Best Amazon Seller Tools: Build Your Winning Tech Stack

Author:

Neha Bhuchar

Last Updated:

Feb 6, 2026

Published on:

Table of Contents

Selling on Amazon in 2026 isn't what it used to be. The days of listing a product, running a few ads, and watching sales roll in are long gone. Today's competitive Amazon marketplace demands precision, speed, and intelligence. The difference between thriving brands and struggling sellers isn't product quality anymore. It's who has the better system.

With rising cost-per-click rates squeezing profit margins and algorithmic changes happening weekly, guessing your way through inventory decisions or ad spend is a luxury no seller can afford. Success now belongs to those who leverage the best Amazon seller tools to automate, optimize, and outmaneuver competitors operating at machine speed.

Why Advanced Amazon Seller Software Tools Matter More Than Ever

Data Overload Without Direction

Amazon provides more business intelligence than ever before. Brand Analytics, Amazon Marketing Cloud, Search Query Performance reports: the data streams are endless. Yet most Amazon sellers drown in metrics without knowing which numbers actually drive profitability or how to act on them quickly enough to matter.

Competition Moves at AI Speed

While you're manually adjusting bids once a week, sophisticated competitors use Amazon seller software tools that adjust pricing and advertising strategies every hour based on real-time signals. By the time you react to a trend, they've already captured the Buy Box and the conversions that come with it.

Scale Breaks Manual Systems

Managing one or two products manually is feasible. Once you reach 10+ SKUs with multiple variations, manual management becomes impossible. You'll face constant stock-outs on bestsellers while overspending on ads for products sitting in warehouses. Without integrated seller tools, scaling means chaos.

The Amazon Seller Software Landscape: Understanding the Gaps

Before we dive into building your ideal tech stack, it's important to understand that not all Amazon seller software is created equal. Each category of tools serves a specific purpose, but they all share a critical blind spot that prevents them from delivering complete business intelligence.

Category | Industry Examples | The Hidden Limitation |

Market Research | Helium 10, SmartScout | Static data; doesn't help with daily operations once the product is live |

PPC & Ads | Perpetua, Pacvue | Often black-box AI that ignores your actual inventory or profit margins |

Inventory | SoStocked, Inventory Planner | Disconnected from ads; you might drive traffic to a product with 2 days of stock |

Financials | Sellerboard, Conjura | Reactive rather than proactive; tells you what you lost, not how to stop the leak |

The challenge for Amazon sellers isn't finding tools. It's finding tools that talk to each other and provide a unified view of your Amazon business.

The Four Pillars: Essential Software Tools Every Amazon Seller Needs

To compete effectively in 2026, your Amazon seller system needs to cover four critical pillars. Let's examine the legacy tools that address each area.

Pillar 1: Product Research and SEO Intelligence

These research tools are the detectives of your Amazon business, uncovering opportunities and tracking competitive movements before they impact your sales performance.

Helium 10

Helium 10 offers a broad suite of tools for keyword research, reverse ASIN lookups, and listing optimization.

Cerebro tool reveals exactly which search terms competitors rank for, showing you search volume, competition levels, and keyword trends over time.

Black Box helps identify profitable products in untapped niches by filtering through Amazon's entire product database using criteria like price range, review count, and estimated sales velocity.

Keyword tracker monitors your search results positioning across thousands of terms, giving you an early warning when organic rankings slip.

Magnet generates keyword ideas based on seed terms for comprehensive keyword research.

Scribbles ensures you're using all your researched keywords effectively within character limits.

Index Checker verifies which keywords Amazon actually indexed for your listing, preventing wasted optimization efforts.

SmartScout

SmartScout has emerged as a rising favorite for sub-category visualization and identifying brand-level gaps.

Market intelligence tools show you where established brands are weak, revealing new opportunities for market share capture.

Traffic graph shows where customers are actually shopping within category trees, highlighting overlooked niches.

Brand comparison features let you benchmark your product visibility against competitors.

Category research tools provide Amazon FBA business insights about market saturation levels before entering new product categories.

Pillar 2: Advertising Automation and Campaign Management

These are the engines that drive traffic and conversions. Without sophisticated PPC campaign management, you're burning money while competitors optimize in real time.

Perpetua

Perpetua uses AI for goal-based bidding across Sponsored Products, Brands, and Display.

Automated budget shifting moves spend toward high-performing ad campaigns while scaling back underperformers.

Goal-based optimization lets you set targets for ACoS, revenue maximization, or profit optimization.

Campaign structure recommendations help you organize products into logical ad groups.

Automated negative keyword harvesting prevents wasted spend on non-converting search terms.

Cross-campaign budget allocation ensures top performers never run out of budget.

Black-box AI approach means you often don't know why specific decisions were made.

Pacvue

Pacvue serves enterprise brands managing advertising across Amazon, Walmart, Target, Instacart, and 100+ other retail media platforms.

Unified dashboard consolidates performance across all retail channels, eliminating the need to log into multiple advertising platforms.

Share-of-voice tracking shows your visibility compared to competitors on critical keywords and categories.

Budget recommendation engines suggest optimal allocation across retailers based on incremental return on ad spend.

Digital shelf analytics monitor content quality, A+ page completeness, and listing optimization across all retail partners.

Broad focus means it lacks the deep Amazon-specific intelligence that specialized tools provide.

Pillar 3: Inventory Management and Operations

These are the logistics tools that keep you in stock and ready to fulfill. Running out of inventory while ads are running is like throwing money into a fire.

SoStocked

SoStocked offers customizable inventory tracking that helps avoid the dreaded out-of-stock status.

Forecasting algorithms account for lead times, seasonality, promotional events, and sales velocity changes to recommend optimal reorder quantities.

Multi-location inventory management tracks stock across different fulfillment centers and warehouses.

Purchase order management streamlines the reordering process with supplier communication tools built-in.

Low stock alerts notify you before inventory reaches critical levels.

Sales velocity tracking identifies products with accelerating or declining demand so you can adjust purchase plans.

Seller Central integration pulls real-time inventory data, though it operates separately from your advertising decisions.

Inventory Planner

Inventory Planner excels for multi-channel sellers managing Amazon FBA business alongside Shopify or other Amazon marketplaces.

Demand forecasting prevents both stock-outs and the capital drain of overordering by analyzing historical sales patterns, seasonality, and growth trends.

Replenishment recommendations tell you exactly what to order and when based on lead times and desired stock coverage.

Multi-warehouse management optimizes inventory distribution across fulfillment locations.

Variant-level forecasting handles complex products with multiple sizes, colors, or styles.

Purchase order tracking monitors shipments from suppliers to Amazon warehouses.

Disconnected from advertising means it doesn't automatically adjust ad spend based on stock positions.

Pillar 4: Sales Analytics and Financial Tracking

These are the accountants of your brand, ensuring every sale actually contributes to your bottom line after Amazon's labyrinth of fees.

Sellerboard

Sellerboard provides a real-time profit dashboard that accounts for every Amazon fee, refund, PPC cost, cost of goods sold, and promotional expense.

Profit margins per product show actual profitability, not just revenue, with mobile app access for monitoring key metrics on the go.

Refund tracking identifies lost revenue from damaged or lost inventory, customer returns, and fee errors.

Email notification alerts warn you when profit margins compress or costs spike unexpectedly.

PPC analytics break down advertising profitability by campaign, ad group, and keyword.

Inventory valuation shows the total value of your stock at Amazon warehouses.

Conjura

Conjura is a popular choice for omnichannel sellers operating across Amazon, Shopify, and TikTok Shop.

Unified profit tracking gives you one source of truth, regardless of where sales occur.

Real-time analytics update throughout the day so you always know your current financial position.

Product-level profitability ranking shows which items in your catalog contribute most to your bottom line.

Cash flow forecasting helps plan for inventory purchases and operational expenses.

Team collaboration features let multiple users access financial data with permission controls.

Accounting software integration with QuickBooks streamlines tax preparation and financial reporting.

The Danger: Tool Fatigue and the Patchwork Problem

Here's the uncomfortable truth about building your Amazon seller system from individual best-in-class tools: you create a fragmented mess that's greater than the sum of its parts in the worst way possible.

Data Silos Create Blind Spots

Your advertising tool optimizes for conversions without knowing inventory is running low. Your inventory software orders based on historical sales data that doesn't account for the promotional campaign starting next week. Your profit analytics show margins shrinking, but you need to log into three separate platforms to understand why. These silos prevent the connected decision-making that separates successful FBA sellers from those struggling to break even.

Subscription Bloat Erodes Margins

Most Amazon sellers using a full patchwork stack pay between $1,000 and $2,000 monthly across multiple subscriptions. Worse, many features overlap. You're paying for keyword research in Helium 10, basic PPC automation in Perpetua, and profit tracking in Sellerboard, with none of them sharing data or insights.

The Investigation Problem

When sales drop unexpectedly, the detective work begins. Is it lost Buy Box due to pricing? Inventory running low, triggering Amazon's algorithm to reduce visibility? Wasted ad spend on keywords where you already rank organically? With fragmented seller tools, you'll spend hours jumping between dashboards, exporting CSV files, and building spreadsheets just to diagnose the problem. By the time you identify the cause, you've lost days of revenue.

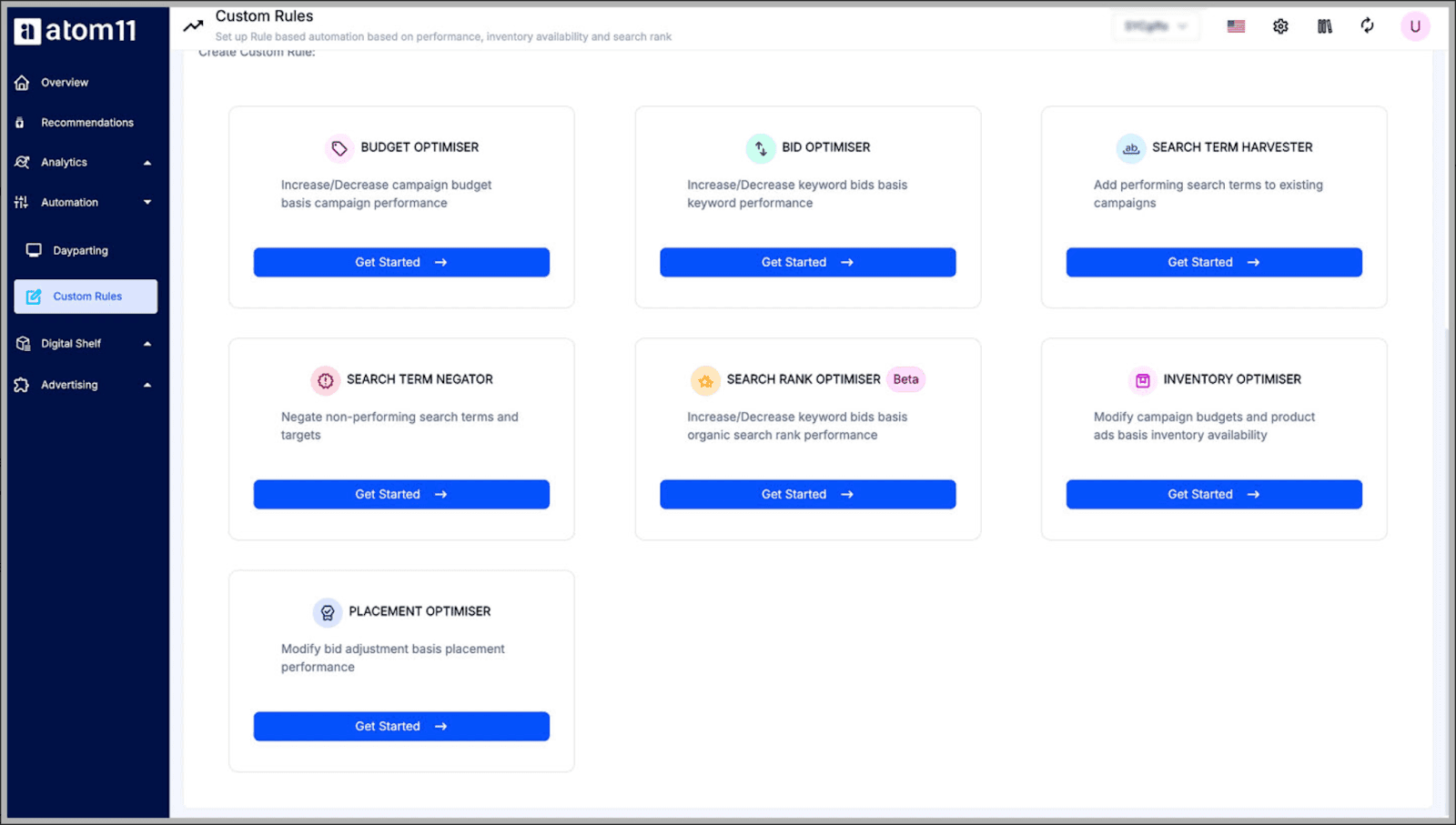

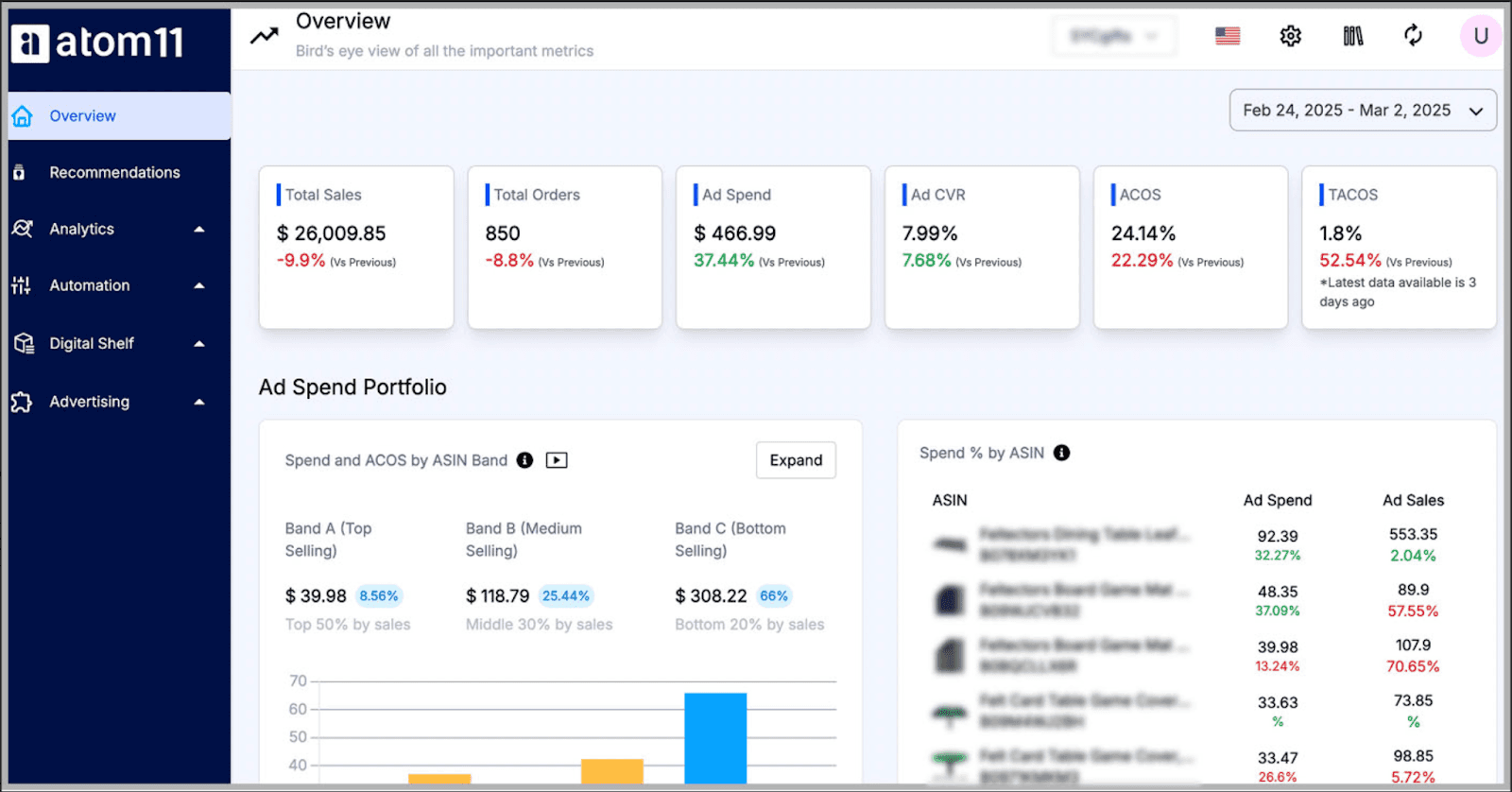

atom11: The All-in-One Operating System for Amazon Sellers

atom11 isn't just another tool in your stack. It's a comprehensive Amazon seller software that replaces the patchwork approach with unified intelligence. Instead of forcing you to connect the dots between disconnected systems, atom11 provides integrated capabilities across all four pillars.

Pillar 1 Capabilities: Research and Market Intelligence

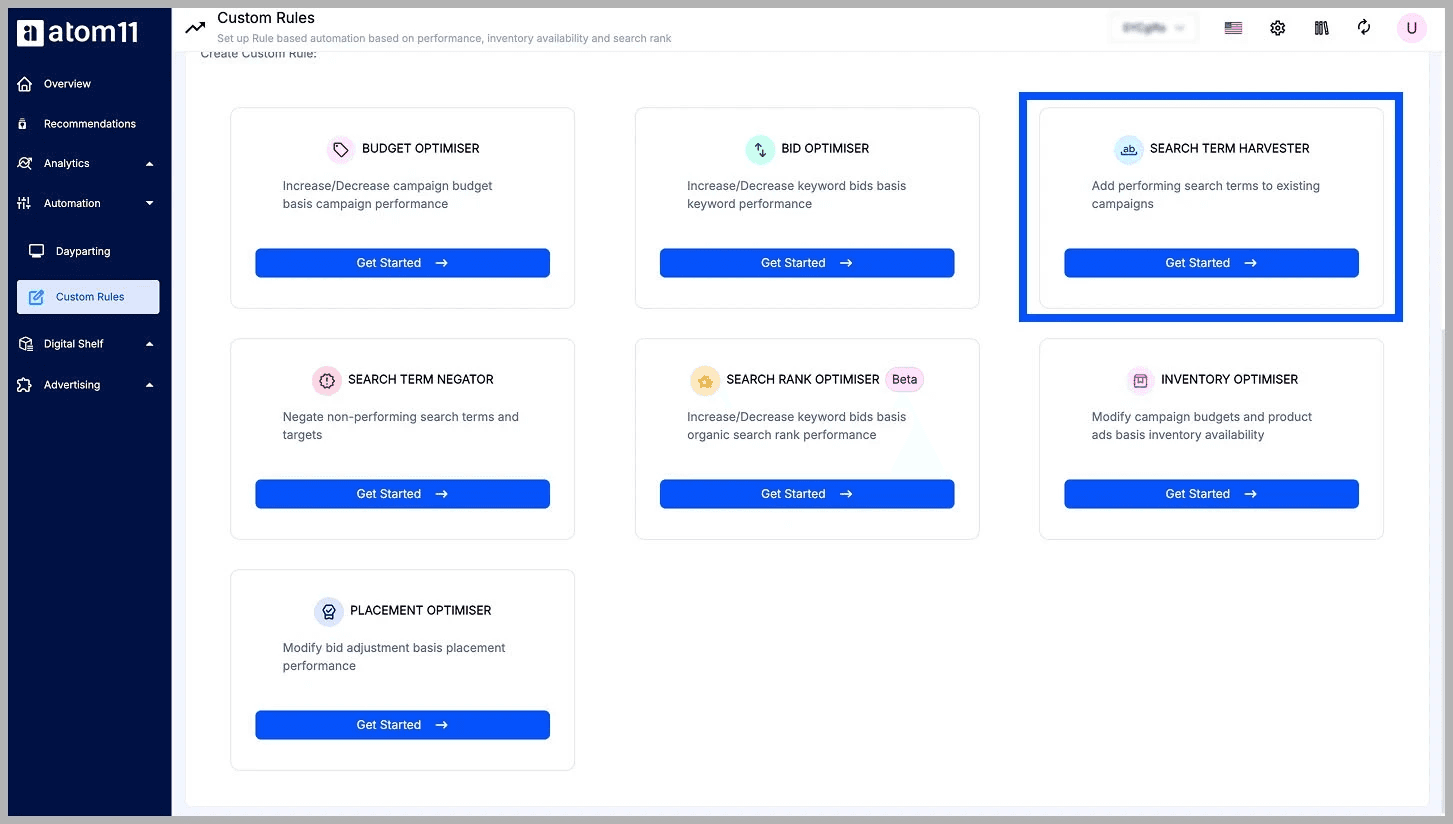

Search Term Harvester

atom11 automates keyword discovery and cleanup by continuously analyzing live Amazon campaign performance.

Daily Keyword Harvesting identifies high-converting search terms from active campaigns to systematically expand coverage

ASIN Target Discovery surfaces new, relevant ASIN targets based on real shopper search behavior

Automated Search Term Negation removes non-performing or wasteful terms to protect efficiency and margins

Rule-Based Controls let you set custom harvesting and negation logic for different categories and use cases

Data-Backed Keyword Growth ensures expansion is driven by performance signals, not estimates or guesswork

Spreadsheet-Free Execution eliminates manual exports and reporting by automating keyword actions end to end

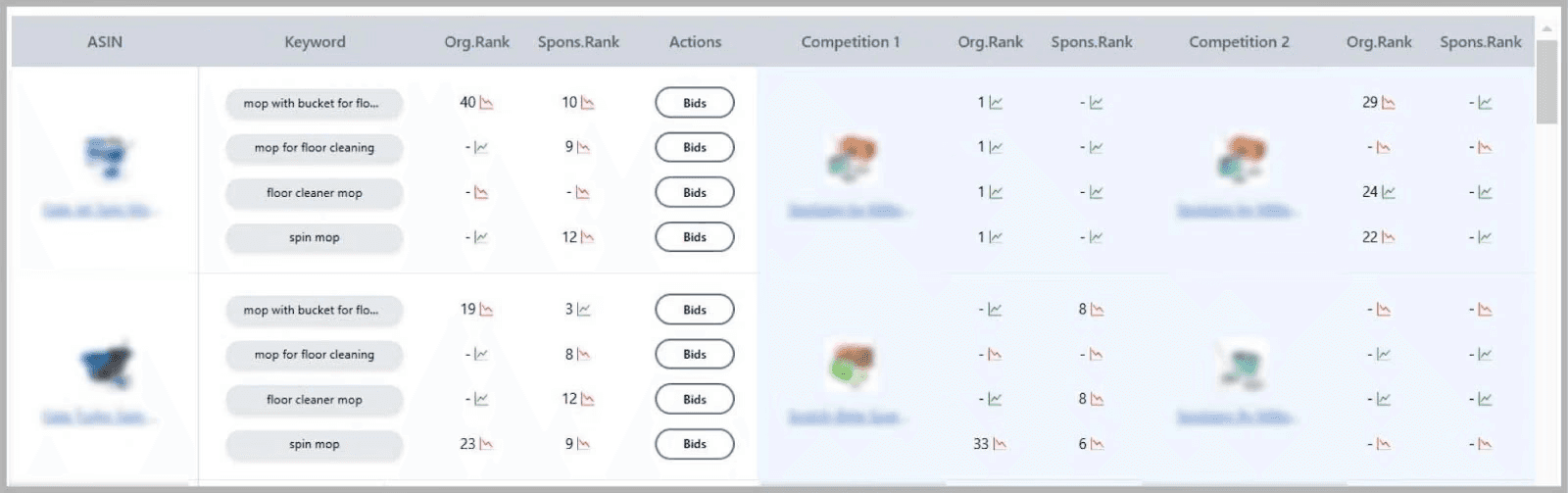

Digital Shelf Analytics

atom11 provides continuous visibility into pricing, rankings, reviews, and competitive position across the Amazon digital shelf.

Pricing Strategy Monitoring tracks your prices and competitors’ pricing trends over time, including discount frequency, timing, and depth

Competitor Price Alerts notify you instantly when key competitors change prices so you can respond proactively

Search Rank Tracking monitors how your products and competitors rank for priority keywords to identify visibility gains or losses

Review & Rating Analysis surfaces changes in customer feedback and ratings to uncover competitive strengths and conversion risks

Best Seller Rank Monitoring tracks competitor BSR movements to gauge shifts in demand and market share

Ad Spend & Pricing Alignment connects digital shelf signals with advertising performance to evaluate how pricing impacts conversion and efficiency

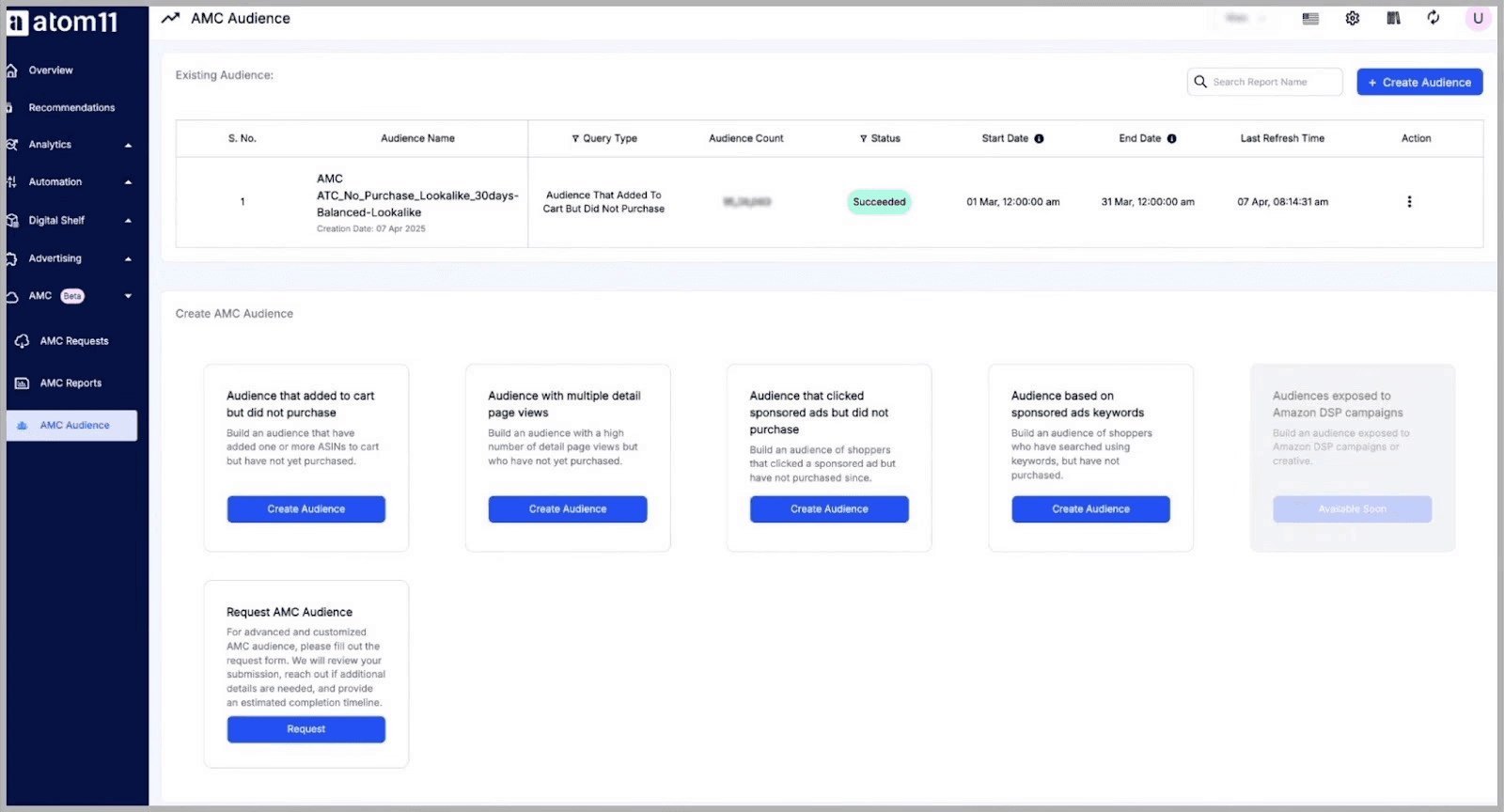

atom11 offers one-click, no-SQL access to advanced analytics that previously required a data science degree.

Pre-built audience templates identify high-value customer segments like repeat purchasers, cart abandoners, and high lifetime value customers.

Automated reporting surfaces insights about customer journeys and conversion rates without manual data extraction.

Overlap analysis shows which customers see multiple touchpoints across Sponsored Products, Brands, Display, and DSP campaigns.

New-to-brand metrics reveal which advertising efforts attract genuinely new customers versus cannibalizing existing demand.

Path-to-purchase visualization maps how customers interact with your brand across multiple sessions before converting.

Audience refresh automation keeps your targeting segments updated without manual rebuilds.

Pillar 2 Capabilities: Advertising Automation

Retail-Aware Automation

atom11's rule engine connects directly to inventory levels, Buy Box status, pricing competitiveness, and organic rank. You can create sophisticated workflows like:

Automatically pause ads when inventory drops below 15 days of stock.

Reduce bids by 50% when you lose the Buy Box to preserve margins.

Cut spend on keywords where you already rank in the top 3 organic search results.

Increase budgets on profitable products with strong inventory positions.

Adjust campaign budgets based on your current pricing versus competitor pricing.

Scale spend when you win back the Buy Box after pricing adjustments.

Reduce advertising on products with declining organic rank to prevent cannibalization.

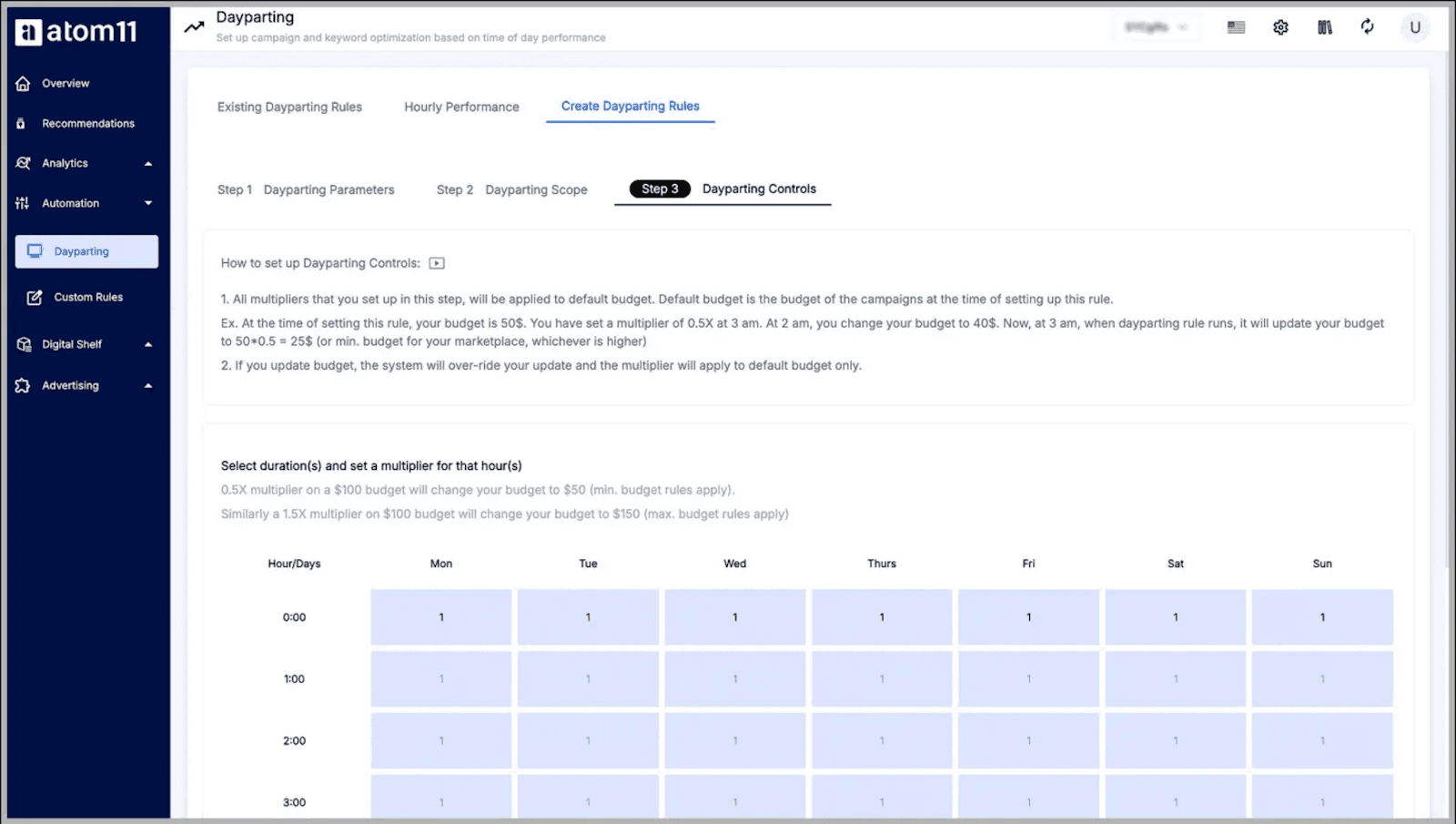

Dayparting

Dayparting uses Amazon Marketing Stream data for hourly bid and budget adjustments based on actual performance patterns.

Hourly performance analysis examines spend, sales, orders, impressions, clicks, ACoS, and ROAS by time of day.

Custom bid multipliers let you set different bid adjustments for different hours when your products convert best.

Budget scheduling allocates more spend to high-conversion time periods while conserving budget during slow hours.

Performance-based optimization ensures you're not wasting budget during low-conversion periods.

Automated execution implements time-based changes without manual monitoring.

| Related Read: Amazon PPC Dayparting: How It Works & When to Use It

Performance Monitor

The Performance Monitor ties every automation rule to measurable outcomes.

Impact tracking shows exactly which bid adjustments improved conversion rates and which budget shifts drove profitable growth.

Historical analysis displays automation performance over 7, 14, and 30-day windows.

Quick rule management lets you disable underperforming automations and double down on successful ones.

Continuous feedback loop validates which optimization strategies actually work for your products.

Full transparency provides audit trails showing why changes happened and what results they produced.

Version Control

Version Control saves complete snapshots of campaign settings, bids, budgets, and placement modifiers before major events.

One-click snapshots capture your entire account state before Prime Day or seasonal promotions.

Instant rollback restores your exact previous settings if experimental strategies don't deliver results.

Risk-free testing eliminates the fear that prevents experimentation during high-stakes campaigns.

Complete state preservation saves every detail so nothing is lost when reverting changes.

Experimentation enablement turns bold testing into a competitive advantage rather than a risk.

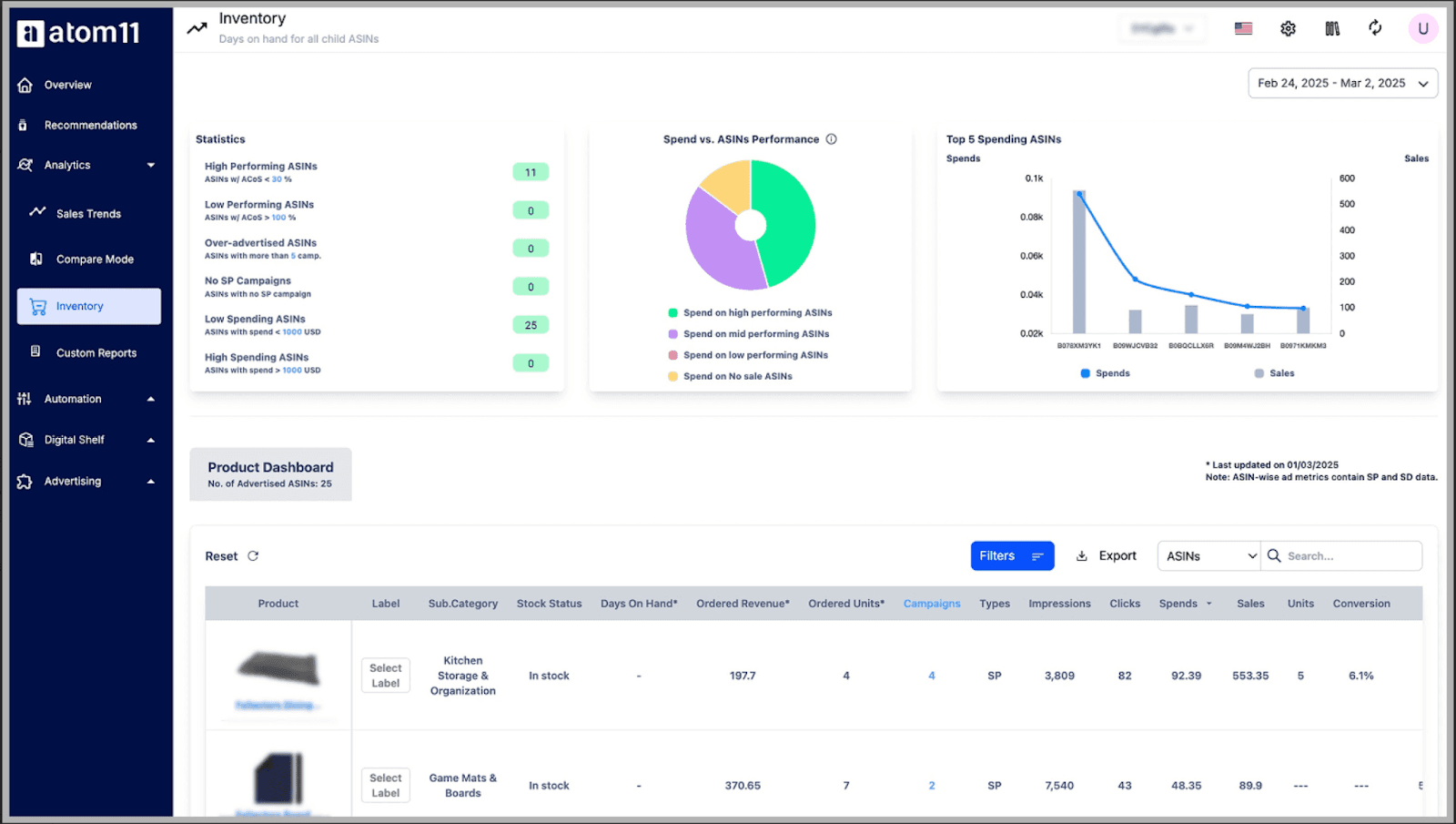

Pillar 3 Capabilities: Inventory Intelligence

Inventory-Aware Advertising

While atom11 isn't a full inventory management system, its inventory-aware advertising prevents the most costly mistake sellers make: driving expensive traffic to products about to stock out.

Real-time stock monitoring tracks inventory levels across all your SKUs continuously

Automatic ad adjustment reduces spend when stock drops below your threshold to avoid accelerating into stock-outs

Increased pressure on healthy inventory scales advertising when stock is plentiful and replenishment is confirmed

Unified decision-making ensures your Amazon ads and inventory strategy work together instead of fighting each other

Profit margin protection prevents the revenue loss from out-of-stock situations triggered by aggressive advertising

Sales velocity optimization maximizes revenue during periods of strong inventory availability

Pillar 4 Capabilities: Sales and Ad Analytics

Neo provides instant diagnostics in plain English when margins compress.

Multi-signal analysis examines Amazon advertising costs, pricing changes, Buy Box ownership, and competitive shifts simultaneously

Root cause identification pinpoints exactly why profitability decreased, such as: "Profit margin decreased 12% because you lost the Buy Box on your top 3 SKUs due to competitor pricing"

Actionable recommendations suggest concrete next steps like adjusting pricing to recapture the Buy Box or reducing ad spend until pricing is competitive

Eliminates investigation time replaces hours of manual analysis with instant, accurate explanations

Connected intelligence links advertising performance to broader retail conditions affecting profitability

Real-Time Performance Tracking

atom11 tracks profitability by connecting advertising costs, Amazon fees, and contribution margins.

Profit-based targeting lets you set goals based on actual profit instead of just ACoS or ROAS

Every dollar accountability ensures advertising spend actually contributes to business growth

Performance dashboards show profitability trends over time with drill-down capabilities

Product-level insights reveal which items, campaigns, or time periods drive the best returns

Margin compression alerts warn you immediately when profitability declines so you can act quickly

Comparison: The Patchwork Stack vs. Unified Intelligence

Understanding the practical differences between managing multiple Amazon seller software tools and using an integrated platform reveals why consolidation matters.

Feature | With Patchwork Stack | With atom11 |

Data Connection | Siloed. Ads don't see inventory levels | Fully integrated retail-aware signals |

Troubleshooting | Hours of manual spreadsheet analysis | Instant diagnosis via Neo AI Copilot |

Risk Management | No way to undo campaign mistakes | One-click version control rollback |

Strategic Depth | Basic ACoS and ROAS targets | Advanced AMC and full-funnel insights |

System Complexity | Managing 4+ logins and separate bills | One command center with unified data |

Learning Curve | Mastering multiple interfaces and workflows | Single platform with consistent logic and 1:1 onboarding support |

Support Experience | Dealing with multiple vendor customer support teams | Dedicated onboarding and Slack channel access |

Monthly Cost | $717 to $1,177+ across multiple tools | $499 for a complete unified platform |

Simplify to Scale: The 2026 Amazon Success Formula

In 2026, winning on Amazon isn’t about stacking more tools—it’s about seeing your business clearly and acting faster than competitors. Fragmented systems slow decisions, hide root causes, and waste valuable time while algorithms and rivals move at machine speed. What once worked in a simpler marketplace now creates friction instead of growth.

atom11 replaces patchwork stacks with unified, retail-aware intelligence across advertising, inventory signals, and profitability. By connecting the data that actually drives outcomes, sellers can diagnose issues instantly, automate with confidence, and scale without operational chaos. Instead of managing software, you focus on running a profitable Amazon business.

Book a demo to see how atom11 transforms fragmented data into unified business intelligence.

FAQs

What are the best all-in-one tools for Amazon sellers?

atom11 leads for retail-aware automation that combines advertising, inventory signals, and profit analytics in a single platform. Helium 10 offers comprehensive product research with limited PPC capabilities, while Jungle Scout excels at product database access and opportunity discovery. The right choice depends on whether you need launch-focused research or an operating system for managing an active Amazon business.

Which Amazon seller tools help with product research and selection?

Jungle Scout provides accurate sales data and supplier databases. Helium 10 offers reverse ASIN lookup and keyword research through Cerebro. SmartScout visualizes market trends and brand gaps. atom11 adds operational intelligence to identify profitable products you can actually execute on successfully.

What tools do successful FBA sellers use to increase profits?

Successful FBA sellers use atom11 for retail-aware optimization that connects advertising to inventory and pricing. Sellerboard tracks real-time profit margins. Conjura provides omnichannel profit analytics. The key is tools that optimize for actual profit, not just revenue or ACoS targets.

Are there any free Amazon seller tools worth trying?

Amazon Seller Central provides free basic analytics, keyword tracker, and campaign management. Most advanced features require paid tools. atom11 offers a 7-day free trial with full feature access and free onboarding to test retail-aware automation risk-free.

Which software is most useful for tracking Amazon sales analytics?

atom11 provides the most actionable sales analytics by connecting performance to retail signals like inventory, pricing, and Buy Box. Neo AI Copilot explains performance changes in plain English with recommended actions, turning analytics from descriptive to prescriptive.

What Are the Main Differences Between Jungle Scout and Helium 10?

Jungle Scout and Helium 10 are strong for product research and keyword discovery, but they stop at launch insights. atom11 extends beyond research by providing operational intelligence across advertising, inventory, and profitability for active Amazon sellers.

Which Software Is Most Useful for Tracking Amazon Sales Analytics?

The most useful Amazon sales analytics software goes beyond surface-level metrics like impressions and clicks. It explains how advertising, inventory availability, Buy Box status, and pricing changes impact revenue. atom11 connects these data points to show why sales change and what actions to take, turning analytics into practical, decision-ready insights.

How Do Amazon Seller Tools Help Optimize Product Listings for SEO?

Amazon seller tools support listing optimization by identifying keywords that influence search visibility and conversions. While many tools rely on estimated data, atom11 uses AMC insights and competitive benchmarks to highlight keywords that attract profitable customers, helping sellers focus SEO efforts on terms that drive long-term value.

What are the top apps for managing Amazon inventory efficiently?

SoStocked offers customizable inventory tracking with lead time management. Inventory Planner works well for multi-channel sellers. atom11 integrates inventory levels directly into advertising decisions, automatically adjusting ad spend based on stock positions to prevent costly stock-outs.

How do Amazon seller tools help optimize product listings for SEO?

Helium 10 and Jungle Scout identify high-volume keywords for listing optimization. atom11's AMC integration reveals which keywords attract high-lifetime-value customers, letting you optimize for profitable search terms rather than just high-volume traffic.

Which Amazon seller software is best for automating routine tasks?

atom11 leads with retail-aware automation that adjusts bids, budgets, and campaigns based on inventory, pricing, and Buy Box status. Teikametrics offers AI-driven flywheel optimization. Perpetua provides goal-based automation, though with less transparency into decision logic.

What tools can help Amazon sellers improve their PPC advertising?

atom11 combines automated bidding with retail intelligence for smarter PPC campaigns. Perpetua offers goal-based AI optimization. Teikametrics connects advertising to profit analytics. The best choice depends on whether you want transparent rule-based control or black-box AI management.

Which software tools are essential for competitive Amazon marketplace success?

Essential tools cover research like Jungle Scout or Helium 10, advertising like atom11 or Perpetua, inventory like SoStocked, and profit tracking like Sellerboard or Conjura. atom11 consolidates advertising, inventory intelligence, and profit analytics in one platform, reducing complexity while improving business goals achievement.