Pacvue vs Skai For Amazon Sellers: Which One Is Better?

Author:

Neha Bhuchar

Last Updated:

Dec 31, 2025

Published on:

Table of Contents

Introduction

The Amazon advertising automation market is evolving fast. Among the top contenders, Pacvue and Kenshoo (now rebranded as Skai) sellers often struggle to decide which tool delivers better performance on their ad campaigns, automation flexibility, and ROI.

The good news? You don't need a $5,000 monthly software budget to access sophisticated PPC automation. The Amazon advertising landscape now offers specialised alternatives that deliver enterprise-level capabilities at accessible prices while actually understanding what makes Amazon unique.

This guide breaks down both platforms across pricing, features, usability, automation depth, and reporting. We'll also reveal how atom11 compares as a retail-aware, rule-based alternative built specifically for Amazon sellers who want real spend efficiency without the enterprise complexity.

What Are Pacvue and Skai (Kenshoo)?

Pacvue Overview

Pacvue launched in 2016 as an enterprise-grade commerce acceleration platform focused on retail media management. The platform serves brands advertising across Amazon, Walmart, Instacart, and other retail channels.

Strengths:

Rule-based automation with customizable triggers

Strong reporting and analytics dashboards

Multi-marketplace management capabilities

Popular among agencies managing multiple client accounts

Weaknesses:

Complex user interface with steep learning curve

High pricing is unsuitable for small to mid-size sellers

Requires significant time investment for setup and management

Pacvue targets enterprise brands and agencies spending $50,000+ monthly across multiple retail media platforms. The platform's breadth comes at the cost of depth in Amazon-specific features.

Skai (Kenshoo) Overview

Kenshoo rebranded as Skai in 2020, positioning itself as a data-driven omnichannel marketing platform. Originally built for search and social advertising, Skai expanded into retail media, including Amazon, as part of its broader offering.

Strengths:

AI-driven predictive analytics and forecasting

Cross-channel campaign management (Amazon, Google, Meta, TikTok)

Advanced data visualization tools

Strong for brands running integrated campaigns across multiple platforms

Weaknesses:

Steep learning curve with complex interface

Not Amazon-focused; retail media is one of many channels

Enterprise pricing puts it out of reach for most Amazon sellers

AI automation lacks transparency and control for Amazon-specific nuances

Skai serves large enterprises managing millions in ad spend across multiple advertising channels. For sellers focused primarily on Amazon, the platform's omnichannel approach introduces unnecessary complexity.

Why Amazon Sellers Need Tools Specialized to Amazon

Amazon sellers need PPC software that’s built specifically around Amazon’s own signals (inventory, Buy Box status, organic rank, category trends) because these directly determine whether ad spend is profitable. An Amazon-focused PPC tool like atom11 can tightly connect ad metrics (ACoS, ROAS, CTR) with retail data and automate platform-specific actions, such as pausing ads on out-of-stock products or adjusting bids when the Buy Box is lost.

Multi-marketplace platforms like Skai or Pacvue must stay generic enough to work across Amazon, Walmart, Google, and more, so Amazon becomes just one channel in a broader template. This often means less granular access to Amazon data, more abstract reporting, and optimization rules that are not fully tuned to Amazon’s auction mechanics, limiting control and performance for sellers who rely mainly on Amazon for revenue.

Pacvue vs Skai (Kenshoo): Complete Feature Comparison

In this section, we'll systematically compare Pacvue and Kenshoo, plus a third software to place their features in the wider context. This will help you choose which one’s best for your needs.

Feature | Pacvue | Skai (Kenshoo) | atom11 |

Automation Type | Rule-based | AI-based | Rule-based + Retail-aware |

Supported Platforms | Amazon, Walmart, Instacart, others | Amazon, Google, Meta, TikTok | Amazon (deep specialization) |

Campaign Management | Multi-marketplace dashboard | Omnichannel dashboard | Amazon-focused interface |

Bid Optimization | Rule-based with scheduling | AI-driven predictive | Custom rules + Real Bid tracking |

Budget Control | Automated with dayparting | Automated pacing | Automated with dayparting |

Keyword Management | Yes | Yes | Harvester + Negator automation |

Inventory Integration | Partial via API | No | Native integration |

Buy Box Awareness | No | No | Yes (pause ads when lost) |

Organic Rank Integration | Yes | No | Yes (adjust bids by position) |

Placement Optimization | Yes | Yes | Yes + Real Bid visibility |

Reporting Depth | Strong for agencies | Cross-channel analytics | Retail + Ads unified dashboard + Ability to create automated refreshable reports on Google Sheets |

Learning Curve | High (2 to 3 months) | Very High (3+ months) | Low (1 to 2 weeks) |

AI Copilot | Limited | Celeste AI | Neo (Amazon-trained) |

Onboarding Support | Self-service for most tiers | Enterprise only | Dedicated to pro and custom plans |

Starting Price | $2,000 to $3,000/month | $3,000 to $5,000/month | $199/month |

Contract Length | Annual | Annual | Monthly & annual |

Best For | Agencies, multi-channel brands | Enterprise omnichannel advertisers | Amazon-focused sellers, brands, and agencies |

G2 Rating |

Automation Capabilities

Pacvue's Rule-Based Automation

Pacvue offers rule-based automation where you set conditions and actions. For example: "If ACoS exceeds 25% for three days, reduce bid by 10%." The platform supports complex rule chains with multiple conditions.

Strengths:

Predictable, controllable automation

Schedule-based rule execution

Custom rules for different campaign types

Limitations:

Rules operate on advertising metrics only, ignoring retail context

No visibility into the actual bid after placement of multipliers

Limited real-time response compared to AI systems

Pacvue's automation works well for straightforward campaign optimization tasks but lacks the retail awareness needed for sophisticated Amazon strategies.

Skai (Kenshoo)'s AI-Driven Engine

Skai uses machine learning to predict performance and automatically adjust bids. The AI analyses historical data, seasonality patterns, and cross-channel signals to optimize campaigns.

Strengths:

Predictive optimization across channels

Automated budget pacing and reallocation

Advanced forecasting capabilities

Limitations:

Black box approach with limited transparency

AI trained on generic advertising, not Amazon-specific patterns

Difficult to override or fine-tune AI decisions

Requires extensive historical data to perform well

For sellers who want to understand why bids changed or manually adjust strategies, Skai's AI approach can feel like losing control. The platform optimizes for its own success metrics, which may not align with your specific Amazon goals.

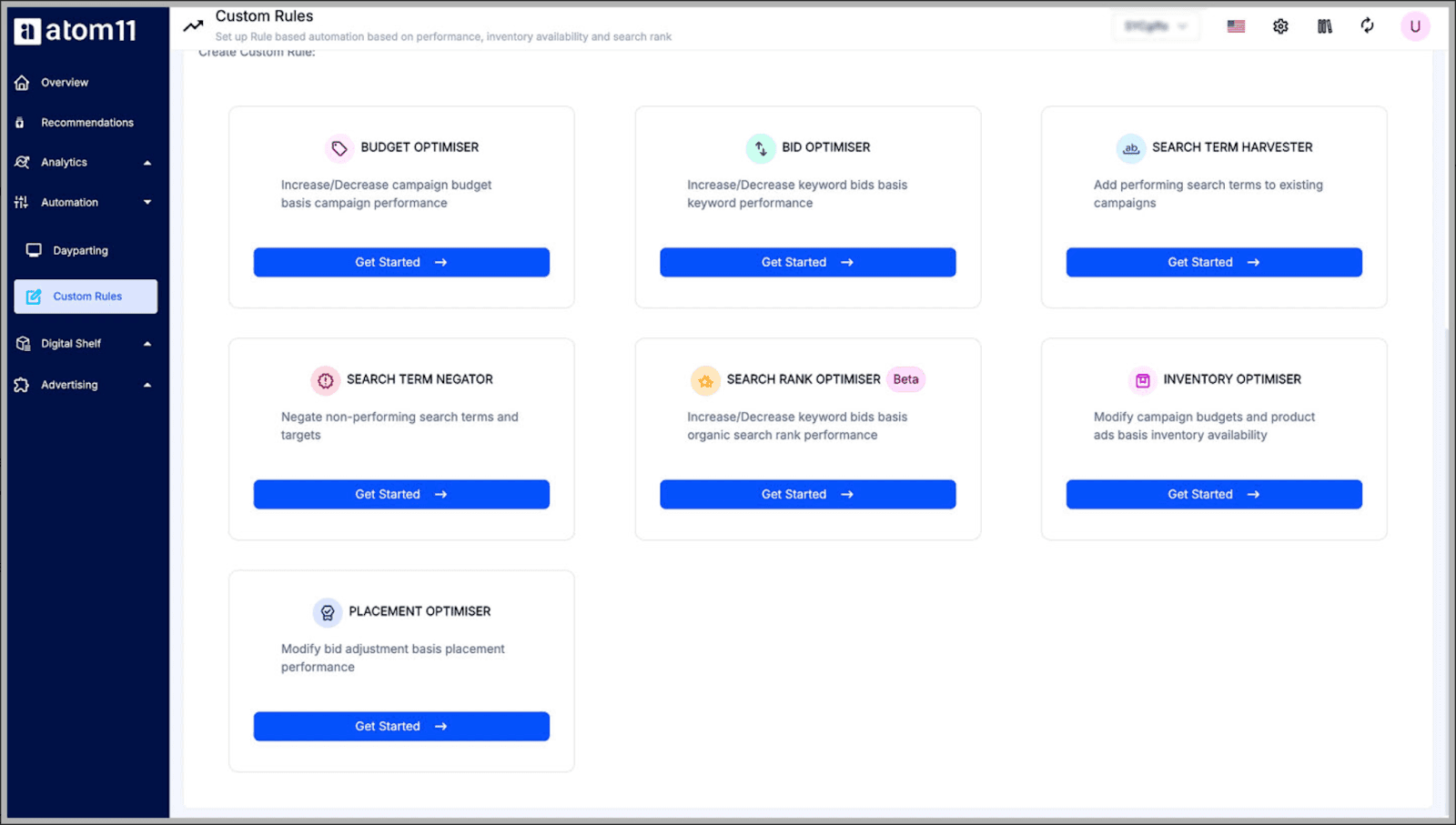

How atom11 Excels in Automation

atom11 combines rule-based precision with retail awareness, giving you control while automating the tedious work and day-to-day PPC optimization.

Core Automation Features:

Custom Rules Engine: Build rules using ACoS, ROAS, CTR, conversions, spend, and more.

Bid & Budget Optimizers: Auto-adjust bids and budgets based on performance trends.

Search Term Automation: Promote winning keywords and negate poor performers automatically. Learn the strategic importance of negative keywords in our guide to search term negation

Real Bid Tracking: See true bid values after placement multipliers for full cost visibility.

Retail-Aware Automation (Unique to atom11):

Inventory & Buy Box Protection: Pause ads when stock is low or Buy Box is lost.

Rank-Aware Bidding: Adjust bids based on Best Seller Rank and organic position to protect ROI and momentum.

Reporting and Analytics

Pacvue Reporting Capabilities

Pacvue excels at reporting, especially for agencies managing multiple client accounts. The platform offers customizable dashboards, scheduled reports, and cross-marketplace comparisons.

Reporting Features:

Campaign performance across retail channels

Keyword-level analytics with search term reports

Budget pacing and spend tracking

Custom report builder with data exports

Limitations:

Reports focus on advertising metrics in isolation

Limited correlation between ad performance and retail factors

Difficult to identify the root causes of performance changes

No integration with inventory or pricing data

Skai (Kenshoo) Analytics Platform

Skai provides sophisticated data visualization and cross-channel attribution, along with advanced features for analyzing performance across publishers. The platform's strength lies in understanding how advertising across different channels works together.

Analytics Features:

Advanced data visualization with custom charts

Cross-channel attribution modelling

Performance forecasting and trend analysis

Integration with business intelligence tools

Limitations:

A complex interface requires training to navigate

Harder to isolate Amazon-specific performance issues

Reports mix Amazon data with other channels, reducing clarity

No retail context (inventory, pricing, Buy Box) in analytics

How atom11 Enhances Insight

atom11 provides unified dashboards that combine advertising performance with retail signals for complete visibility.

Dashboard Features:

Overview Dashboard: Sales, spend, ACoS, TACoS, conversion rates, and ROAS at campaign, ad group, and ASIN levels

Sales Trends Dashboard: Identifies root causes of performance changes by correlating ad metrics with inventory, pricing, and Buy Box status

Recommendations Engine: Provides personalized, actionable suggestions to move your campaigns closer to your target ACoS based on your account data

Real Bid Visibility: Shows actual bids after placement multipliers, preventing surprise costs

AI Copilots and Intelligence Features

Pacvue's AI Capabilities

Pacvue offers limited AI features focused primarily on bid optimization suggestions and keyword recommendations. The platform leans more heavily on rule-based automation than AI-driven decision making.

AI Features:

Bid recommendation engine

Keyword expansion suggestions

Performance anomaly detection

Limitations:

AI features feel like add-ons rather than core functionality

Additional costs reporting and retail-aware analytics

Dayparting overrides all bid and budget changes done manually

Skai (Kenshoo) Intelligence

Skai Intelligence is the platform's AI layer, providing predictive analytics, automated optimization, and natural language query capabilities.

Features:

Predictive performance forecasting

Automated budget allocation across channels

Natural language report generation

AI-powered insights and recommendations

Strengths:

Sophisticated AI trained on massive cross-channel datasets

Strong for predicting trends and optimizing omnichannel budgets

Limitations:

Generic AI is not specialized for Amazon's unique ecosystem

Limited conversational capabilities for campaign management

Expensive add-on requiring higher-tier pricing

atom11's Neo: Amazon-Specialized AI Copilot

atom11 launched Neo, an AI copilot trained specifically on Amazon advertising patterns and retail context. Neo understands the nuances of Amazon PPC in ways generic AI cannot.

Neo's Capabilities:

Natural Language Campaign Management: Comprehend prompts in plain English, like "Increase bids by 15% on all campaigns with ACoS below 20%"

Conversational Analytics: "Why did my ACoS spike last week?" Neo analyses and explains in plain language

Strategic Recommendations: Suggest specific actions based on your account performance, not generic best practices

Amazon-Specific Knowledge: Understands concepts like Buy Box dynamics, organic rank cannibalization, and BSR fluctuations

Atom11’s Neo has even won the AI Innovation Award at the Amazon Partner Awards 2025.

Onboarding and Support

Pacvue Onboarding

Pacvue offers self-service onboarding for most pricing tiers, with dedicated support reserved for enterprise contracts. New users navigate extensive documentation and video tutorials to learn the platform.

Onboarding Process:

Self-guided platform tour

Knowledge base and video library

Community forums for peer support

Dedicated account manager (enterprise tier only)

Timeline: 2 to 3 months to become proficient

The complex interface and lack of guided onboarding mean most sellers struggle for months before feeling comfortable with the platform.

Skai (Kenshoo) Onboarding

Skai provides onboarding support for enterprise clients only. The platform's complexity requires extensive training, typically delivered through scheduled sessions over several weeks.

Onboarding Process:

Initial setup and integration support

Scheduled training sessions (enterprise only)

Documentation and certification programs

Quarterly business reviews (high-tier contracts)

Timeline: 3+ months to achieve proficiency

Skai's omnichannel complexity means even experienced advertisers need significant training. For Amazon-only sellers, much of this training covers irrelevant features.

atom11's Onboarding

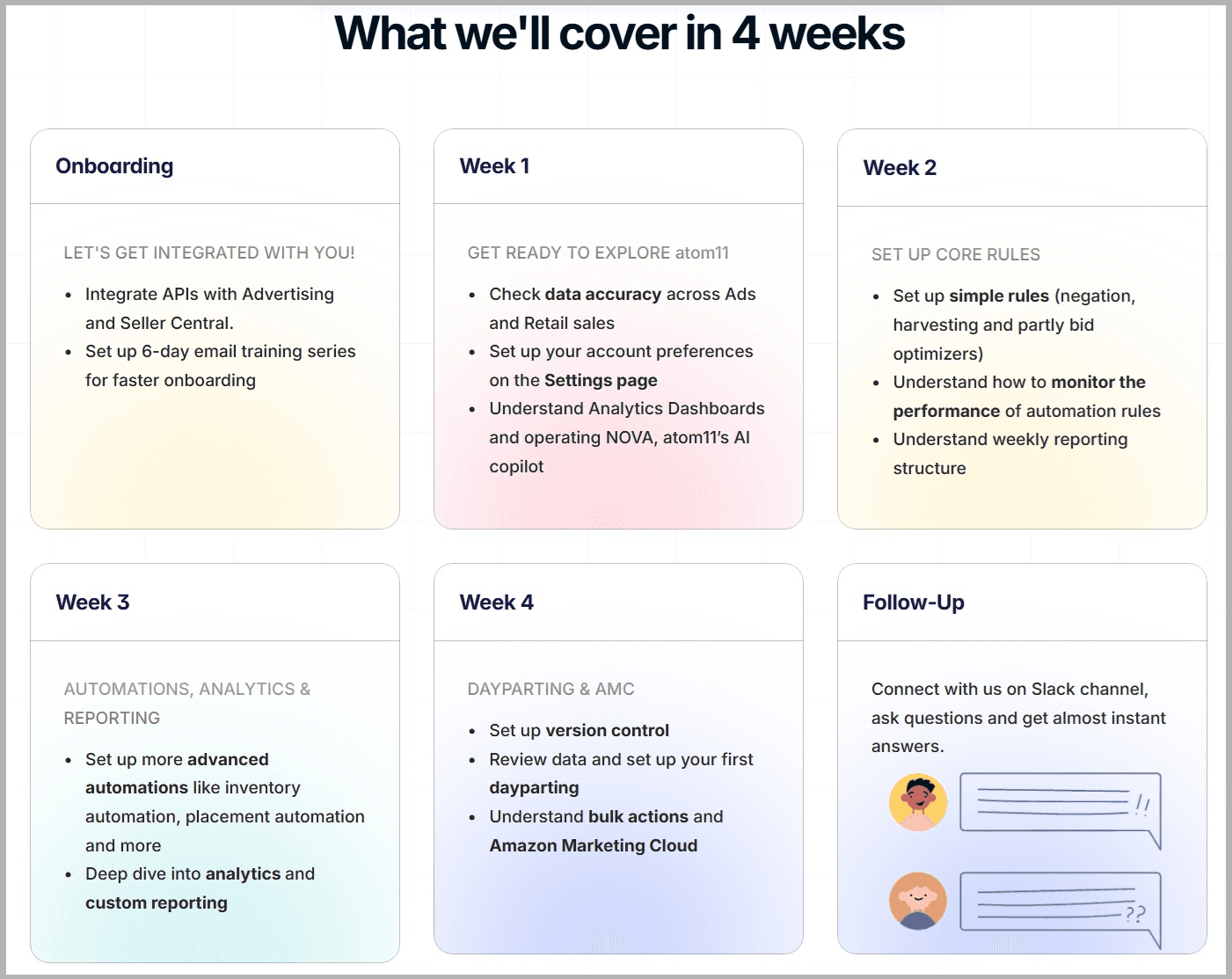

atom11 provides dedicated onboarding support for all pricing tiers, ensuring sellers succeed quickly regardless of their plan level.

Ongoing Support:

Regular check-ins during the first 90 days

Performance reviews and optimization suggestions

Priority support response times

Access to Amazon PPC management and strategy resources

This hands-on approach means sellers don't waste months learning a complex platform. You're optimizing Amazon advertising campaigns and reducing costs within weeks, not quarters.

Explore atom11's comprehensive onboarding program: Onboarding for Amazon Sellers.

Pricing Comparison: What Does Each Platform Cost?

Cost Factor | Pacvue | Skai (Kenshoo) | atom11 |

Free trial? | No | Yes | Yes, 30 days |

Starting Price | $2,000-$3,000/month | $3,000-$5,000/month | $199/month |

Setup Fee | $3,000-$10,000 | $10,000-$50,000 | $0 |

Contract | Annual required | Annual required | Month-to-month |

Platform Fee | 3-4% of ad spend | 3-7% of ad spend | None |

Minimum Spend | $50,000/month | $100,000/month | None |

Onboarding Time | 2-3 months | 3+ months | 1-2 weeks |

Pacvue Pricing Structure

Pacvue doesn't publish pricing publicly, requiring sales conversations for quotes. Based on industry data and user reports, expect the following:

Estimated Pricing:

Starter Tier: $2,000 to $3,000/month (minimum $50,000 monthly ad spend)

Growth Tier: $4,000 to $6,000/month (minimum $150,000 monthly ad spend)

Enterprise Tier: Custom pricing (typically $10,000+/month for $500,000+ monthly ad spend)

Additional Costs:

Setup fees: $3,000 to $10,000, depending on complexity

Annual contracts required (no month-to-month option)

Platform fees are typically 3% to 5% of ad spend

Additional charges for premium features and integrations

For smaller sellers and mid-size Amazon businesses spending $5,000 to $50,000 monthly, Pacvue's pricing is prohibitively expensive, especially given the learning curve and time investment required.

Skai (Kenshoo) Pricing Structure

Skai targets enterprise advertisers with pricing to match. The platform's omnichannel approach means you're paying for features you may not need if you're focused primarily on Amazon.

Estimated Pricing:

Commerce Media Tier: $3,000 to $5,000/month (minimum $100,000 monthly ad spend)

Omnichannel Tier: $8,000 to $15,000/month (minimum $500,000 monthly ad spend across channels)

Enterprise Tier: Custom pricing (typically $20,000+/month for $1M+ monthly ad spend)

Additional Costs:

Implementation fees: $10,000 to $50,000, depending on scope

Annual contracts required with quarterly minimums

Platform fees: 3% to 7% of managed ad spend

Skai Intelligence (AI features): Additional 15% to 25% premium

For Amazon-focused sellers, Skai's pricing structure charges you for omnichannel capabilities you won't use. The platform makes sense when you need integrated management across multiple advertising channels, not for Amazon-only strategies.

atom11 Pricing: Transparent and Accessible

atom11 offers straightforward, transparent pricing designed for Amazon sellers and agencies at all levels.

Pricing Tiers:

Starter Plan: $199/month (up to $25,000 monthly ad spend)

Growth Plan: $399/month (up to $75,000 monthly ad spend)

Professional Plan: $799/month (up to $200,000 monthly ad spend)

Agency Plan: Custom pricing for agencies managing multiple accounts

No Hidden Costs:

No setup fees

No platform percentage fees

No annual contracts (month-to-month billing)

No additional charges for premium features

Why atom11 Is the Smarter Alternative for Amazon Sellers

atom11 goes beyond ad metrics by combining advertising data with retail signals like inventory levels, pricing, Buy Box status, and organic rank, giving you a true picture of what drives performance.

Retail-Aware Automation: Dynamically adjusts bids or pauses ads when stock runs low or the Buy Box is lost.

Custom Rules + Real Bid Visibility: Build granular rules using ACoS, ROAS, CTR, and conversions, and see the actual bid after placement multipliers for total transparency.

Placement Optimizer: Automatically adjusts bids across Top of Search, Product Pages, and Rest of Search based on performance. To understand placement strategy in depth, read our Amazon Ads Placement 101 guide covering how placement multipliers impact your true bid costs and conversion rates.

Advanced Dashboards: Explore Sales Trends, Root Cause Analyser, and the AMC Suite to uncover insights that go beyond PPC metrics.

Version Control: Save and restore bid strategies for seasonal events like Prime Day or Black Friday with one click.

Smarter Scheduling: Use Dayparting at both bid and budget levels to focus spend during peak hours.

Ready to see how this works on your own account? Book a demo with atom11 and explore these capabilities in action.

Conclusion

Pacvue and Skai (Kenshoo) serve enterprise advertisers with pricing from $2,000-$20,000+ monthly, requiring 2-3+ months onboarding, best suited for omnichannel campaigns or multi-marketplace management.

For Amazon-focused sellers and agencies, atom11 delivers superior value through retail-aware ad automation that integrates advertising with inventory, Buy Box, pricing, and organic rank data. Starting at $199/month with transparent pricing and month-to-month flexibility, atom11 makes sophisticated automation accessible to sellers at all levels.

The platform's Amazon specialization, intuitive interface, and dedicated onboarding mean you're optimizing campaigns in weeks with features enterprise tools lack: Real Bid visibility, retail-aware triggers, and Neo AI trained specifically on Amazon patterns, making atom11 the right Amazon PPC software for Amazon-focused brands.

Ready to see the difference retail-aware automation makes? Book a demo to experience atom11's Amazon-specialized platform in action.

FAQs

Which platform, Pacvue or Kenshoo, offers better features for retail media advertising?

For retail media advertising features specifically, Pacvue usually has the edge: it’s built as a retail-media–first command center with deep marketplace coverage (Amazon, Walmart, Instacart, Target, etc.), share-of-voice tracking, budget planners, and retail-signal–aware automation across 100+ networks. Kenshoo (now Skai) also has strong retail media capabilities, but they’re positioned inside a broader omnichannel suite, so it’s better if you care as much about cross-channel analytics as about pure retail media. If you’re mainly focused on Amazon retail media rather than a huge multi-retailer setup, a lighter Amazon-first PPC platform like Atom11 can be easier to adopt and more cost-efficient than heavyweight tools such as Pacvue or Skai.

Is Kenshoo or Pacvue better suited for multi-channel ad campaign management?

For multi-channel ad campaign management, Kenshoo/Skai is generally better suited, because it was designed as an omnichannel platform spanning search, social, app, and retail media, with unified data and optimization across walled-garden media like Google, Meta, Microsoft, Amazon, TikTok, and others. Pacvue can manage campaigns across many retail marketplaces and some commerce-focused channels, but its core strength is still retail and marketplace media rather than full-funnel, cross-channel orchestration.

What is the difference between Pacvue and Kenshoo for Amazon PPC management?

The main difference between Pacvue and Kenshoo (now Skai) for Amazon PPC management is that Pacvue is built as a retail-media-first platform with deep Amazon- and marketplace-specific tools, while Skai is an omnichannel suite spanning retail media, search, and social across many “walled gardens." For a team that lives mostly inside Amazon ads and marketplaces, Pacvue tends to feel more specialized, whereas Skai is often chosen when you want one layer to manage Amazon alongside Google, Meta, TikTok, etc.

How do user reviews compare Pacvue vs Kenshoo for Amazon advertising?

When you compare user reviews of Pacvue vs Kenshoo/Skai for Amazon advertising, Pacvue typically scores slightly higher on ease of use and quality of support, while Skai reviews often praise its strong reporting and enterprise-level capabilities. In practice, users say Pacvue feels more intuitive for retail media teams, while Skai can be more powerful but also a bit heavier to learn.

How does pricing compare between Pacvue and Kenshoo for Amazon advertisers?

In terms of pricing, both Pacvue and Skai usually work on custom quotes, often mixing platform fees with a percentage of ad spend; benchmark data suggests Pacvue commonly starts around the mid-hundreds per month plus up to ~3% of spend, while Skai tends to be priced higher for enterprise use. If that model feels overkill for your current spend, a more focused Amazon PPC tool like atom11 can be easier to justify and predict from a budget standpoint.

Is Pacvue more suited to small and mid-sized Amazon sellers compared to Kenshoo?

Pacvue can be more approachable for small and mid-sized Amazon sellers than Kenshoo/Skai because its workflows, dashboards, and automation are very Amazon- and marketplace-centric, even though it still targets sophisticated brands and agencies. Skai is usually positioned more squarely at large, omnichannel enterprises, so truly lean Amazon-first teams often prefer a lighter tool like atom11 rather than jumping straight into a big suite.

What feature sets does Pacvue offer that Kenshoo lacks for Amazon DSP & AMC integration?

For Amazon DSP & AMC integration, Pacvue emphasizes features like combined Sponsored Ads + DSP dashboards, native AMC audience creation and activation, and prebuilt AMC reporting templates tied directly into optimization and automation rules. Skai also supports advanced Amazon ad types, but Pacvue markets more Amazon-specific DSP+AMC workflows out of the box rather than treating Amazon as just one of many channels.

When should a brand switch from Kenshoo to Pacvue for Amazon PPC strategy?

A brand should consider switching from Kenshoo/Skai to Pacvue for Amazon PPC strategy when Amazon and other marketplaces become the main growth engine and you need deeper retail media controls (like inventory-aware rules, AMC-driven insights, and marketplace-specific automation) rather than broad omnichannel coordination. It’s also a common move when Amazon budgets outgrow generic search/social tools and the team wants a UI and roadmap built primarily around retail media.

Which offers stronger bid management automation: Pacvue or Kenshoo?

For bid management automation, Pacvue is known for very granular, rules-based Amazon bidding (including custom rule logic and advanced retail signals), while Skai leans into AI-driven optimization across multiple channels and retailers. If your priority is ultra-detailed Amazon PPC control, Pacvue tends to be the stronger fit; if your priority is unified, cross-channel bid optimization, Skai’s automation is designed for that.

Which platform has better reporting for Amazon ads: Pacvue or Kenshoo?

In terms of reporting for Amazon ads, Pacvue often wins on Amazon-specific dashboards, AMC-enriched views, and marketplace operational data in one place, while Skai reviews highlight its powerful, flexible reporting and historical comparison across channels. So if your reporting questions are mostly about Amazon retail media performance, Pacvue usually feels more tailored; if you need to compare Amazon against Meta, Google, and others in big, unified tables, Skai is very strong.

Which platform supports broader marketplace advertising: Pacvue or Kenshoo?

Pacvue supports a wide range of retail marketplaces (100+ retailers and Amazon’s expanding Retail Ad Services), making it very broad within commerce and retail media. Skai, on the other hand, supports many retail networks plus major search and social platforms, so it’s broader if you include Google/Meta-style channels, while Pacvue is broader if you care specifically about marketplace and retail media coverage.

Which tool is better for Amazon PPC automation: Pacvue or Kenshoo?

For Amazon PPC automation specifically, Pacvue is usually considered better because its rules, alerts, and workflows are built natively for Amazon and retail media use cases, whereas Kenshoo/Skai’s automation is designed to orchestrate many channels at once. That said, if you’re focused almost entirely on Amazon and want a faster, simpler automation layer without the complexity of enterprise suites, an Amazon-first tool like atom11 can be a very pragmatic alternative.