SellerApp's keyword/search volume estimates, sales projections, and actual marketplace data. This can lead to misguided product selection and keyword targeting decisions.

Customer Support Gaps: Some reviewers mention slow response times from customer support, particularly for complex technical issues, leaving them stuck when they encounter problems.

TLDR Comparison Table

The table below compares the top SellerApp competitors and alternatives based on pricing, feature depth, and best use cases.

Software | Best for | Key Features | Starting Price | Free Trial? | G2 Rating |

atom11 | Sellers and agencies needing retail-aware automation | AI Copilot Neo, Version control, Sales performance monitoring, Dayparting, AMC suite, Retail-aware automation, Free onboarding support | $199/month | Yes, 7 days (no credit card needed) | |

Helium 10 | All-in-one solution for product research + PPC | Product research suite, Listing optimization, PPC automation (Adtomic), Inventory management, Profit analytics | $39/month | Yes, 7 days | |

Xnurta (formerly Xmars) | Mid-to-large brands seeking AI-driven optimization | AI-powered bidding, Multi-marketplace support, Custom reporting, Campaign automation | $750/month or % of ad spend | No | |

Hector.ai | Sellers wanting AI + AMC integration | AMC-powered insights, Self-serve DSP access, Targeting 360 command center, Keyword-level ACoS targeting | Custom pricing | No | N/A |

Pacvue | Large brands managing multiple marketplaces | Share-of-voice optimization, Digital shelf analytics, Cross-retailer budget planning, Commerce acceleration suite | Custom pricing | No | |

Skai | Enterprise brands with an omnichannel strategy | Omnichannel execution, Retail + social commerce bridge, Advanced audience management, AI planning layer | $95k/year | No | |

Adlabs | Agencies and brands managing large portfolios | Multi-client dashboard, Bulk campaign management, Advanced automation rules, White-label reporting | $40/month + 1% of ad spend | No | N/A |

Intentwise | Data-driven sellers focused on analytics | Advanced analytics, AMC integration, Custom dashboards, Multi-marketplace insights | $1000/month | Yes, 14 days | |

BidX | Sellers managing Amazon & Walmart internationally | SKU-level ACoS targeting, TACOS-aware rules, Multi-marketplace support, One-click campaign setup | $495/month | Yes, 14 days | |

Perpetua | Brands running multi-channel Amazon ads | Goal-based AI engine, Deep Amazon ad-type coverage, Integrated DSP optimization, Keyword harvesting | $695/month | Yes, 30 days | |

Quartile | Large brands focused on automated Amazon advertising | Enterprise-grade PPC automation, Budget optimization, AI-driven bidding, Multi-account management | Custom pricing | No | |

Adbrew | Brands and agencies prioritizing speed and usability | AI-assisted bidding, Bulk operations, Fast campaign setup, Rule-based automation | $499/month | Yes |

Below is a detailed breakdown of the top SellerApp alternatives, including how each tool compares to SellerApp in terms of PPC automation, analytics depth, scalability, and day-to-day advertising management for Amazon accounts. These SellerApp competitors range from lightweight tools for growing sellers to enterprise-grade platforms for large brands.

atom11

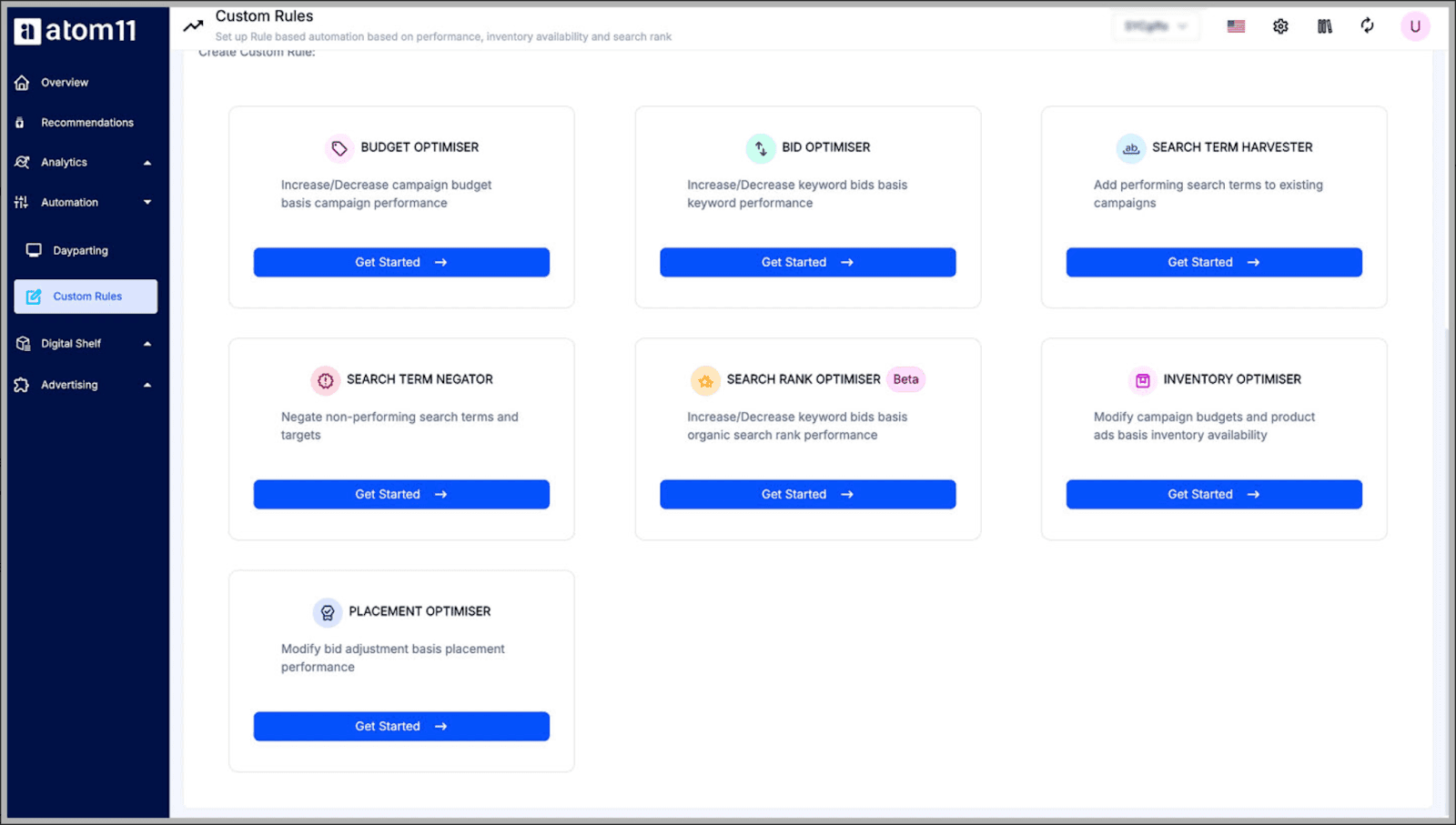

If Quartile is your full-service AI powerhouse, atom11 is your precision PPC brain that understands retail reality. atom11 is an Amazon PPC software with advertising and analytics that connects campaigns directly to inventory signals like stock levels, alongside Buy Box status, pricing, and Amazon Marketing Cloud data, all controlled through transparent rule-based automations.

Best for

Mid-to-large Amazon sellers, brands, and agencies who want powerful automation but need complete transparency and control over how their campaigns operate. Ideal for teams that understand PPC fundamentals and want to leverage retail signals for smarter optimization.

Key Features

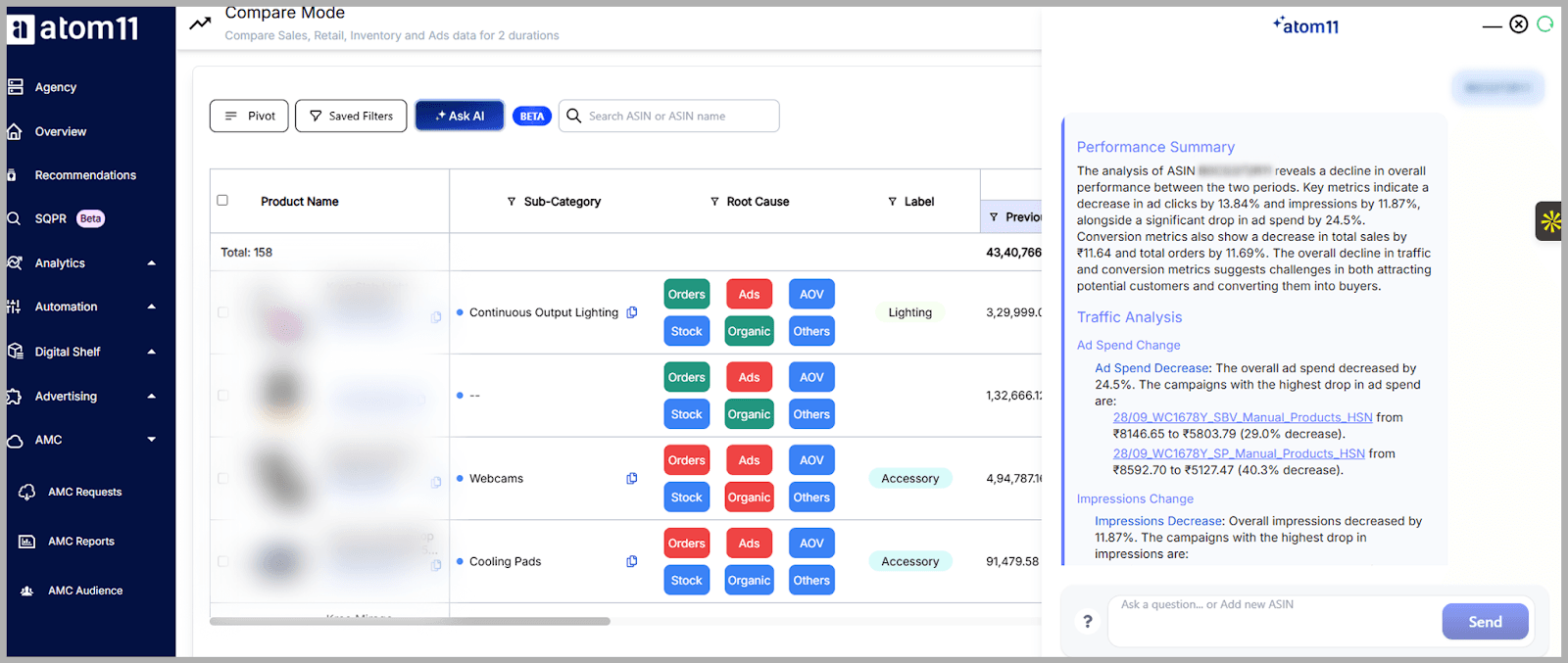

AI Copilot Neo

Neo diagnoses sales and performance fluctuations in plain English, combining 10+ retail signals including ads, pricing, inventory, and digital shelf data. Instead of just showing charts, Neo provides detailed insights and suggests concrete, retail-aware actions. For example, if sales drop, Neo might identify that you lost the Buy Box due to pricing and recommend pausing high-spend campaigns until pricing is competitive again.

Version Control

Save complete snapshots of campaign settings, bids, budgets, and placement modifiers before major events like Prime Day or Black Friday. Test aggressive strategies, knowing you can roll back to your exact previous state with one click. This eliminates the fear of "baking in" mistakes during high-stakes campaigns.

Performance Monitoring

The dedicated Performance Monitor ties every rule-driven change (bid adjustments, budget shifts, dayparting) to its impact on KPIs over time. You can quantify which automations actually improve performance and quickly disable the ones that don't, creating a continuous optimization feedback loop.

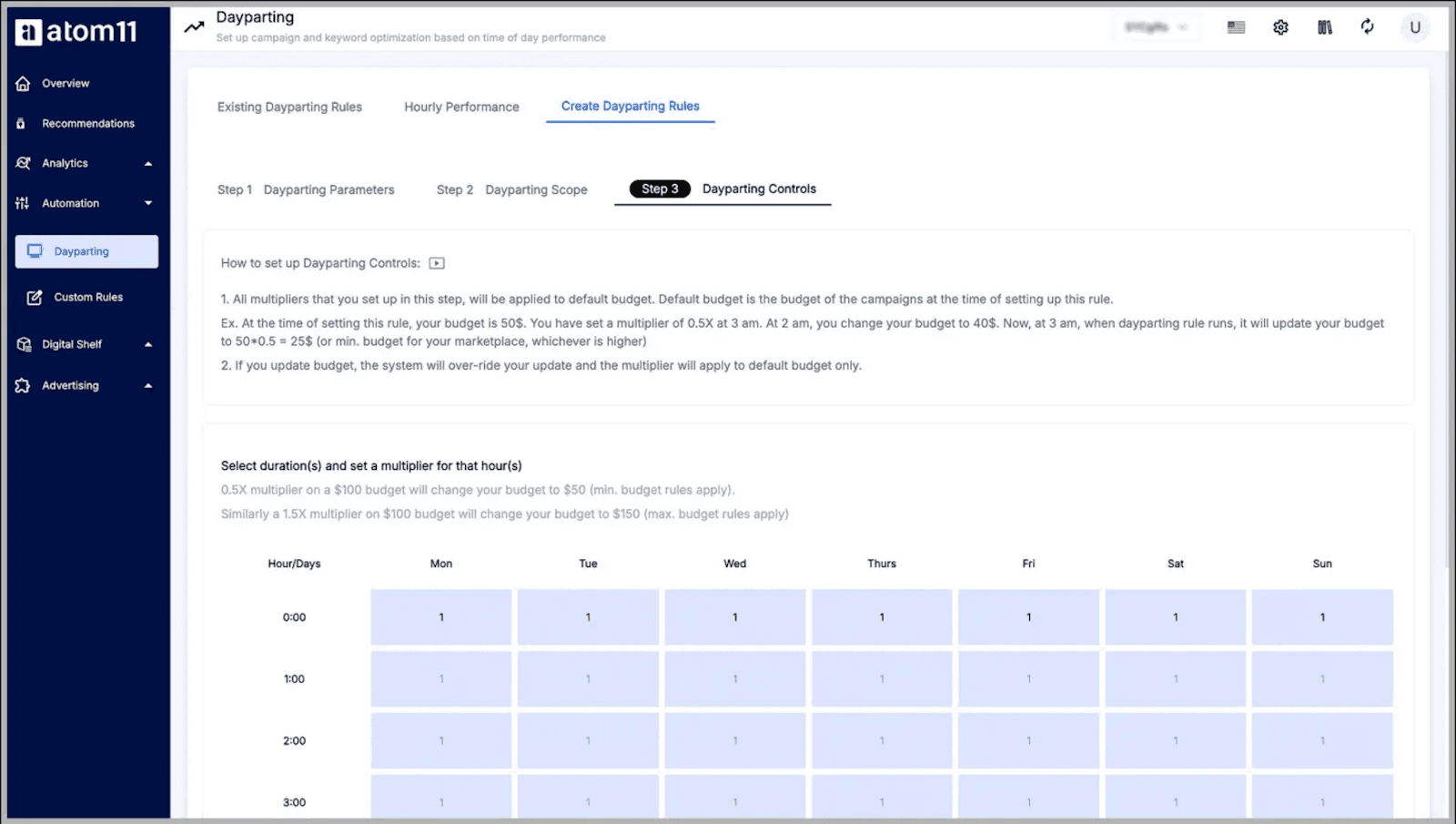

Dayparting with Retail Signals

Uses Amazon Marketing Stream data for hourly dayparting on bids and budgets, layering in rules based on inventory, search rank, and Buy Box ownership. You don't just show more ads at certain hours; you show them when both shopper intent and retail conditions align for maximum conversion potential.

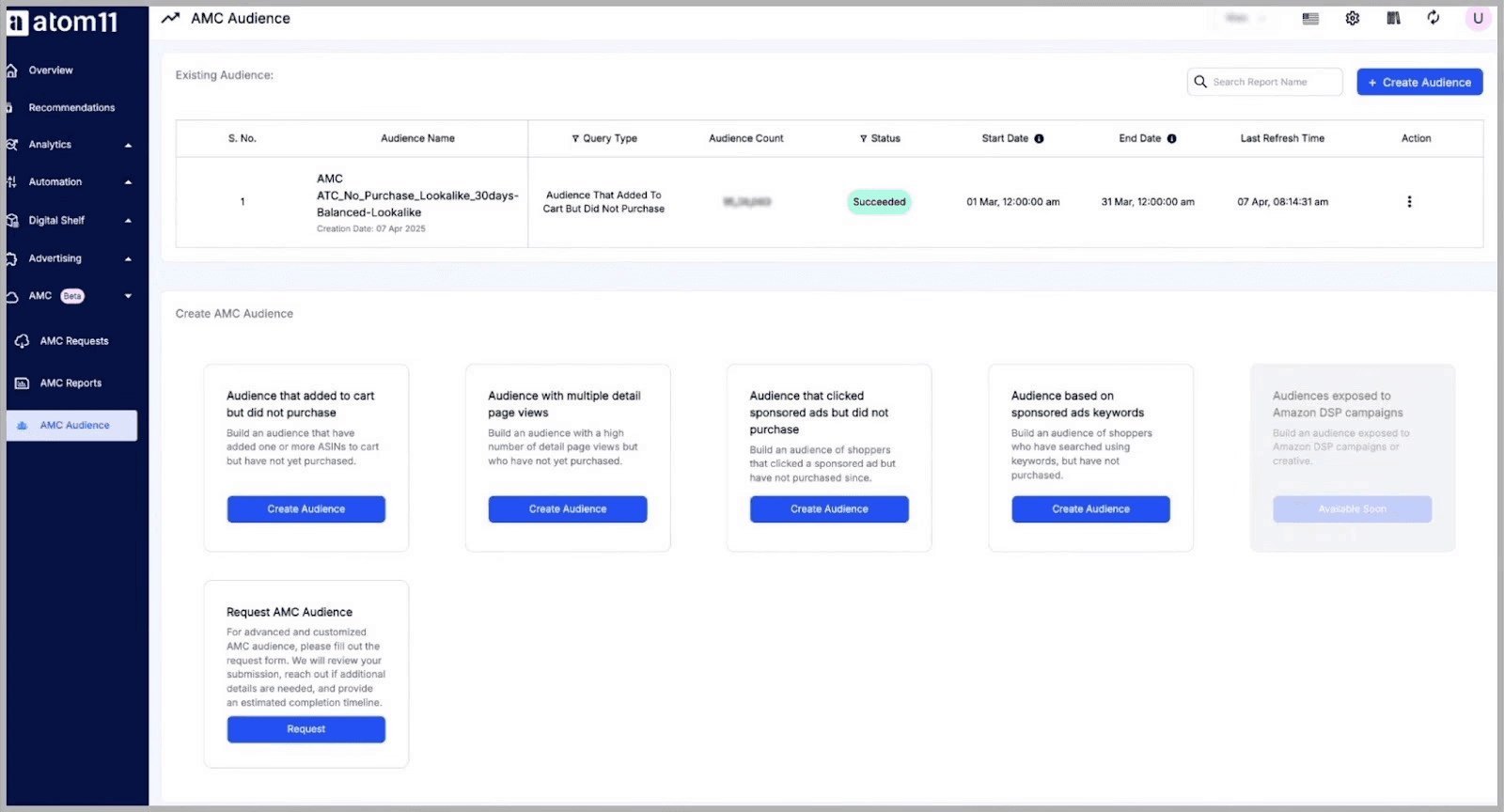

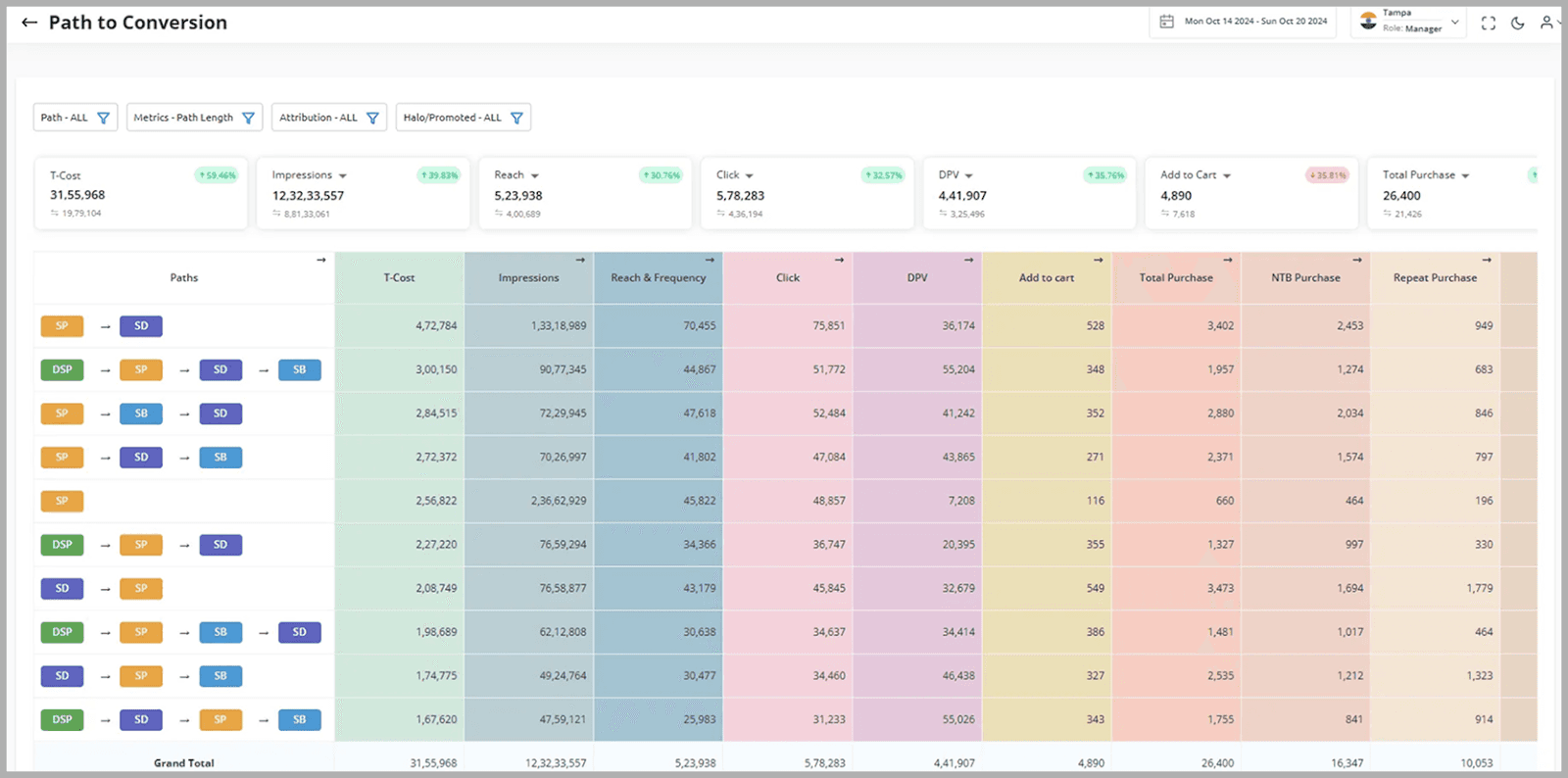

AMC Suite

One-click, no-SQL access to Amazon Marketing Cloud with ready-made reports and pre-built audience templates. If you're new to AMC, start with our comprehensive Amazon Marketing Cloud guide covering setup, use cases, and optimization strategies. Build Sponsored Ads and DSP audiences like cart abandoners or high-LTV customers, then refresh them automatically. No data science degree required.

Retail-Aware Automation

The rule engine wires directly into retail signals: inventory levels, pricing changes, Buy Box status, organic rank, and cannibalization metrics. Create automations like:

Pause ads on low-stock SKUs automatically

Cut bids when you lose the Buy Box

Reduce spend on keywords where you already rank organically

Free Onboarding Support

New accounts get a structured 4-week 1:1 onboarding program at no extra cost. An expert sets up automations, AMC reports, version control, and dayparting with you, then continues support via a shared Slack channel.

How atom11 Compares to SellerApp

SellerApp offers broad coverage across product research, keyword tracking, listing optimization, and basic PPC, making it useful as an all-in-one toolkit. atom11, by contrast, is purpose-built for advertising depth. Instead of surface-level bid automation, atom11 connects PPC decisions directly to real retail signals like inventory levels, Buy Box ownership, pricing competitiveness, and organic rank. atom11’s transparent, rule-based automation lets you see exactly why changes happen, validate impact through performance monitoring, and safely test strategies using version control, capabilities SellerApp doesn’t offer. For sellers who outgrow SellerApp’s basic PPC and need sophisticated, retail-aware advertising optimization, atom11 delivers significantly more control, intelligence, and scalability starting at $199/month.

Helium 10

Helium 10 is positioned as an all-in-one e-commerce suite for Amazon, Walmart, and TikTok Shop sellers, combining product research, listing optimization, operations management, and PPC automation in a single platform.

Best for

Growing Amazon sellers who want comprehensive tools covering the entire selling journey from product discovery through advertising under one subscription. Particularly valuable for sellers who need both research and advertising capabilities. However, according to some sellers, having too many features has made navigating Helium10 difficult.

Key Features

Complete Product Research Suite: Black Box, Cerebro, and Magnet tools for finding products and keywords

Listing Optimization: Scribbles, Index Checker, and Listing Analyzer ensure SEO-optimized listings

Operations Dashboard: Inventory monitoring, refund recovery, and account health alerts

Adtomic PPC Automation: AI-powered bid management with performance tracking

Multi-marketplace Support: Works across Amazon US and international markets, plus Walmart

Profit Analytics: Comprehensive profit tracking accounting for all fees and costs

Chrome Extension Tools: Quick access to key metrics while browsing Amazon

Academy Training: Extensive educational resources for learning Amazon strategies

How atom11 Compares

Helium 10 offers broad functionality across research, listings, and basic PPC, while atom11 is purpose-built for advertising depth. atom11 connects PPC optimization to retail signals Helium 10 doesn’t integrate, including inventory, Buy Box, pricing, and organic rank, and adds advanced capabilities like version control, hourly dayparting, performance monitoring, and one-click AMC access. Helium 10 works as an all-in-one toolkit; atom11 excels when advertising performance is the primary growth lever.

Xnurta (formerly Xmars)

Xnurta is an AI-driven advertising platform designed for mid-to-large brands looking to optimize campaigns across Amazon and other marketplaces with machine learning-powered automation.

Best for

Mid-size to enterprise brands that want advanced AI optimization across multiple marketplaces but need less hand-holding than Quartile's full-service model.

Key Features

AI-Powered Bidding Engine: Machine learning algorithms optimize bids based on conversion probability

Multi-Marketplace Management: Unified dashboard for Amazon, Walmart, and other retail media platforms

Custom Reporting: Build tailored reports focused on your specific KPIs

Campaign Automation: Automated campaign creation and structure optimization

Budget Allocation: AI-driven budget distribution across campaigns and marketplaces

Performance Forecasting: Predictive analytics for expected campaign outcomes

Bulk Operations: Scale changes across hundreds of campaigns simultaneously

API Integration: Connect with external tools and data sources

How atom11 Compares

Xnurta uses AI-driven automation where optimization decisions are largely handled by machine learning, while atom11 emphasizes transparent, rule-based control. atom11 goes further by wiring retail signals like inventory, Buy Box status, and pricing directly into automation logic and adds version control and AI-driven root-cause analysis through Neo. Xnurta fits sellers comfortable with black-box AI; atom11 suits teams that want flexible, retail-aware optimization that they can control.

Hector.ai

HectorAI provides advanced Amazon PPC automation with tight Amazon Marketing Cloud integration and self-serve Amazon DSP access, positioning itself as a command center for comprehensive Amazon advertising.

Best for

Sellers wanting to combine Sponsored Ads optimization with AMC insights and DSP campaigns in a single platform, particularly those ready to leverage upper-funnel advertising.

Key Features

Amazon Marketing Cloud Integration: AMC-powered insights and audience building for journey-based optimization

Self-Serve Amazon DSP: Pay-as-you-go DSP access without upfront commitments

Targeting 360 Command Center: Unified dashboard consolidating all key metrics and controls

Keyword-Level ACoS Targeting: Set profitability targets at the keyword/ASIN level through HectorBid

Automated Bid Optimization: AI-driven bid calculations based on live CPC and conversion rates

Custom Audience Creation: Build and activate AMC audiences for Sponsored and DSP campaigns

Performance Analytics: Comprehensive reporting across all Amazon ad types

Budget Management: Intelligent budget allocation across campaigns and ad types

How atom11 Compares

Both platforms integrate Amazon Marketing Cloud, but atom11 extends beyond insights into retail-aware automation. While Hector emphasizes AMC reporting and DSP access, atom11 directly connects Sponsored Ads optimization to inventory, Buy Box, pricing, and organic rank, with transparent rule logic, version control, and performance monitoring. Hector is strong for DSP-led strategies; atom11 offers deeper Sponsored Ads intelligence tied to real retail conditions.

Pacvue

Pacvue is built for large brands managing advertising across Amazon, Walmart, Target, Instacart, and 100+ other retail media platforms, combining retail media management with commerce acceleration capabilities.

Best for

Enterprise brands and agencies with complex multi-retailer strategies that need unified management across dozens of retail media platforms alongside digital shelf and commerce operations.

Key Features

Share-of-Voice Optimization: Track SOV across keywords and categories, then use SOV targets in bid rules

Digital Shelf Analytics: Monitor retail-readiness, content health, ratings, stock, and Buy Box across retailers

Cross-Retailer Budget Planning: Recommends budget allocation between retailers based on incremental returns

Commerce Acceleration Suite: Integrates marketplace operations, retail media, digital shelf, and measurement

100+ Retailer Coverage: Manage campaigns across Amazon, Walmart, Target, Instacart, Kroger, and many more

Advanced Reporting: NIQ/Profitero data integration for comprehensive commerce insights

Retail Media Performance: Full-funnel measurement connecting media to actual Amazon sales outcomes

Team Collaboration: Multi-user workflows with role-based permissions

How atom11 Compares

Pacvue is built for omnichannel retail media across 100+ retailers, whereas atom11 focuses exclusively on Amazon depth. atom11 embeds retail signals like inventory, pricing, and Buy Box ownership directly into PPC automation and adds version control and performance monitoring, which Pacvue doesn’t natively offer at the bid-logic level. Pacvue fits enterprise omnichannel needs; atom11 delivers greater Amazon-specific intelligence at a significantly lower starting price.

Skai

Skai (formerly Kenshoo) is an enterprise-grade omnichannel marketing platform that manages retail media alongside paid search, paid social, display, and app campaigns for large advertisers.

Best for

Enterprise brands with massive budgets managing complex advertising across Google, Meta, TikTok, Amazon, Walmart, and other channels that need unified planning, execution, and measurement.

Key Features

True Omnichannel Execution: Manage retail media, search, social, display, and app campaigns in one UI

Retail + Social Commerce Bridge: Connect social discovery to retail outcomes and optimize accordingly

Advanced Audience Management: Automate CRM and third-party data onboarding across channels

AI Planning Layer: Bedrock-based AI agents surface cross-channel insights and recommendations

Budget Optimization: Shift spend between channels based on performance and opportunity

Custom Measurement: Build attribution models matching your specific customer journey

Team Workflows: Enterprise collaboration with approval chains and role-based access

API Integrations: Connect to existing martech stack and data warehouses

How atom11 Compares

Skai is designed for enterprise omnichannel marketing across search, social, and retail media, while atom11 is purpose-built for Amazon sellers. atom11 connects PPC decisions to retail signals Skai doesn’t account for, including inventory, Buy Box, and pricing, and adds version control, performance monitoring, and AI-driven root-cause diagnosis. Skai suits brands managing massive cross-channel budgets; atom11 delivers superior Amazon-specific control and value at $199/month.

Adlabs

Adlabs is designed specifically for Amazon advertising agencies and large brands managing extensive campaign portfolios across multiple accounts and marketplaces.

Best for

Agencies managing advertising for many clients or large brands with complex multi-account structures that need powerful bulk operations and white-label reporting.

Key Features

Multi-Client Dashboard: Manage dozens of Amazon Seller Central accounts from one interface

Bulk Campaign Management: Create, edit, or pause hundreds of campaigns simultaneously

Advanced Automation Rules: Set sophisticated rules for bid adjustments and budget allocation

White-Label Reporting: Client-facing reports with custom branding

Team Collaboration: Role-based permissions and workflow management

Budget Controls: Set account-level and campaign-level budget caps

Performance Analytics: Cross-account insights and benchmarking

Campaign Templates: Reusable structures for faster client onboarding

How atom11 Compares

Adlabs prioritizes multi-account efficiency and bulk operations, while atom11 prioritizes smarter optimization at the account level. atom11’s retail-aware automation factors in inventory, Buy Box status, pricing, and organic rank, supported by version control and performance monitoring, capabilities Adlabs doesn’t offer. Adlabs works for operational scale; atom11 drives stronger per-account performance through deeper retail intelligence.

Intentwise

Intentwise specializes in advanced Amazon advertising analytics, AMC integration, and data-driven optimization for sellers who prioritize deep insights and custom reporting.

Best for

Data-driven sellers and brands who want sophisticated analytics and Amazon Marketing Cloud insights to inform their advertising strategies across marketplaces.

Key Features

Advanced Analytics Engine: Deep-dive reporting with custom metrics and dimensions

AMC Integration: No-SQL access to Amazon Marketing Cloud with pre-built queries

Custom Dashboards: Build personalized views focused on your specific KPIs

Multi-Marketplace Insights: Unified reporting across Amazon, Walmart, and other platforms

Audience Analysis: Understand customer segments and their advertising response

Performance Attribution: Connect advertising spend to actual sales outcomes

API Access: Export data to external BI tools and data warehouses

Automated Reporting: Schedule and distribute reports to stakeholders

How atom11 Compares

Intentwise focuses on analytics and AMC-driven insights, while atom11 combines analytics with action. atom11 not only surfaces insights through AMC and AI Copilot Neo, but also ties them to rule-based automation connected to retail signals, supported by version control and performance monitoring. Intentwise is ideal for insight-led manual optimization; atom11 delivers insight plus execution.

BidX

BidX focuses on automating advertising operations for Amazon and Walmart sellers with emphasis on campaign creation, SKU-level targeting, and international marketplace support.

Best for

Sellers managing campaigns across Amazon and Walmart in multiple countries who need SKU-level ACoS control and multi-currency support.

Key Features

SKU-Level ACoS Targeting: Set profitability targets for individual products

TACOS-Aware Rules Engine: Optimize using Total ACoS (paid + organic sales)

One-Click Campaign Setup: Automated campaign creation and restructuring

Multi-Marketplace Support: Manage Amazon and Walmart across countries

Multi-Currency Handling: Native support for international marketplace currencies

Automated Suggestions: System recommends bid changes and budget adjustments

Advanced Dashboards: Performance insights across accounts and marketplaces

Bulk Operations: Scale optimizations across many campaigns efficiently

How atom11 Compares

BidX emphasizes SKU-level control and multi-marketplace support, particularly for Walmart, while atom11 focuses on deeper Amazon-specific intelligence. atom11 integrates inventory, Buy Box, pricing, and organic rank directly into automation and adds version control and performance monitoring, delivering more sophisticated optimization at a lower starting price. BidX is strong for cross-retailer coverage; atom11 delivers superior Amazon performance.

Perpetua

Perpetua is a comprehensive Amazon advertising platform known for its goal-based AI engine and deep coverage of all Amazon ad types, including DSP, serving brands and agencies running sophisticated multi-channel strategies.

Best for

Established brands and agencies running comprehensive Amazon advertising campaigns across Sponsored Products, Brands, Display, and DSP who want AI-driven optimization.

Key Features

Goal-Based AI Engine: Set ACoS and budget targets; AI manages bids across Amazon, Instacart, and Walmart.

Deep Amazon Ad Coverage: Supports Sponsored Products, Brands, Brands Video, Display, and DSP

Integrated DSP Optimization: AI-powered DSP budget allocation outperforming Amazon's native optimization

Bulk Onboarding: Launch hundreds of ASINs into campaigns quickly

Keyword Harvesting: Automated discovery and addition of winning search terms

Performance Tracking: Rich analytics with custom dashboards

Multi-Marketplace: Unified management across Amazon US, EU, and other regions

Strategic Guidance: Optimization playbooks and best practices

How atom11 Compares

Perpetua relies on goal-based AI to manage optimization decisions automatically, while atom11 uses transparent, rule-based automation you control. atom11 uniquely ties optimization to retail signals like inventory, Buy Box, and pricing, and adds version control and performance monitoring for safe experimentation. Perpetua suits teams seeking hands-off AI; atom11 is better for sellers who want explainable, retail-intelligent automation at $199/month.

| Related read: Top 12 Perpetua Competitors for Amazon Sellers

Quartile

Quartile is an enterprise-focused Amazon advertising platform designed to automate and optimize PPC at scale. Unlike keyword or listing-centric tools, Quartile operates almost entirely on AI-driven decision-making, managing bids, budgets, and campaign structures automatically for large brands with significant ad spend.

Best for

Large brands and enterprise sellers running high-volume Amazon advertising who want hands-off, AI-managed optimization without needing granular manual control.

Key Features

AI-Driven PPC Automation: Automated bid and budget optimization across Sponsored Products, Brands, and Display

Portfolio-Level Budget Management: Allocates spend dynamically across products and campaigns based on performance goals

Enterprise Account Structure: Built to manage large catalogs and multiple brands efficiently

Always-On Optimization: Continuous bid adjustments without manual rule creation

Performance Reporting: High-level dashboards focused on revenue, efficiency, and scalability

Managed-Service Orientation: Platform is often paired with strategic support for enterprise advertisers

How atom11 Compares

Quartile relies on opaque, AI-only automation that works well for hands-off enterprise teams but offers limited visibility into why changes happen. atom11 takes a transparent, rule-based approach, letting you define automation logic tied directly to retail signals like inventory, Buy Box, pricing, and organic rank, then validate impact through performance monitoring. With version control, root-cause analysis, and a starting price of $199/month (vs enterprise contracts), atom11 delivers advanced automation without sacrificing control or affordability.

Adbrew

Adbrew is a modern Amazon PPC automation platform focused on speed, usability, and AI-assisted optimization. It emphasizes fast setup, clean workflows,ical execution, and collaborative tools, making it popular among lean teams and agencies that want to move quickly without enterprise overhead.

Best for

Brands and agencies looking for fast campaign setup, AI-assisted bid optimization, and an intuitive interface without long-term contracts.

Key Features

AI-Assisted Bid Optimization: Machine learning–driven bid recommendations based on performance signals.

Fast Campaign Creation: Rapid setup and restructuring of Sponsored Ads campaigns.

Bulk Operations: Scale bid, budget, and keyword changes across campaigns instantly.

Rule-Based Automation: Custom if-then workflows for bids, budgets, and keyword control.

Search Term Mining: Automated discovery of converting terms and negative keyword suggestions.

Team Collaboration Tools: Multi-user access with permissions for brands and agencies.

How atom11 Compares

Adbrew prioritizes speed and usability, while atom11 prioritizes intelligence and control. atom11 integrates retail context into every optimization decision and adds version control, AI-driven root-cause analysis, and AMC-powered insights, going beyond Adbrew’s ad-metric-focused optimization. Adbrew works for fast execution; atom11 delivers smarter, retail-aware execution.

Features to Look for Based on Your Business Type

When evaluating SellerApp alternatives, it’s important to compare the range of features offered by each based on your business stage rather than treating all SellerApp competitors as equal.

Business Type | Essential Features to Have in a PPC Tool |

New Sellers (First Year) |

|

Growing Sellers (1–3 Years) |

|

Established Brands (3+ Years) |

|

Enterprise / Agencies |

|

Why atom11 is the Best SellerApp Competitor for Advertising

Among the 12 SellerApp alternatives covered here, atom11 stands out as the most powerful tool-of-choice for sellers who prioritize advertising performance over the broad tool coverage offered by many SellerApp competitors. While SellerApp provides comprehensive research and basic PPC in one platform, many brands need sophisticated advertising capabilities that justify a specialized tool.

Advertising Specialization vs. Jack of All Trades: SellerApp spreads functionality across product research, listing optimization, and basic PPC. atom11 focuses exclusively on advertising excellence, delivering retail-aware automation that connects campaigns to inventory, Buy Box, pricing, organic rank, and cannibalization metrics. This specialization produces measurably better advertising results.

Retail Intelligence That Others Don't Offer: SellerApp's PPC automation focuses on basic bid adjustments based on performance metrics. atom11's retail-aware approach prevents waste by automatically pausing ads on out-of-stock products, reducing bids when you've lost the Buy Box, and cutting spend on keywords where you already rank organically. No other platform integrates retail intelligence this deeply into optimization logic.

Transparency Over Black Box: SellerApp's automation operates somewhat opaquely, making changes without always explaining why. atom11 uses rule-based automation where you define the logic, see exactly what triggers each change through an audit trail, and validate impact through Performance Monitoring. You maintain complete control while benefiting from sophisticated automation.

Unique Safety and Diagnostic Tools: atom11 provides version control (save campaign settings before big events and roll back instantly) and AI Copilot Neo (diagnose why performance changed in plain English), capabilities that SellerApp doesn't offer. These tools let you test aggressively knowing you can recover, and understand performance shifts quickly.

Accessible Specialized Pricing: SellerApp's advanced PPC features require $99-299/month plans. atom11 starts at $199/month with no lengthy contracts, delivering significantly more sophisticated advertising capabilities at a similar or lower price point than SellerApp's higher tiers.

Award-Winning Innovation: atom11's excellence has been recognized by Amazon itself at the Amazon Partner Awards. The platform won the Amazon Ads AI Innovation Award 2025 and the Beyond the Funnel Innovation Award 2024 for APAC, validating its sophisticated approach to Amazon advertising. These aren't marketing awards; they're recognition from Amazon that atom11's technology represents genuine innovation in advertising optimization.

For sellers who use SellerApp's research tools but need better advertising results, atom11 provides the specialized solution: retail-aware automation you control, at accessible pricing, backed by award-winning technology. Book a demo to see how atom11 can optimize your Amazon advertising better than SellerApp's basic PPC module.

FAQs

What is a good alternative to SellerApp for Amazon sellers?

The best SellerApp alternative depends on your priorities. For advertising excellence, atom11 leads with retail-aware automation connecting campaigns to inventory, Buy Box, and pricing at $199/month. For comprehensive all-in-one tools, Helium 10 offers the most extensive suite starting at $39/month. For product research focus, Jungle Scout provides proven research tools from $49/month. For budget-friendly research, AMZScout starts at $49.99/month. For advertising with AI, Perpetua delivers goal-based optimization at $695/month.

Do SellerApp alternatives offer better listing optimization tools?

Several alternatives specialize in listing optimization beyond SellerApp's capabilities. PickFu offers unique consumer testing with real target customer feedback. Helium 10's Scribbles and Listing Analyzer provides more sophisticated optimization. Jungle Scout's Listing Builder integrates keyword research more seamlessly. Viral Launch combines optimization with competitive analysis and split testing. For sellers prioritizing listing optimization, these specialized tools often deliver better results than SellerApp's general-purpose optimizer.

What are the top AI-powered alternatives to SellerApp?

Top AI-powered alternatives include atom11 (retail-aware AI with transparent rules, $199/month), Perpetua (goal-based AI for multi-channel, $695/month), Teikametrics (Flywheel 2.0 predictive AI, $499/month), Helium 10 (AI-powered research and Adtomic automation, $39/month starting), and Viral Launch (AI listing optimization and Kinetic PPC). atom11 stands out by combining AI diagnostics through Copilot Neo with transparent rule-based automation, giving you both intelligence and control.

What is the cheapest SellerApp alternative for beginners?

The most affordable alternatives for beginners include Helium 10 starting at $39/month with comprehensive tools, SmartScout at $29/month for category research, ZonGuru at $49/month for user-friendly tools, and AMZScout at $49.99/month for product research. While SellerApp offers a free plan/freemium tier, these paid alternatives typically provide better data accuracy and more useful features for growing sellers. For advertising specifically, atom11's $199/month is worthwhile when ad spend justifies professional optimization.