Quartile vs. Teikametrics: Which One Should You Use for Amazon Ads?

Author:

Neha Bhuchar

Last Updated:

Jan 2, 2026

Published on:

Table of Contents

If you’re scaling your Amazon business, “manual” is no longer a strategy. Once your catalog, keywords, and PPC campaigns hit a certain complexity, you almost inevitably aim for automation to keep performance and budgets under control without compromising efficiency.

PPC automation platforms like Quartile and Teikametrics promise smarter bidding, always-on optimization, and better ROAS, because most teams ultimately want ad efficiency, not just ad automation for its own sake. But they’re built with slightly different users in mind. Quartile skews toward high-spend brands and agencies that want aggressive automation and are comfortable handing over a lot of control, while Teikametrics positions itself as an AI-powered marketplace optimization layer for Amazon and Walmart, with more emphasis on bidding + profitability for sellers and brands at different maturity levels.

In this guide, we’ll break down Quartile vs. Teikametrics across the levers that actually matter: automation, analytics, AI depth, workflows, support, and total cost of ownership. Then we’ll introduce atom11, a newer, Amazon-specialized PPC software built to unify retail + ads data and automate against the full funnel (from shelf to sale), not just CPC bids.

What is Quartile?

Quartile is an AI-driven advertising platform best known for managing very large Amazon PPC programs. The company positions itself as a leader in ecommerce advertising, using patented machine learning to automate advertising campaigns across marketplaces like Amazon, Walmart, Instacart, and Google Shopping.

At its core, Quartile is built around a single-keyword campaign architecture and hourly bidding powered by Amazon Marketing Stream data. The platform dynamically creates and manages thousands of highly granular campaigns, with the goal of squeezing maximum performance from your budget while minimizing manual work.

Overall, Quartile fits brands or agencies with high ad spend, large catalogs, and a strong appetite for “black-box” automation, as long as the results justify the cost.

Key Features of Quartile

Single-Keyword Campaign Architecture: Quartile automatically structures Sponsored Ads into highly granular single-keyword campaigns to maximize control over bids, budgets, and placements.

AI-Powered Bidding with Amazon Marketing Stream: The platform uses Amazon Marketing Stream to perform automated hourly bidding, constantly adjusting bids to hit ROAS or ACoS targets while reducing wasted spend.

Cross-Marketplace Support: Beyond Amazon, Quartile can optimize ad campaigns on channels like Walmart, Instacart, and Google Shopping, giving larger brands a single layer across multiple marketplaces.

Automated Keyword Harvesting & Negative Targeting: Quartile continuously mines search term data to add new converting keywords and negate poor performers, reducing manual spreadsheet work for PPC teams.

Performance Analytics & Dashboards: Users get dashboards and analytics (often backed by Power BI) to track performance by campaign, keyword, and product, though deeper retail analysis often happens outside the platform.

What is Teikametrics?

Teikametrics is an AI-powered ecommerce optimization platform that started as a bidding tool and has since evolved into a broader retail media and profitability solution, with its flagship product Flywheel AI.

The platform focuses heavily on Amazon and Walmart, combining algorithmic bidding, budget automation, and basic inventory/profitability insights so sellers and brands can understand not just ad performance, but how that performance ties to margins and stock.

Overall, Teikametrics is often a better fit for sellers and brands who want AI-driven bidding plus basic profitability insights without the complexity of a full enterprise suite.

Key Features of Teikametrics

Flywheel AI for Ad Optimization: Teikametrics’ Flywheel AI automates campaign creation, targeting, and bidding to maximize sales and ROAS across Amazon and Walmart.

Multichannel Marketplace Coverage: Native support for Amazon and Walmart retail media, with additional capabilities around Amazon DSP and Walmart onsite display in higher tiers with advanced features.

Profitability & Inventory Insights: The platform pulls in key metrics like ACoS, sales lift, and conversion rates, and in advanced plans adds inventory optimization and refunds recovery.

Always-On Optimization & Keyword Automation: Flywheel handles ongoing bid adjustments, keyword actions, and continuous optimization for campaigns based on goals like target ROAS or ACoS.

Flexible Self-Service Pricing Tiers: Essentials self-service plans typically start around $79–$99/month for lower ad spend and scale up to $399–$499/month + 3% of monthly ad spend above $10K, with separate pricing for larger managed accounts.

Comparing Quartile vs. Teikametrics

So, between Quartile and Teikametrics, which one is right for you as an Amazon seller and advertiser? To practically answer that, let’s compare them across the dimensions that matter most to Amazon-specific brands and agencies.

1. Automation & Bidding Intelligence

Quartile leans heavily into campaign-level and keyword-level automation, using single-keyword campaigns and hourly bidding to micro-optimize performance with minimal advertising efforts. The engine relies on Amazon Marketing Stream data and large-scale pattern recognition across billions in managed ad spend. This is powerful if your catalog is large, your spend is significant, or you’re comfortable letting the platform restructure and run much of your account with minimal intervention. However, the same automation can feel like a black box. You see results, but not always the reasoning.

Teikametrics’ Flywheel AI also runs goal-based automation: you set campaign performance targets, and the system optimizes bids, ad budgets, and keyword actions to hit those targets. It’s less obsessed with radical single-keyword architectures and more focused on keeping spend efficient across ad types and marketplaces. Compared to Quartile, Teikametrics’s automation tends to feel slightly more accessible to smaller teams, slightly less aggressive in terms of restructuring and hyper-granular campaign building.

2. Data, Reporting & Analytics Depth

Quartile provides robust campaign and keyword analytics, often backed by Power BI dashboards, letting teams drill into performance across marketplaces and ad strategies. Quartile proves to be strong for ad performance analytics but limited when you need joined-up retail analytics, for example, tying ACoS, inventory, pricing, and organic rank together without exporting to external tools.

Teikametrics highlights reporting across ad performance, profitability (margins, ACoS, TACoS), and key Amazon/Walmart metrics, which can help teams contextualize results against broader market trends like CPC inflation or category seasonality. It’s generally considered easy to get started with Teikmetrics’ standard dashboards, and more limited for power users who want fully custom metrics or deep retail + ads mashups without leaving the platform.

In essence, both tools do a good job on advertising analytics, but neither gives you truly retail-native, digital-shelf-aware analytics out of the box. That’s exactly the gap a platform like atom11 is designed to fill.

3. AI Capabilities Beyond Bidding

Quartile’s core AI strength is still large-scale campaign automation (structuring, bidding/budgets, and optimization), but it now also offers a conversational AI layer (AI Data Assistant) in its Pro Suite to help users ask questions and get faster performance answers and outputs.

On the other hand, Teikametrics’ Flywheel AI focuses primarily on predictive bidding, campaign automation, and profitability-aware optimizations. You do get analytics, but not a full AI assistant that helps explain why performance changed and what trade-offs you’re making.

4. Ease of Use, Onboarding & Day-to-Day Workflow

Quartile can be easy to set up from a connection standpoint, but the underlying mechanics (single-keyword builds, automation levers, etc.) are better suited to advanced users or teams with in-house PPC expertise. Once live, a lot of the day-to-day work on Quartile is reviewing performance, coordinating with your account manager, and making high-level strategy adjustments rather than micro edits

Teikametrics typically scores well on “time to value”, connecting your account and seeing the first optimizations is fairly straightforward. Day-to-day use focuses on monitoring Flywheel dashboards, adjusting goals, budgets, and constraints, and also reviewing profitability metrics and inventory flags

Teikametrics tends to feel more approachable for smaller teams, whilst Quartile may feel heavier but pays off for organizations ready to fully commit to its methodology.

5. Support, Services & Strategic Partnership

Quartile is often described as a hybrid of software and agency with service features like dedicated account managers, regular business reviews, strategic input on big events and launches. When the relationship works, brands see it as a strong extension of their in-house team. When expectations aren’t aligned, the “done-for-you” model can feel rigid or misaligned with internal priorities.

Teikametrics combines self-service support via docs, chat, and tutorials, community and educational content. They also offer higher-tier ad management services for brands that want a managed solution on top of Flywheel. Support quality tends to vary by plan, with larger spenders getting more white-glove treatment.

6. Pricing & Total Cost of Ownership

Quartile’s pricing is not disclosed publicly. They have to be contacted to receive a custom quote.

Teikametrics pricing is built on tiered ad-spend-linked plans for various levels of ad spends:

Essentials: $149–$499/month for ad spend up to $10K

Advanced: $1,199/month for ad spend of $10K+

Enterprise: Custom pricing for ad spends reaching $10k+ per month. This tier allows you view and create customized dashboards, and view and request new AMC Dashboards.

Why atom11 Is A Better Alternative to Quartile and Teikametrics

While Quartile and Teikametrics are primarily bidding and campaign automation layers, atom11 is the specialized Amazon PPC software, a single place where ads, retail signals, digital shelf, and detailed analytics live together.

Instead of optimizing in isolation, atom11 combines Amazon Ads data, Seller Central retail metrics (inventory, pricing, organic rank, TACoS), and digital shelf signals like Buy Box, suppressions, and competitor actions.

It’s designed for advanced individual sellers, mid-market and enterprise brands, agencies and aggregators that manage multiple accounts, and for teams that want to automate aggressively without giving up transparency and control. To further cement its innovation-driven reputation, atom11 recently won the AI Innovation Award 2025 at Amazon Partner Awards for its ingenious AI copilot, Neo, an external validation that it’s more than “just another rules engine."

Atom11’s pricing is structured as SaaS tiers aligned to ad spend, with retail analytics, dayparting, and automation included in base plans, which makes it easier to model total cost vs. ad-spend-percentage tools.

How atom11 Outperforms Quartile and Teikametrics

Below are the areas where atom11 offers a meaningfully different approach, and how that compares to Quartile and Teikametrics.

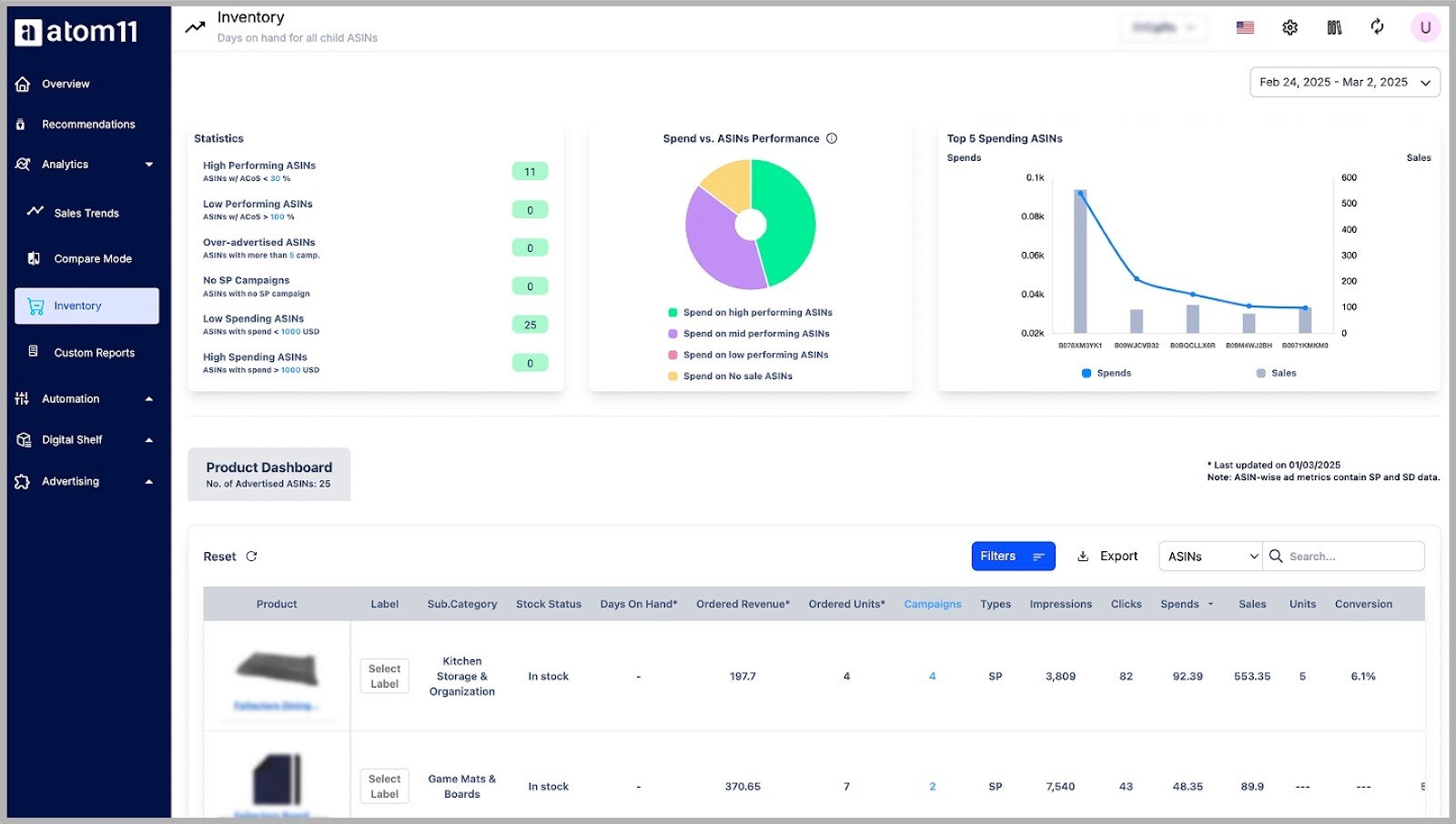

1. Advanced Retail Analytics

Atom11 doesn’t just show you ACoS and ROAS. It unifies your ad performance, organic sales, pricing and promos, inventory and stockouts, and competitor signals into ASIN-level and account-level analytics so you can spot the real drivers of sales changes.

Where Quartile and Teikametrics focus primarily on ad-side metrics, atom11’s dashboards answer questions like: “Did my sales drop because of bad bids, or because we ran out of stock?”, “Is my TACoS high because of cannibalization, or a genuine lift in total revenue?”

This depth of retail + ads analytics usually requires exporting into BI tools when you’re on Quartile or Teikametrics; with atom11, it’s native.

2. Retail Automation

Atom11’s automation engine is built to combine ads with retail guardrails, rule-based automations that factor ACoS/TACoS, inventory, pricing, and competition, “If retail reality changes, adjust the ads” logic (e.g., pause or down-bid SKUs low on stock or losing Buy Box).

Quartile and Teikametrics are excellent at bid and budget optimization, but they typically optimize within ad channels, not fully against real-time retail conditions. With atom11, you can tie automations to inventory thresholds, avoid pumping budget into products that are suppressed or not winning the Buy Box, and protect margins by linking pricing and ad intensity

In practice, that means better results, less wasted spend, and fewer “why are we still advertising this?” moments.

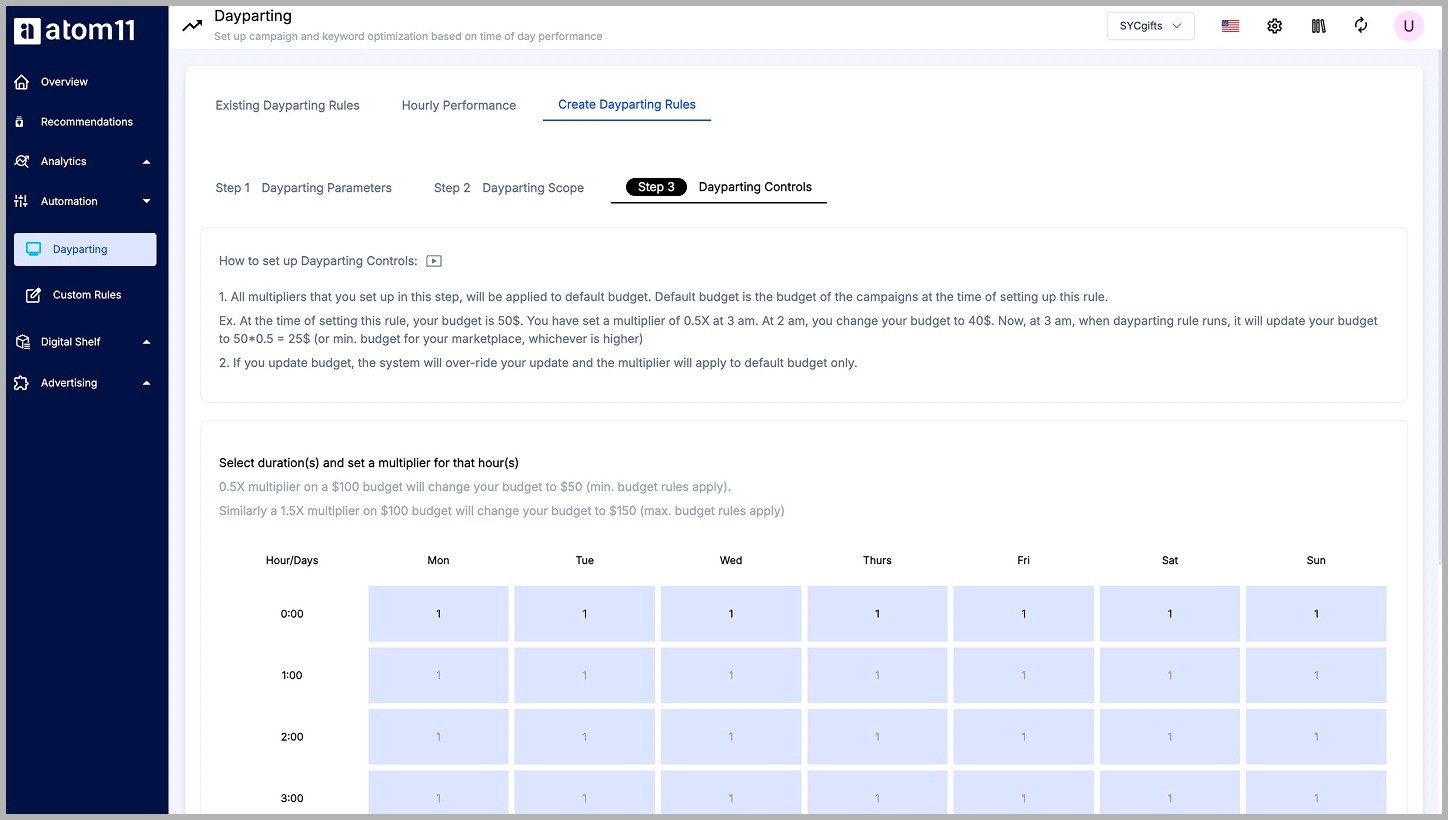

3. Dayparting Automation

Atom11 offers hour-level and day-level dayparting that uses Amazon Marketing Stream data plus your performance history and historical data to find the most profitable hours and days for your ads. Key advantages here is that atom11 can adjust both bids and budgets by time block, not just one or the other, apply different schedules per Amazon PPC campaign or portfolio, use the Evaluate feature to measure the before/after impact of your dayparting strategy over time.

Quartile does leverage hourly data for bidding, but it doesn’t expose a dedicated, retail-aware dayparting module in the same way. Teikametrics, similarly, focuses on predictive bidding rather than marketer-friendly dayparting controls.

4. Amazon Marketing Stream

Atom11 consumes Amazon Marketing Stream (AMS) data to provide near-real-time insights and power time-sensitive automations, identify peak hours and days by ASIN, campaign, or keyword, automate budget/bid changes based on hourly performance patterns, and react faster to sudden changes in CPCs, conversions, competition, or market conditions.

Quartile also uses AMS under the hood, but primarily to power its own proprietary algorithm. Teikametrics absorbs marketplace data for Flywheel, but the way hourly patterns surface to the user is more limited. Atom11 explicitly exposes AMS-driven analytics and controls so you can design strategies, not just watch the algorithm act.

| Related read: Amazon Marketing Stream Guide For Advertisers

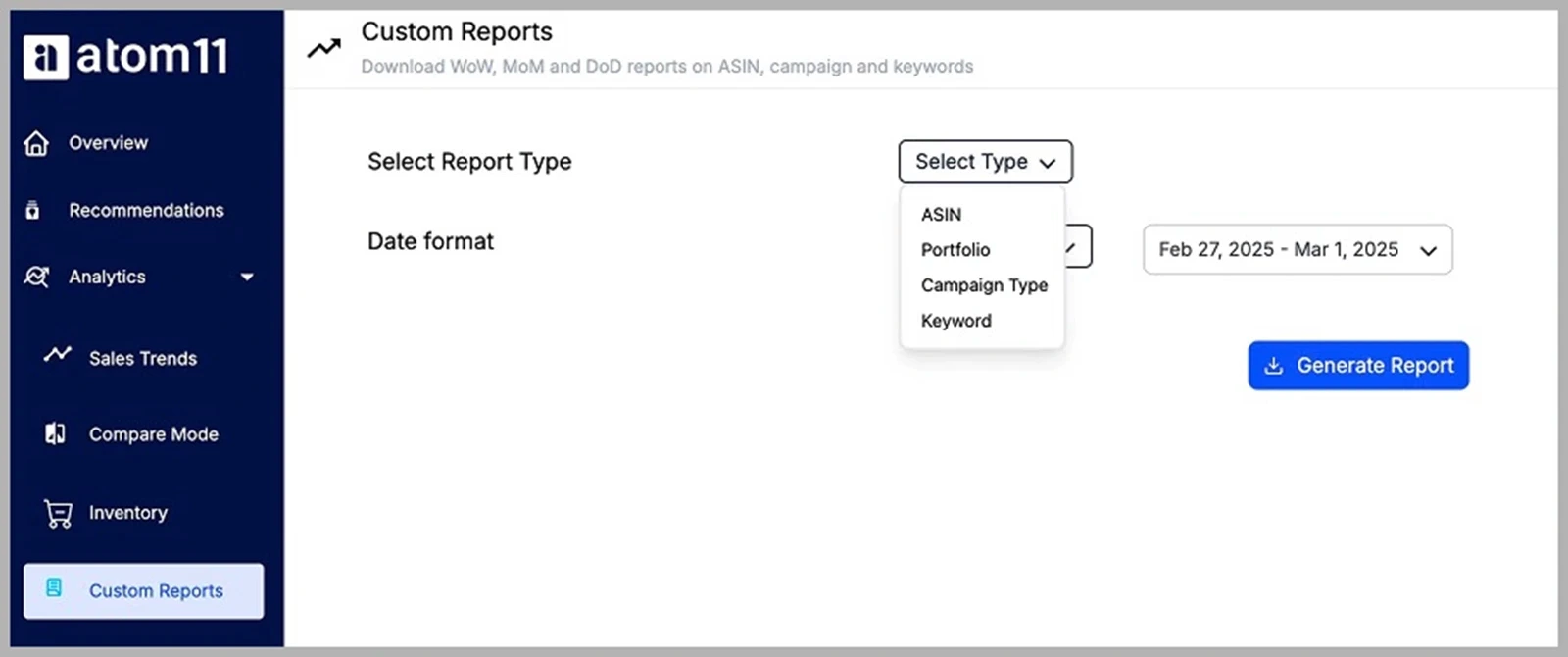

5. Custom Reporting

Atom11 ships with a drag-and-drop custom reporting layer that helps you build dashboards with your own KPIs and formulas, mix ads, sales, and retail metrics in the same view, and export or connect to tools like Power BI, Looker, Google Sheets, and Zoho Analytics when you need additional modeling. Many Quartile and Teikametrics users end up exporting data to BI tools anyway for deep analysis. Atom11 leans into that reality by giving you powerful in-app customization and offering easier connections to external analytics stacks. If your team lives in spreadsheets or BI dashboards, this alone can be a major time-saver.

6. Digital Shelf Analytics

Atom11 treats digital shelf performance as a first-class signal, helping you protect share of voice by monitoring Buy Box wins/losses, suppressions, and competitor activity. Atom11 also overlays these signals with ad performance to understand why sales and ROAS fluctuated. You can also build automations that react when shelf health deteriorates (e.g., reduce bids when you’re losing Buy Box, or when a listing is suppressed). Quartile and Teikametrics can infer some of this via performance metrics, but they don’t position digital shelf analytics as a core module in the same way, meaning many teams manage shelf visibility in completely separate tools.

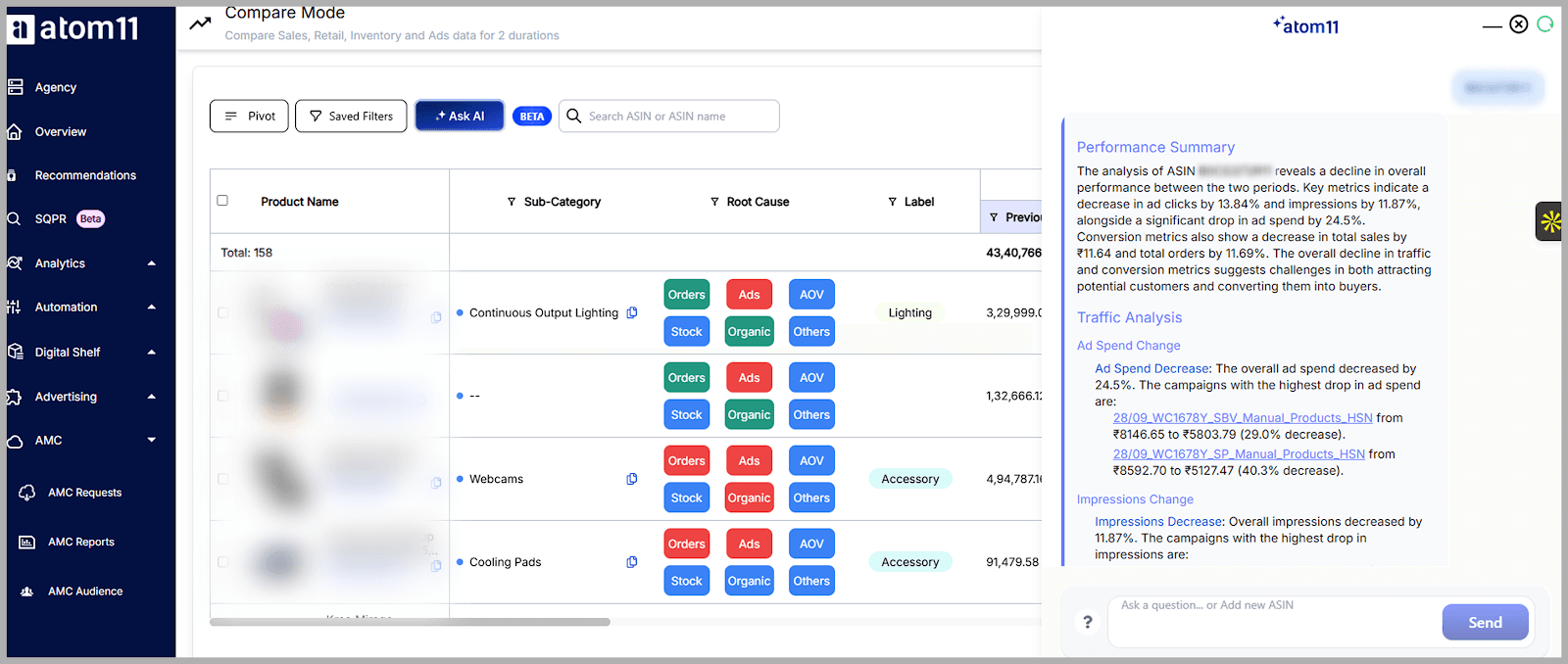

7. Atom11’s AI Copilot Neo for Valuable Insights

Finally, atom11’s AI copilot Neo acts as an on-demand analyst inside your Amazon account, allowing you to ask natural-language questions like “Why did sales drop last week?” or “Which campaigns are wasting budget?”. Neo analyzes ads + retail + shelf data together, then responds with explanations and recommended actions, not just charts. This is a fundamentally different AI approach compared to Quartile and Teikametrics, which focus their AI inside optimization engines rather than as a transparent, conversational decision partner.

Taken together, these capabilities make atom11 feel less like “another optimization layer” and more like a retail-centric operating system for Amazon advertising.

To help you gain a better understanding of just how ingenious atom11 is to you as an Amazon seller in relation to other PPC software out there, here’s a comparison table of atom11, Quartile, and Teikametrics.

Features | atom11 | Quartile | Teikametrics |

Pricing | Starts at $199 per month (flat fee) | Custom | Tiered pricing, starting with essentials at $149/month |

Free trial | 7-day | Not available | 30-day |

G2 rating | |||

Core positioning | Retail-aware Amazon PPC software. | Ad optimization platform focused on improving efficiency. | Predictive bidding + goal-based automation |

Retail-aware automation | Automates bids with inventory, pricing, buy box guardrails. | Optimizes bids/budgets mostly within ad channels. | Predictive bidding automation; fewer explicit retail guardrails. |

AI Assistant | Yes (genAI Copilot Neo) | Yes (available in Pro Suite) | Yes |

Custom reporting & KPI flexibility | Drag-and-drop reporting with custom KPIs; easy BI connections. | Reporting is often exported for deeper custom analysis. | Reporting is often complemented by exports; in-app flexibility also varies. |

Digital shelf analytics | Tracks Buy Box, suppressions, competitors, all in oneplace, also ties to automation. | Shelf issues inferred, analytics are usually managed in separate tools. | Marketplace signals exist, with shelf automation being less central. |

Onboarding support | 4-week 1:1 expert-led onboarding/training (included free-of-cost with plans) + Slack support | Dedicated onboarding + ongoing training | Onboarding guides + experts support |

Conclusion

Quartile and Teikametrics are both a clear step up from manual campaign management in Amazon Ads. Quartile excels at high-volume, high-spend automation with granular single-keyword structures and hourly bidding. Teikametrics offers accessible, marketplace-focused AI optimization for Amazon and Walmart, with a strong emphasis on profitability and ease of onboarding. But they are, fundamentally, first-generation solutions.

Atom11 is built for teams that have outgrown that first generation and now want retail + ads + automation + AI insights in one place, native retail-aware analytics instead of endless exports, and a pricing model that feels like modern SaaS, not an ever-growing tax on ad spend.

If you’re at the stage where simply “bidding smarter” isn’t enough and you need a platform that understands inventory, pricing, digital shelf, and long-term profitability, then atom11 can give you the best results. Book a demo and put retail-aware automation, deep analytics, and Neo’s AI insights to work on your account.

FAQs

1) What are Amazon PPC automation tools, and why do sellers use them?

Amazon PPC automation tools are software platforms that automatically manage parts of your Amazon advertising (bids, budgets, keywords, and campaign creation) so you’re not relying on manual updates. Sellers use them to save time, reduce wasted spend, and keep performance steady as catalogs and marketplaces grow; tools like atom11 also try to go a step further by tying ad decisions to retail reality (inventory, pricing, and shelf health), not just ad metrics.

2) What’s the difference between a “black-box” tool and a more transparent PPC platform?

A “black-box” PPC tool makes lots of changes automatically but gives you limited visibility into why those decisions happened. A more transparent platform still automates the heavy lifting, but it shows the reasoning, lets you set guardrails, and requires only necessary human intervention. This is where atom11 positions itself, aiming for aggressive automation without losing explainability and control.

3) How do I know whether my business is “big enough” to benefit from PPC automation?

Your business is usually “big enough” when manual PPC management starts falling behind: too many ASINs, too many search terms, frequent budget shifts, or multiple marketplaces that make weekly spreadsheet tweaks feel impossible. If your team is spending more time firefighting than planning, automation becomes worth it; atom11 can be especially relevant once you need ads management that responds to inventory and Buy Box realities, not just bid math.

4) Will PPC automation improve profitability, or does it only optimize ad metrics like ACoS/ROAS?

PPC automation can improve profitability, but only if it optimizes toward profit-aware outcomes rather than chasing ACoS/ROAS in isolation. The best setups incorporate margin, inventory risk, and total sales impact, so you’re not pouring spend into low-stock or suppressed products; atom11 is built around that idea by using retail-aware guardrails (like stock and shelf signals) to prevent “efficient” ads from becoming unprofitable growth.

5) What should I look for in reporting and analytics from an Amazon Ads platform?

The best practices for evaluating an Amazon Ads platform including looking for reporting that clearly shows performance by ASIN, keyword, and campaign and helps you explain what changed and why. Strong analytics also connect ads to retail signals like organic sales, price changes, Buy Box wins/losses, and stockouts; that “joined-up” view is a core reason teams consider atom11, since it’s designed to keep retail + ads data in one place instead of forcing constant exports.

6) How can I evaluate the real cost of an Amazon PPC tool beyond the sticker price?

The real cost includes the fee model (subscription vs. percentage of ad spend), the time your team spends operating the platform, and the extra work needed for custom reporting or troubleshooting automation. To keep the “total cost” predictable, many teams prefer tools that bundle core capabilities in tiers and reduce dependence on external BI. Atom11 is often evaluated on that basis because it positions itself as a SaaS-style platform with built-in retail-aware analytics and automation, rather than an ever-growing tax tied directly to spend.

7) Are there user reviews comparing Quartile vs Teikametrics performance?

Yes, there are user reviews directly comparing Quartile vs Teikametrics performance on software review and comparison sites like G2, Capterra, and various SaaS comparison pages, where sellers discuss results, support quality, and reasons for switching between the two platforms.

8) Do Quartile and Teikametrics integrate with other ecommerce platforms apart from Amazon?

Yes, both Quartile and Teikametrics integrate with other ecommerce and advertising channels beyond Amazon: Quartile supports platforms like Walmart, Instacart, Google, Facebook, and can connect to Shopify stores, while Teikametrics focuses heavily on Amazon and Walmart with multichannel ad optimization features; exact integrations can change, so it’s wise to confirm them against your current stack.