Top 13 Intentwise Alternatives & Competitors for Amazon PPC

Author:

Neha Bhuchar

Last Updated:

Jan 30, 2026

Published on:

Table of Contents

Intentwise is an advanced Amazon advertising analytics platform built for data-driven sellers and brands who prioritize deep insights, Amazon Marketing Cloud integration, and sophisticated reporting capabilities. The platform specializes in analytics-first optimization, custom dashboards, and multi-marketplace insights for teams that want to understand their advertising performance at a granular level.

The platform stands out for its analytics depth and AMC-powered insights. Advanced reporting capabilities provide detailed performance attribution, while custom dashboards allow teams to build personalized views focused on specific KPIs. Multi-marketplace analytics deliver unified insights across Amazon, Walmart, and other retail platforms with comprehensive data visualization.

At $1,000 per month, Intentwise delivers powerful analytics for sellers who value insight-driven decision-making. As teams mature, many brands begin evaluating Intentwise competitors that complement strong analytics with automated execution, rather than replacing insight with manual work. Many Intentwise alternatives combine actionable insights with automated execution, retail-aware optimization, and more accessible pricing for their advertising campaigns.

Why Amazon sellers look for Intentwise alternatives

Despite its analytics strength, many Amazon sellers explore Intentwise competitors that deliver integrated automation, better value, and actionable optimization. Common concerns include:

High pricing for analytics focus: At $1,000 per month, Intentwise costs significantly more than platforms offering both analytics and automation, limiting ROI for smaller teams.

Limited retail signal integration: While AMC insights are strong, the platform doesn't connect optimization to real-time inventory levels, Buy Box status, pricing competitiveness, or organic rank.

Manual optimization required: Insights must be translated into manual bid adjustments and budget changes, creating operational friction for lean teams.

No version control or safety mechanisms: The lack of campaign snapshots and rollback capabilities increases risk during high-stakes testing periods.

TLDR comparison table of Intentwise competitors

Software | Best for | Key Features | Starting Price | Free Trial? | G2 Rating |

atom11 | Sellers and agencies needing retail-aware automation | AI copilot Neo, Version control, Performance monitoring, Dayparting, AMC suite, Retail-aware automation, Free onboarding support | $199/month | Yes, 7 days | 5.0/5 |

Trellis | Mid-size brands wanting AI automation + profit focus | Profit-first optimization, Multi-marketplace support, Automated bid management, Inventory integration, Custom reporting | Custom pricing | Yes, 14 days | 4.1/5 |

Helium 10 | All-in-one solution for product research + PPC | Product research suite, Listing optimization, PPC automation, Profit analytics | $129/month | Yes, 7 days | 4.1/5 |

BidX | Sellers managing Amazon & Walmart internationally | SKU-level ACoS targeting, TACOS-aware rules, Multi-marketplace support, Multi-currency handling | $495/month | Yes, 14 days | 4.8/5 |

Pacvue | Large brands managing multiple marketplaces | 100+ retailer coverage, Digital shelf analytics, Share-of-voice optimization, Cross-retailer planning | Custom pricing | No | 4.3/5 |

Quartile | Large brands focused on automated Amazon advertising | Enterprise-grade automation, AI-driven bidding, Portfolio-level budgeting, Always-on optimization | Custom pricing | No | 4.6/5 |

Hector.ai | Sellers wanting AI + AMC integration | Self-serve DSP access, AMC-powered insights, Targeting 360 center, Keyword-level ACoS | $529/year | No | 4.5/5 |

Skai | Enterprise brands with omnichannel strategy | Omnichannel execution, CRM integration, Advanced audience management, AI planning layer | $114k/year | No | 4.1/5 |

Teikametrics | Mid-size sellers wanting hands-off AI | Flywheel 2.0 AI, Goal-based optimization, Profit analytics, Inventory intelligence | $179/month | Yes, 14 days | 4.4/5 |

Xnurta | Multi-marketplace brands needing AI automation | AI-powered bidding, Multi-marketplace dashboard, Performance forecasting, Budget allocation | $750/month | No | 4.7/5 |

M19 | Mid-size sellers wanting AI-driven optimization | AI-powered automation, Performance forecasting, Advanced analytics, Multi-marketplace support | $479 + 3% of adspend | Yes, 14 days | 4.8/5 |

Adbrew | Brands and agencies prioritizing speed and usability | AI-assisted bidding, Bulk operations, Fast campaign setup, Rule-based automation | $799/month | Yes | 4.8/5 |

Ad Badger | Sellers wanting expert-guided PPC with automation | Managed service options, AI-assisted bidding, Expert PPC guidance, Educational resources | Custom pricing | Yes, 14 days | 4.5/5 |

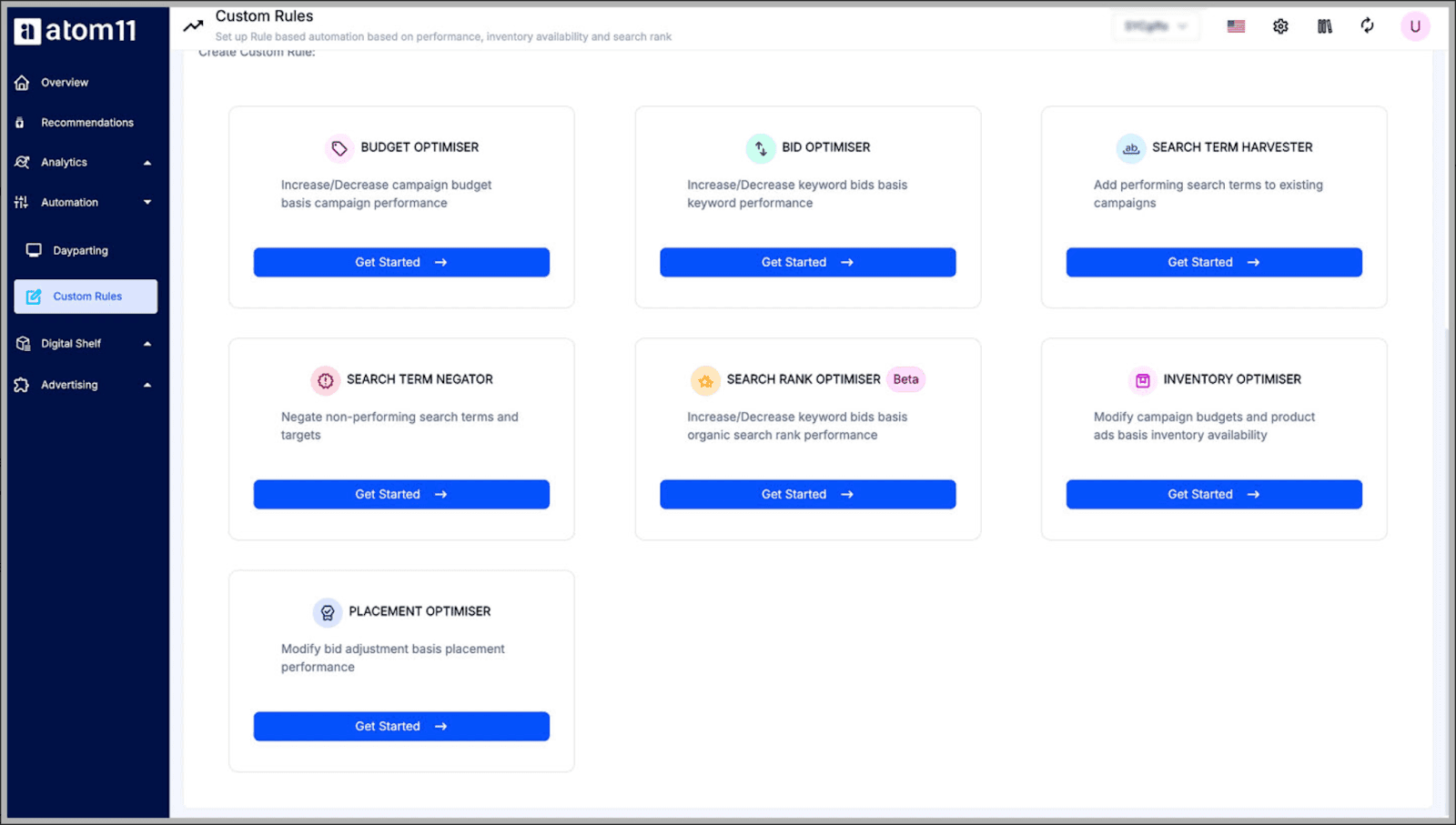

atom11

Atom11 is your intelligent optimization engine that connects insights to action. atom11 is an Amazon PPC software with advertising and analytics that links campaigns directly to inventory, Buy Box status, pricing, and Amazon Marketing Cloud data, all powered by transparent rule-based automations that deliver complete visibility into campaign performance.

Best for

Mid-to-large Amazon sellers, brands, and agencies who want powerful analytics combined with retail-aware automation. Ideal for teams that need both deep insights and the ability to act on them automatically without sacrificing transparency or control over their advertising campaigns.

Key features

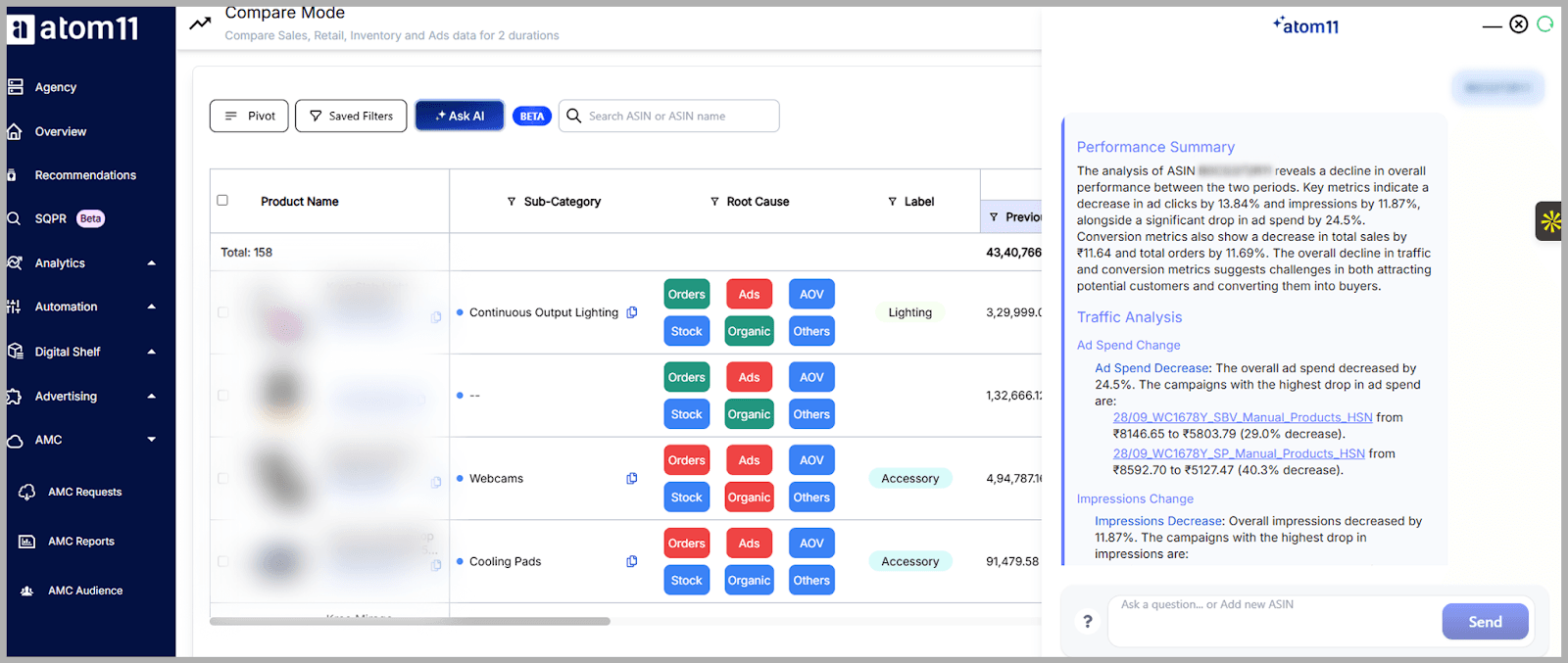

1. AI Copilot Neo

Neo diagnoses sales and ad performance fluctuations in plain English, combining 10+ retail signals including ads, pricing, inventory, and digital shelf data. Instead of requiring you to analyze dashboards manually, Neo suggests concrete, retail-aware actions. For example, if sales drop, Neo might identify that you lost the Buy Box due to pricing and recommend pausing high-spend campaigns until pricing is competitive again, delivering actionable insights for immediate optimization.

2. Version control

Save complete snapshots of campaign settings, bids, budgets, and placement modifiers before major events like Prime Day or Black Friday. Test aggressive strategies, knowing you can roll back to your exact previous state with one click. This eliminates the fear of implementing risky changes during high-stakes campaigns, providing safety that Intentwise's analytics-only approach lacks for automated campaign management.

3. Performance monitoring

The dedicated Performance Monitor ties every rule-driven change (bid adjustments, budget shifts, dayparting) to its impact on KPIs over time. You can quantify which automations actually improve performance and quickly disable the ones that don't, creating a continuous optimization feedback loop with full transparency for your advertising platform decisions.

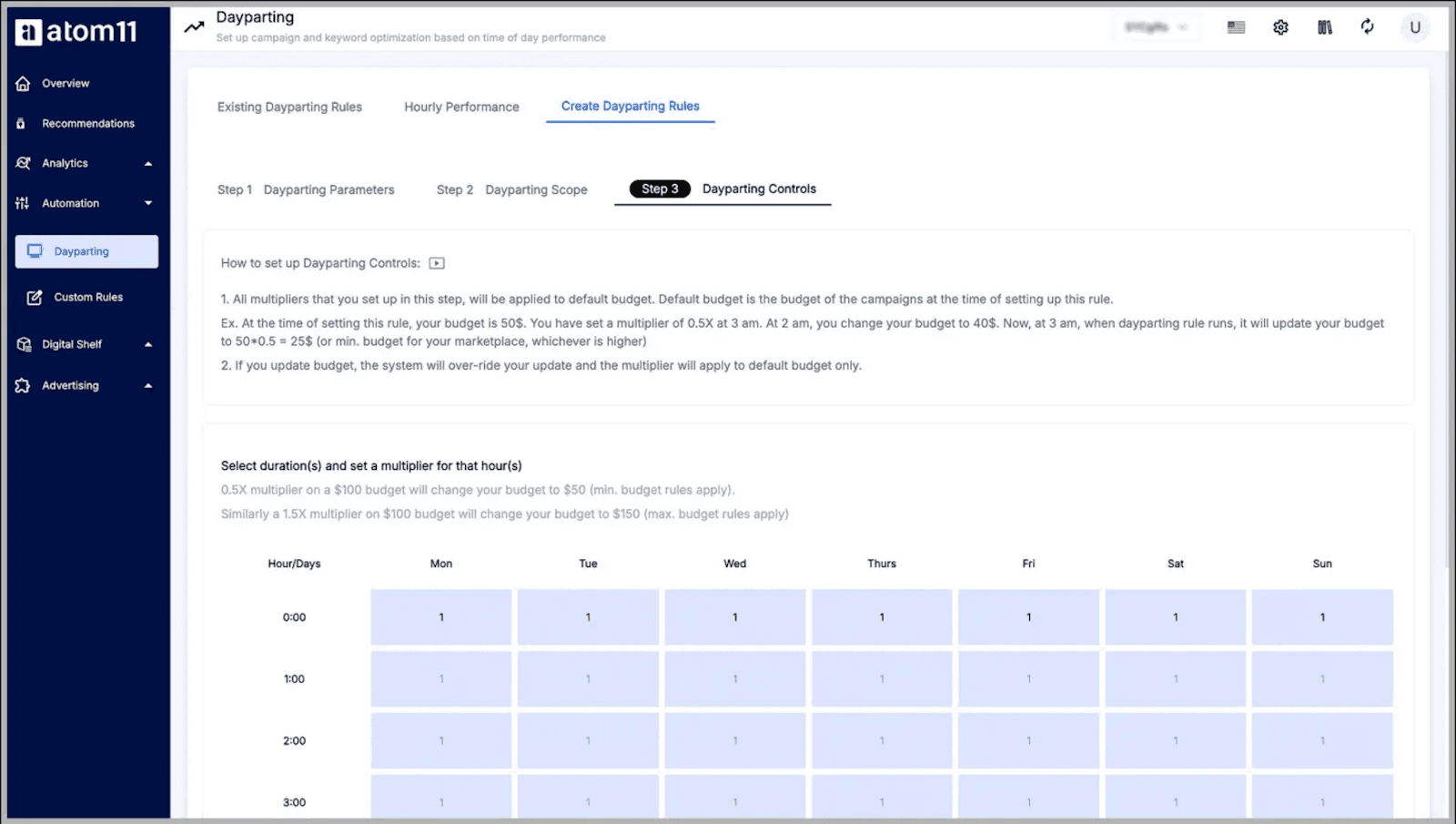

4. Dayparting

Uses Amazon Marketing Stream data for hourly dayparting on bids and budgets, layering in rules based on inventory, search rank, and Buy Box ownership. You don't just show more ads at certain hours; you show them when both shopper intent and retail conditions align for maximum conversion potential, optimizing campaign performance for profitability.

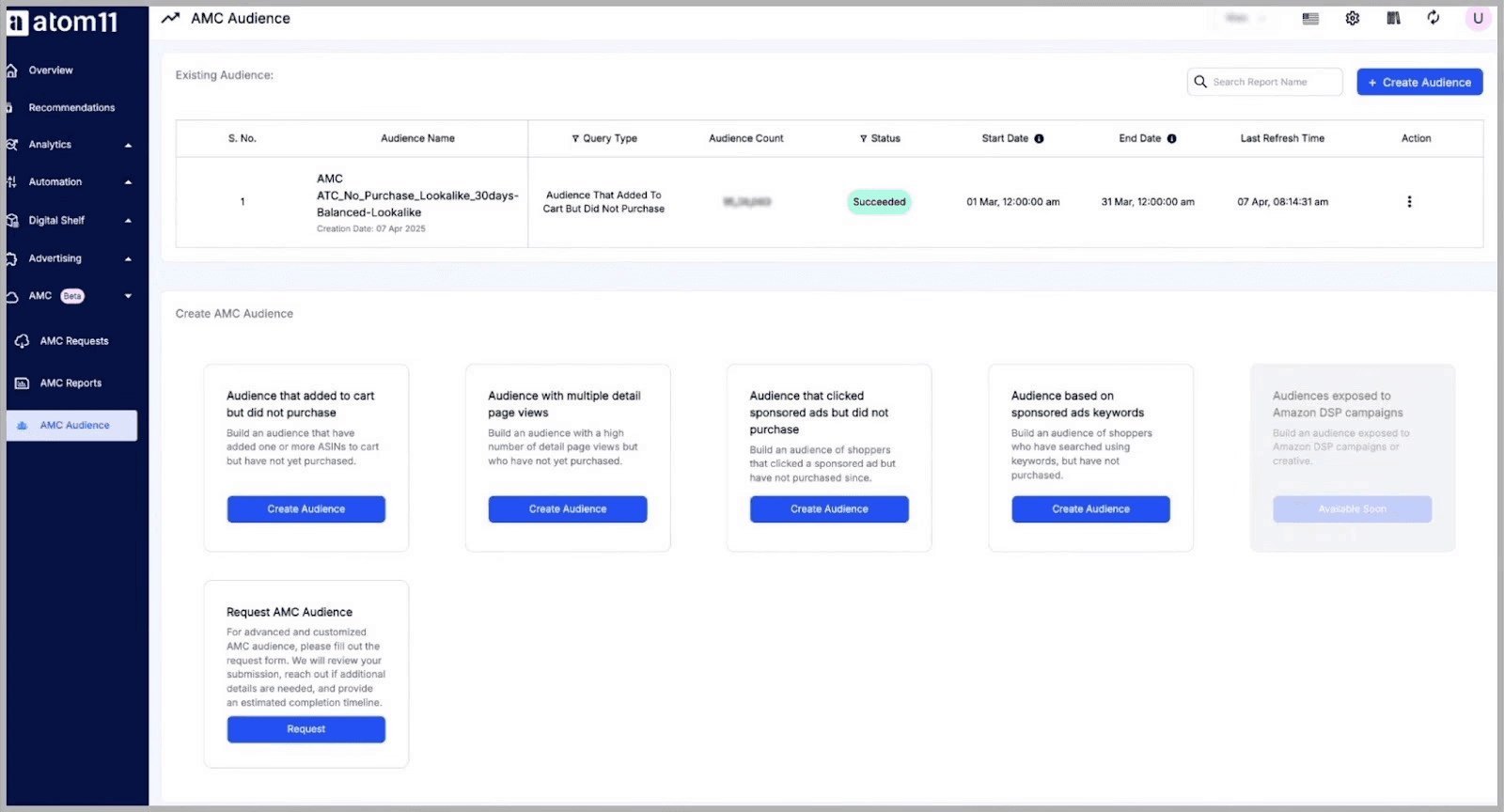

5. AMC Suite

One-click, no-SQL access to Amazon Marketing Cloud with ready-made reports and pre-built audience templates. Build Sponsored Ads and Amazon DSP audiences like cart abandoners or high-LTV customers, then refresh them automatically. No data science degree required, making advanced analytics accessible to all sellers for enhanced ad management.

| Related Read: What Is Amazon Marketing Cloud & How To Use It

6. Retail-aware automation

The rule engine wires directly into retail signals: inventory levels, pricing changes, Buy Box status, organic rank, and cannibalization metrics. Create automations like:

Pause ads on low-stock SKUs automatically.

Cut bids when you lose the Buy Box.

Reduce spend on keywords where you already rank organically.

7. Free Onboarding Support

New accounts get a structured 4-week 1:1 onboarding program at no extra cost from the support team. An expert sets up automations, AMC reports, version control, and dayparting with you, then continues support via a shared Slack channel for ongoing campaign optimization guidance.

Trellis

Trellis is an AI-powered Amazon advertising platform known for its profit-first optimization approach and intelligent automation across multiple marketplaces. The platform combines machine learning-driven bid management with inventory integration and profitability tracking for mid-size brands seeking hands-off optimization with strong functionality.

Best for

Mid-size Amazon and Walmart sellers who want AI-driven advertising automation that prioritizes true profitability over simple ACoS targets, particularly those managing operations across multiple marketplaces for their seller accounts.

Key features

Profit-first AI optimization setting targets based on actual profit margins, not just ACoS.

Multi-marketplace support managing Amazon and Walmart advertising from one platform.

Automated bid management with AI adjusting bids based on profitability and inventory signals.

Dynamic pricing based on real-time market conditions, boosting profits.

Inventory integration connecting ad spend to real-time stock levels automatically.

Custom reporting capabilities for building tailored performance views and dashboards.

Performance forecasting with predictive analytics for expected outcomes and planning.

Team collaboration tools with multi-user access and role-based permissions.

How atom11 compares

Trellis focuses on profit-first AI automation, while atom11 provides transparent, rule-based automation you control. atom11 links PPC decisions to retail signals Trellis doesn't fully integrate, including Buy Box status and organic rank, with version control and performance monitoring.

Helium 10

Helium 10 is positioned as an all-in-one e-commerce suite for Amazon, Walmart, and TikTok Shop sellers, combining product research, listing optimization, operations management, and PPC automation in a single platform with tools for every stage of business growth and keyword research capabilities.

Best for

Growing Amazon sellers who want a wide array of automation tools covering the entire selling journey from product discovery through advertising under one subscription. Particularly valuable for sellers who need both keyword research and advertising capabilities for Amazon Seller Central management.

Key features

Complete product research suite with Black Box, Cerebro, and Magnet tools.

Listing optimization using Scribbles, Index Checker, and Listing Analyzer.

Operations dashboard with inventory monitoring and refund recovery.

Adtomic PPC automation with AI-powered bid management.

Multi-marketplace support across Amazon US, international markets, and Walmart.

Profit analytics tracking all fees and costs comprehensively.

Chrome extension tools for quick metric access while browsing.

Academy training with extensive educational resources for learning strategies.

How atom11 compares

Helium 10 provides broad tools for research, listings, and basic PPC, while atom11 is built for advertising depth. atom11 links PPC optimization to retail signals Helium 10 doesn't track, including inventory, Buy Box, pricing, and organic rank, and adds features like version control, hourly dayparting, performance monitoring, and one-click AMC access. Helium 10 suits all-in-one needs, while atom11 excels when advertising performance is the main driver of Amazon PPC growth.

BidX

BidX focuses on automating advertising operations for Amazon and Walmart sellers with emphasis on campaign creation, SKU-level targeting, and international marketplace support for multi-currency management with precision control over PPC campaigns.

Best for

Sellers managing campaigns across Amazon and Walmart in multiple countries who need SKU-level ACoS control and multi-currency support for international sales execution with their PPC ads and advertising automation.

Key features

SKU-level ACoS targeting setting profitability goals for individual products.

TACOS-aware rules engine optimizing using Total ACoS (paid + organic sales).

One-click campaign setup with automated creation and restructuring.

Multi-marketplace support managing Amazon and Walmart across countries.

Multi-currency handling with native support for international currencies.

Automated suggestions recommending bid changes and budget adjustments.

Advanced dashboards providing performance insights across accounts.

Bulk operations scaling optimizations across many campaigns efficiently.

How atom11 compares

BidX focuses on SKU-level control and multi-marketplace support, especially for Walmart, while atom11 delivers deeper Amazon-specific intelligence. atom11 integrates inventory, Buy Box, pricing, and organic rank into automation, with version control and performance monitoring, offering more sophisticated PPC optimization at a lower starting price than both BidX ($495/month) and Intentwise ($1,000/month). BidX suits cross-retailer coverage, while atom11 provides superior Amazon PPC performance with full transparency.

Pacvue

Pacvue is built for large brands managing advertising across Amazon, Walmart, Target, Instacart, and 100+ other retail media platforms, combining retail media management with commerce acceleration capabilities for enterprise-scale marketing campaigns with comprehensive analytics and share of voice tracking.

Best for

Enterprise brands and agencies with complex multi-retailer strategies that need unified management across dozens of retail media platforms alongside digital shelf and commerce operations for their advertising platform and campaign management.

Key features

Share-of-voice optimization tracking SOV across keywords and categories.

Digital shelf analytics monitoring retail-readiness and content health.

Cross-retailer budget planning recommending allocation based on incremental returns.

Commerce acceleration suite integrating marketplace operations and measurement.

100+ retailer coverage managing campaigns across major platforms.

Advanced reporting with NIQ/Profitero data integration.

Retail media performance connecting media to actual sales outcomes.

Team collaboration with multi-user workflows and role-based permissions.

How atom11 compares

Pacvue supports omnichannel retail media across 100+ retailers, while atom11 focuses exclusively on Amazon. atom11 integrates retail signals like inventory, pricing, and Buy Box ownership into PPC automation, with version control and performance monitoring that Pacvue lacks at the bid-logic level. Like Intentwise, Pacvue targets higher budgets with custom pricing, while atom11 delivers deeper Amazon-specific intelligence at a lower starting price of $199/month for focused campaign management.

| Related read: Pacvue vs Perpetua: Which Amazon Ads Platform Fits Your Needs?

Quartile

Quartile is an enterprise-focused Amazon advertising platform designed to automate and optimize PPC at scale. Unlike analytics or reporting-centric tools, Quartile operates almost entirely on AI-driven decision-making, managing bids, budgets, and campaign structures automatically for large brands with significant ad spend and advertising efforts.

Best for

Large brands and enterprise sellers running high-volume Amazon advertising who want hands-off, AI-managed optimization without needing granular manual control or involvement in Amazon PPC campaigns and bid management.

Key features

AI-driven PPC automation with automated bid and budget optimization.

Portfolio-level budget management allocating spend dynamically based on goals.

Enterprise account structure built to manage large catalogs efficiently.

Always-on optimization with continuous bid adjustments without manual rules.

Performance reporting with high-level dashboards focused on revenue and efficiency.

Managed-service orientation often paired with strategic support.

How atom11 compares

Both Quartile and Intentwise offer powerful capabilities but take different approaches. Quartile is a black box AI for enterprise teams, while Intentwise excels at analytics. atom11 uses transparent, rule-based automation tied to retail signals like inventory, Buy Box, pricing, and organic rank, with performance monitoring to validate impact. With version control, root-cause analysis, and plans starting at $199/month (compared to custom enterprise pricing for both Quartile and Intentwise), atom11 delivers advanced automation without sacrificing control or affordability for your PPC strategy.

| Related Read: Quartile Pricing Guide: Costs, Add-Ons & Alternatives

Hector.ai

HectorAI provides advanced Amazon PPC automation with tight Amazon Marketing Cloud integration and self-serve Amazon DSP access, positioning itself as a command center for comprehensive Amazon advertising with full-funnel visibility and advanced algorithms for advertising campaigns.

Best for

Sellers wanting to combine Sponsored Ads optimization with AMC insights and DSP campaigns in a single platform, particularly those ready to leverage upper-funnel advertising for their ad campaigns and display ads.

Key features

Amazon Marketing Cloud integration with AMC-powered insights and audience building.

Self-serve Amazon DSP with pay-as-you-go access without upfront commitments.

Targeting 360 command center consolidating all key metrics and controls.

Keyword-level ACoS targeting setting profitability goals at keyword/ASIN level.

Automated bid optimization with AI-driven calculations based on live data.

Custom audience creation building and activating AMC audiences.

Performance analytics with comprehensive reporting across all ad types.

Budget management with intelligent allocation across campaigns.

How atom11 compares

Both platforms integrate Amazon Marketing Cloud, but atom11 goes beyond insights with retail-aware automation. While Hector focuses on AMC reporting and DSP access, atom11 links Sponsored Ads optimization to inventory, Buy Box, pricing, and organic rank, with transparent rule logic, version control, and performance monitoring. Hector suits DSP-led strategies, while atom11 delivers deeper Sponsored Ads intelligence tied to real retail conditions at a more transparent starting price than Intentwise.

Skai

Skai (formerly Kenshoo) is an enterprise-grade omnichannel marketing platform that manages retail media alongside paid search, paid social, display, and app campaigns for large advertisers with integrated CRM and Salesforce Marketing Cloud connections using sophisticated algorithms and machine learning.

Best for

Enterprise brands with massive budgets managing complex advertising across Google, Meta, TikTok, Amazon, Walmart, and other channels that need unified planning, execution, and measurement for their advertising platform and marketing automation.

Key features

True omnichannel execution managing retail media, search, social, and display.

Retail + social commerce bridge connecting social discovery to retail outcomes.

Advanced audience management automating CRM and third-party data onboarding.

AI planning layer with Bedrock-based AI agents surfacing insights.

Budget optimization shifting spend between channels based on performance.

Custom measurement building attribution models matching customer journeys.

Team workflows with enterprise collaboration and approval chains.

API integrations connecting to existing martech stack.

How atom11 compares

Skai targets enterprise omnichannel marketing across search, social, and retail media, while atom11 is built specifically for Amazon sellers. atom11 links PPC decisions to retail signals like inventory, Buy Box, and pricing, with version control, performance monitoring, and AI-driven root-cause analysis. While both Skai and Intentwise serve larger-scale budgets with enterprise pricing, atom11 delivers superior Amazon-specific control and value at $199/month for focused analytics and actionable insights.

Teikametrics

Teikametrics (formerly Flywheel) is an AI-powered marketplace optimization platform combining advertising automation with profit analytics, inventory management, and multi-marketplace support for mid-size sellers wanting hands-off optimization with strong functionality and PPC automation.

Best for

Mid-size Amazon and Walmart sellers who want AI-driven advertising automation combined with profit tracking and inventory intelligence, particularly those managing operations across multiple marketplaces for their seller accounts and campaign performance.

Key features

Flywheel 2.0 AI engine with goal-based optimization across marketplaces.

Automated bid management adjusting bids based on profitability targets.

Multi-marketplace support covering Amazon and Walmart advertising.

Profit analytics tracking true profitability across all fees and costs.

Inventory intelligence connecting ad spend to stock levels.

Goal-based optimization setting revenue, profit, or efficiency targets.

Performance dashboards with custom reporting and insights.

Team collaboration with multi-user access and permissions.

How atom11 compares

Teikametrics uses AI-driven goal-based optimization similar to Intentwise's analytics focus, while atom11 provides transparent, rule-based automation. atom11 integrates retail signals like Buy Box status, pricing, organic rank, and inventory, with version control and performance monitoring to validate automation impact. At $599/month, Teikametrics is cheaper than Intentwise but more expensive than atom11, which delivers greater transparency and Amazon-specific intelligence at $199/month with better results.

Xnurta (formerly Xmars)

Xnurta (formerly Xmars) is an AI-driven advertising platform designed for mid-to-large brands looking to optimize campaigns across Amazon and other marketplaces with machine learning-powered automation specializing in conversion probability analysis and precision targeting.

Best for

Mid-size to enterprise brands comfortable with AI-driven optimization and managing campaigns across multiple marketplaces who want hands-off automation for their advertising campaigns.

Key features

AI-powered bidding engine optimizing bids based on conversion probability.

Multi-marketplace management with unified dashboard across retail platforms.

Custom reporting capabilities for building tailored performance views.

Campaign automation for structure optimization and creation.

Budget allocation algorithms distributing spend intelligently.

Performance forecasting with predictive analytics for expected outcomes.

How atom11 compares

Xnurta operates as a black-box AI platform similar to Adbrew's AI-assisted approach but with less transparency. atom11 uses rule-based automation that shows exactly why changes happen, integrates retail signals Xnurta doesn't account for, including inventory, Buy Box, pricing, and organic rank, and adds version control and performance monitoring. At $750/month, Xnurta costs nearly as much as Adbrew ($799/month), but both lack atom11's retail intelligence available at $199/month for better ROI.

M19

M19 (formerly SellerMetrics) is an AI-powered Amazon advertising platform focused on machine learning-driven bid optimization, comprehensive analytics, and multi-marketplace support for mid-size sellers seeking advanced automation with strong profitability tracking and performance forecasting capabilities for their advertising efforts.

Best for

Mid-size Amazon and Walmart sellers who want AI-driven advertising automation combined with advanced analytics and performance forecasting, particularly those managing operations across multiple marketplaces for their seller accounts and campaign optimization.

Key features

AI-powered bid automation using machine learning algorithms for optimization.

Multi-marketplace support covering Amazon and Walmart advertising.

Advanced analytics with comprehensive custom dashboards.

Automated keyword harvesting discovering and adding winning search terms.

Budget optimization distributing spend across campaigns intelligently.

Performance forecasting with predictive analytics for expected outcomes.

Real-time performance monitoring tracking KPIs continuously.

Team collaboration tools with role-based access and permissions.

How atom11 compares

M19 uses AI-powered automation similar to Intentwise's analytics approach, while atom11 provides transparent, rule-based automation. atom11 integrates retail signals M19 doesn't account for, including inventory levels, Buy Box status, pricing competitiveness, and organic rank, and adds version control and performance monitoring to validate automation impact. At $479/month plus ad spend, M19 costs less than Intentwise but more than atom11's $199/month, which delivers greater transparency and Amazon-specific intelligence for PPC optimization.

Adbrew

Adbrew is an AI-assisted Amazon advertising platform built for brands and agencies that prioritize speed, usability, and fast campaign execution. It focuses on bulk operations, rapid campaign setup, and performance-based bid recommendations for teams scaling Amazon PPC efficiently with automation tools.

Best for

Brands and agencies looking for fast campaign setup, AI-assisted bid optimization, and an intuitive interface without long-term contracts, ideal for teams prioritizing speed and marketing automation with key features.

Key features

AI-assisted bidding suggesting optimizations based on performance signals.

Bulk operations for rapid campaign creation and management.

Fast campaign setup with streamlined workflows.

Rule-based automation with custom if-then workflows.

Search term mining automated discovery of converting terms.

Multi-account management for agencies managing multiple clients.

Performance dashboards with real-time reporting and insights.

Team collaboration tools with multi-user access and permissions.

How atom11 compares

Adbrew focuses on execution speed and AI-assisted recommendations, while atom11 prioritizes intelligence and control. Where Intentwise excels at analytics and Adbrew focuses on fast execution, atom11 integrates retail context into every optimization decision and adds version control, AI-driven root-cause analysis, and AMC-powered insights. Adbrew works for fast execution at $799/month; atom11 delivers smarter, retail-aware execution with transparent automation you can validate and control at $199/month.

Ad Badger

Ad Badger is an Amazon advertising platform that combines AI-assisted automation with expert-guided PPC management, offering both self-service software and managed service options for sellers who want sophisticated optimization backed by experienced strategists and educational resources with customer service.

Best for

Amazon sellers and agencies wanting AI-powered automation combined with expert guidance and PPC training, particularly those who value educational support alongside automation tools for their advertising campaigns and ad management.

Key features

AI-assisted bid optimization with machine learning-driven recommendations.

Managed service options with dedicated PPC experts and strategists.

Advanced keyword research and search term optimization tools.

Automated negative keyword discovery filtering non-converting terms.

Custom reporting and performance analytics dashboards.

Search term harvesting automatically adding winning keywords to campaigns.

Performance tracking with detailed keyword-level insights.

Educational resources including PPC training and best practices.

How atom11 compares

Ad Badger combines automation with managed services and educational support, while atom11 focuses on self-service retail intelligence. atom11 integrates inventory, Buy Box status, pricing, and organic rank directly into automation, with version control, performance monitoring, and AI Copilot Neo for root-cause diagnosis that Ad Badger lacks. At custom pricing with managed service fees, Ad Badger costs more than atom11's $199/month, which delivers retail-aware optimization with transparent automation for Amazon sellers who want full control.

What Sellers Should Look for in Intentwise Alternatives

Business Stage | Monthly Price Range | Key Features / Capabilities | Notes |

Individual Sellers | ~$150/month | Basic bid automation, budget controls, negative keyword management, simple reporting, easy onboarding, user interface simplicity | Intentwise's $1,000/month pricing is too high at this stage. Prioritize ease of use and free trials. |

Small Brands / Agencies | $200-$500/month | Rule-based automation, dayparting, TACOS tracking, version control, multi-account support, actionable insights | Look for platforms that combine analytics with automation, not just reporting like Intentwise. |

Mid-size Brands / Agencies | $500-$1,500/month | Retail-aware automation, Buy Box and inventory signals, advanced analytics, AMC integration, performance monitoring, data analysis | Tools should connect PPC decisions to inventory and profitability with automated execution, not manual implementation. |

Large Brands / Agencies | Custom pricing | Enterprise automation, cross-marketplace coverage, AMC and DSP integration, custom BI, audience targeting, market intelligence | Choose partners that scale with complexity and provide both insights and automated optimization. |

Why is atom11 the Best Intentwise Alternative?

atom11 is a strong Intentwise alternative for Amazon sellers who want analytics combined with automated execution. While Intentwise focuses on insights and reporting, atom11 gives sellers the ability to act on those insights automatically through retail-aware optimization at more accessible pricing.

Analytics meets automation

atom11 combines AMC access, custom dashboards, and AI Copilot Neo's diagnostic capabilities with rule-based automation that acts on insights automatically. Unlike Intentwise's analytics-only approach requiring manual implementation, atom11 connects insights directly to campaign execution.

Retail-aware Amazon optimization

PPC decisions tie to real retail signals such as inventory, Buy Box status, pricing, and organic rank, preventing wasted spend on non-competitive products. This retail intelligence goes beyond Intentwise's performance analytics.

Transparent, controllable automation

Unlike many Intentwise competitors, atom11 uses transparent rule-based automation tied directly to retail signals with full audit trails showing why changes happen. Performance monitoring validates which automations work.

Safer testing with built-in safeguards

Version control allows instant rollbacks, while AI Copilot Neo explains performance changes in plain language. This makes experimentation safer than Intentwise's analytics approach.

Lower cost with faster time to value

atom11 starts at $199 per month with a 7-day free trial and free onboarding, compared to Intentwise's $1,000/month pricing. This delivers better ROI for sellers needing both insights and automated action.

Amazon-first focus with proven recognition

atom11 specializes exclusively in Amazon PPC and has the AI Innovation Award 2025 and the Beyond the Funnel Innovation Award 2024 for APAC, demonstrating advanced tools for advertising performance and campaign optimization.

Questions Sellers Ask | Without atom11 | With atom11 |

Why did my sales suddenly drop this week? | Check multiple reports and guess the cause | Ask Neo & get the cause in seconds |

How do I stop spending on low-stock SKUs? | Manually pause or down-bid when stock drops | Auto-adjust bids & budget based on inventory rules |

How do I make daily PPC quicker and better? | Tweak bids, negatives, and budgets by hand | Set rules once; automations handle the rest |

Can I test changes without breaking campaigns? | You can’t undo changes | Use version control to test and roll back instantly |

How do I understand performance hassle-free? | Juggle tools and spreadsheets | See ads + retail data in one dashboard |

For most Amazon sellers and brands frustrated with Intentwise's high costs, lack of automated execution, or analytics-only approach, atom11 offers a superior alternative: retail-aware automation you control, combined with powerful analytics, at accessible pricing, backed by award-winning technology. Book a demo to see how atom11 can optimize your Amazon advertising better than Intentwise.

FAQs

What is Intentwise used for?

Intentwise is used for advanced Amazon advertising analytics, AMC integration, and data-driven optimization. The platform specializes in custom dashboards, performance attribution, multi-marketplace insights, and sophisticated reporting for sellers who prioritize deep analytics and data analysis capabilities, starting at $1,000/month.

What are the benefits of using Intentwise?

Intentwise offers advanced analytics capabilities, Amazon Marketing Cloud integration with no-SQL access, custom dashboard creation, multi-marketplace reporting, API access for external BI tools, and automated report scheduling. The platform excels at providing deep insights into advertising performance across Amazon and other marketplaces.

What are the best alternatives to Intentwise for Amazon PPC?

Top Intentwise alternatives include atom11 ($199/month) for retail-aware automation with analytics, Trellis ($199/month) for profit-first AI optimization, Helium 10 ($39/month) for all-in-one research and PPC, BidX ($495/month) for SKU-level targeting, and Teikametrics ($599/month) for hands-off AI optimization with better results.

Can other tools match Intentwise's analytics and AMC integration?

Yes. atom11 delivers one-click AMC access with pre-built reports plus retail-aware automation, Pacvue offers advanced reporting with NIQ integration, Hector.ai provides AMC-powered insights with DSP access, and several platforms offer comprehensive analytics at lower price points than Intentwise's $1,000/month.

Is there a cheaper tool than Intentwise for Amazon ad management?

Yes. atom11 starts at $199/month, Helium 10 at $39/month, BidX at $495/month, Trellis at $199/month, M19 at $479/month plus ad spend, and Teikametrics at $599/month. Each offers PPC automation and analytics at a lower cost than Intentwise's $1,000/month pricing with key features.

Which Intentwise alternatives are suitable for small and mid-sized Amazon sellers?

atom11 ($199/month) suits mid-sized sellers seeking retail-aware automation with analytics, Helium 10 ($39/month) works for growing sellers needing all-in-one tools, BidX ($495/month) supports international sellers, and Trellis ($199/month) fits mid-sized teams needing profit-focused AI optimization with advanced features.